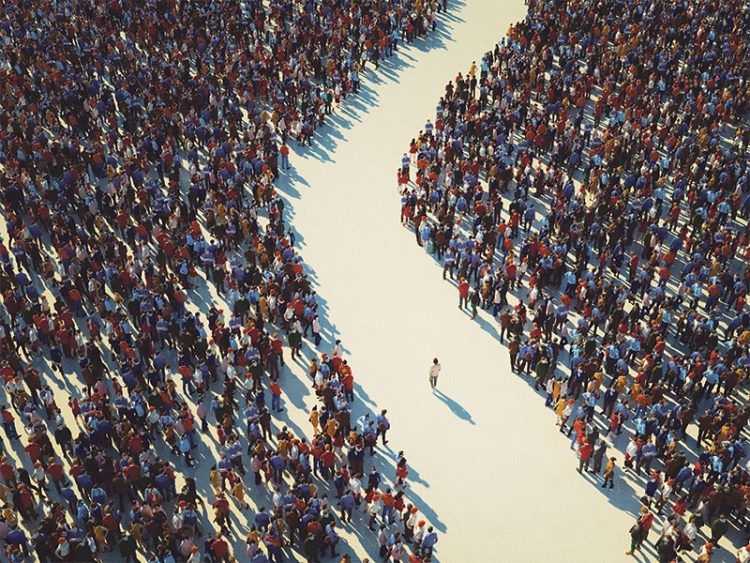

How advisors can stand out in a crowd online

Be honest, transparent, consistent, advisors say

Be honest, transparent, consistent, advisors say

Over a 30-year career, Sybil Verch sees opportunities where others see obstacles

For a young Penny Stayropoulos, financial planning was a beacon amid crisis

Glen Rattray has guided clients through many bear markets and crises since joining the investment industry in 1985

Segmenting your clients by revenue rather than assets can provide valuable insights

Upgrading your technology can boost efficiency and improve your interactions with clients

Freedom to choose your digital tools varies by firm, but independence has its risks and rewards

Banks, insurance firms and practice management software providers have launched generative AI tools for financial advisors and retail customers

Four advisors let us know what they love about their planning software, and how it could be improved.

Helping your clients decide how much to take out, and when, involves many variables

How to bring 401(k)s and IRAs north of the border

Spouses with a significant gap between their ages need to examine pensions, taxes and estate planning strategies

Rising life expectancies make planning a challenge, but new tools and strategies can help your clients reach their goals

When a client moves to a new employer, decisions about their employee pension plan can have a profound effect

Working in retirement offers psychological and financial benefits for clients, but it also affects their financial plans

A successful practice requires a diversity of personalities, work habits and individual styles. Use these tools to help create the right mix

Financial literacy is important to Michail Tsirikos, who specializes in advising teachers and other educational workers

A passion for sports helped kick-start Ayana Forward’s business career. Today, she runs an independent fee-only practice

Creating an organization chart can help you identify ways to put your practice in growth mode

Online wills services aren’t for everyone, but they can serve a wide range of clients

While digital assets may have lost their lustre in 2022, analysts remain confident in crypto’s underlying blockchain technology

Pandemic necessity has led to extended tech solutions

A collaborative approach may help you convince management of the benefits of social media as a multi-faceted communication tool

Even conservative strategies felt the pain last year

Whether you agree with the change or not, you can leverage the transition to your advantage with the right approach