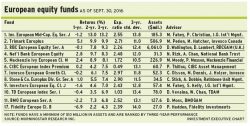

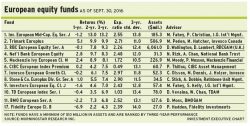

“Caution” is the watchword in Europe

Portfolio managers point to uncertainty caused by Brexit and sluggishness of many economies in Europe

- By: Michael Ryval

- October 31, 2016 October 30, 2019

- 23:45

Portfolio managers point to uncertainty caused by Brexit and sluggishness of many economies in Europe

Look for weakness in retirement income

Study shows the outperformance of equity mutual funds with concentrated portfolios

Recent reforms designed to contain corruption and limit government spending could set the stage for further gains this year

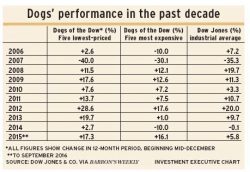

This decades-old strategy may seem counterintuitive, but it has outperformed the S&P 500 almost every year since 2008

The macro trends for low bond rates remain, including long-term demographic changes. The stocks of corporate-bond issuers may be more attractive to investors as a…

Editorial

After a rocky year in office beset by scandals and accusations of incompetence, Liberal premier Dwight Ball finally is setting an agenda for tackling the…

Alberta's campaign to create a new "living wage" by raising the minimum wage may have laudable goals, but is more likely to kill jobs and…

The premier's opposition to the federal cap-and-trade plan, required by global agreements, puts the province in a small minority of Canadians who oppose the policy

Toronto-based Vanguard Investments Canada Inc. has launched two currency-hedged exchange-traded funds (ETFs). Vanguard FTSE Developed Asia Pacific All Cap Index ETF tracks the performance of…

A new emerging-markets ETF is available from Toronto-based Sphere Investment Management Inc. Sphere FTSE Emerging Markets Sustainable Yield Index ETF is a smart-beta fund that…

The move follows a $2 million administrative penalty and Quebec ban by the Tribunal administratif des marchés financiers du Québec

Deadlines to implement the client-focused reforms were extended, and dealers are working out how to comply with the new requirements

Adapting to the pandemic has revealed new efficiencies

From stock market booms and busts to the rapid advance of technology and consolidation in the brokerage business, two veteran advisors describe how they met…

Twenty-five years ago, a "four pillars" policy kept the banking, insurance, investment and trust businesses legally separate. But with the toppling of that structure, Canada's…

An increasingly varied ETF universe calls for a highly specialized strategist

Once a passive, index-tracking product, ETFs now make up a diverse array of investment strategies

A video breakdown of the 2024 Report Card on Banks themes

Planners and advisors just want to be well coached, paid fairly and provided with effective tools

Branch planners and advisors say compliance support is important, but cited several hurdles

A breakdown of the Net Promoter Score results within 2025’s Advisors’ Report Card

Methodology for our annual Report Card series research

Advisors, firms have gotten better at planning exits over the past decade

In this, Investment Executive‘s (IE) second annual ETF Guide for financial advisors, we discuss some major trends in products and strategies in the exchange-traded fund…

James Breech and cougar global integrate financial planning and investment management to meet clients' goals

Reg Jackson says his clients were looking for a lower-cost alternative to mutual funds

How advisors rated their firms

Advisors praise their firms' online platforms, which have significant integration of investment and banking accounts

Advisors have many concerns about their firms' technology, and several firms have much room for improvement

Robo-advisors are expected to add more sophisticated ETFs to their product lineups as the ETF industry continues to expand

Financial services firms large and small are moving into the field, which means more choice for your clients

Food for thought for two investors with dissimilar needs and goals, from two ETF experts

Higher wages could bolster consumer spending, but rising interest rates and stricter mortgage rules pose challenges for the housing market

Solid economic growth in B.C. is expected to continue. However, the new NDP government faces challenges

A resurgence in oil prices helped Alberta’s economy enjoy a healthy rebound in 2017, and further growth is expected this year

Accelerate is the first in Canada to launch an ETF that provides indirect exposure to private assets through BDCs

The funds accounted for at least US$350 billion in global net asset value in 2023

Demographics, tech advancements expected to drive growth in the sector

A portfolio manager must have the discipline to stick to a process over time, especially during a crisis or a bear market

Steve Hawkins, president and CEO of Horizons ETFs, has successfully launched novel products

Macroeconomic risks help drive growth

Guiding newer hires requires time and patience, and veteran advisors can’t always lead that effort

Investments in technology and business support are needed, but so too is strategic consistency

Four in 10 advisors said culture was the key thing firms should focus on, more than any other category group

Advisor moves to Raymond James, Manulife Wealth and ScotiaMcLeod, plus appointments at Centurion, CIRO, PSP and OSC

Short-term interest rate tightening is likely to flatten the yield curve if not accompanied by expectations of higher future inflation

Continued sluggishness in the U.S. and European economies

Proposals would make alternative investments more accessible

New Nova Scotia law aims to balance right to independence and protection

Digital coach aims to support advisors rather than replace them

Be honest, transparent, consistent, advisors say

Over a 30-year career, Sybil Verch sees opportunities where others see obstacles

For a young Penny Stayropoulos, financial planning was a beacon amid crisis

Provincial authorities are targeting licensing exam security, MGAs, seg fund disclosures and other issues

Introduced in the 2019 federal budget, these annuities provide income beginning as late as age 85

A successful claims process begins at the time of sale, say experienced advisors

The CSA is considering a ban on the practice

Evergreen fund gating is natural, and will happen again

This isn’t just an entrepreneur’s issue. It directly affects the advisors and institutions who serve these businesses

Assets under administration reach $3.5 billion

Firms that responded to advisors' concerns and helped them solve problems were rated highest

How insurance advisors rated their agencies' performance

Advisor credentials and titles are set to change, but an agreement on how appears to be a long way off

There are some hidden shoals in the CRm2 regime. regulators offer advice on how to navigate them

Erez Blumberger of AUM Law Professional Corp. talks about educating clients on CRM2 reports

Through a new web survey, insurance advisors across Canada shared their working experiences

Report casts doubt on regulator’s independence

Rising interest rates and reduced regulation may create options for U.S. banks that exploit niche markets and M&A strategies

Lower prices and faith in the underlying tech have contributed to positive inflows, providers suggest

After two big years for high-flying names, manufacturers are following investors to more humble terrain

Author and analyst Eric Balchunas discusses John Bogle's legacy

The average dealer advisor was adjusting their client mix and refining their services coming into 2025

For developing advisors in this highly independent space, are firms and mentors stepping up?

More firms are investing in this area, but advisors are asking for more hands-on guidance

In some cases, closing accounts before moving abroad might make sense

How section 166 certificate applies to underused housing tax, when HST applies to tips and deducting Covid benefit repayments

Taxpayers who do not seek advice regarding their offshore assets can easily run afoul of the T1135 reporting rules

The former financial services CEO left his mark — and he’s not done yet

SRO consolidation helps level the playing field for firms

CEO Richard McIntyre is facing backlash on technology rollouts and new advisor fees

Rethinking health care

The Canadian health-care system is listing under the weight of changing demographics and failure to revisit the way health care's spending dollars are spent