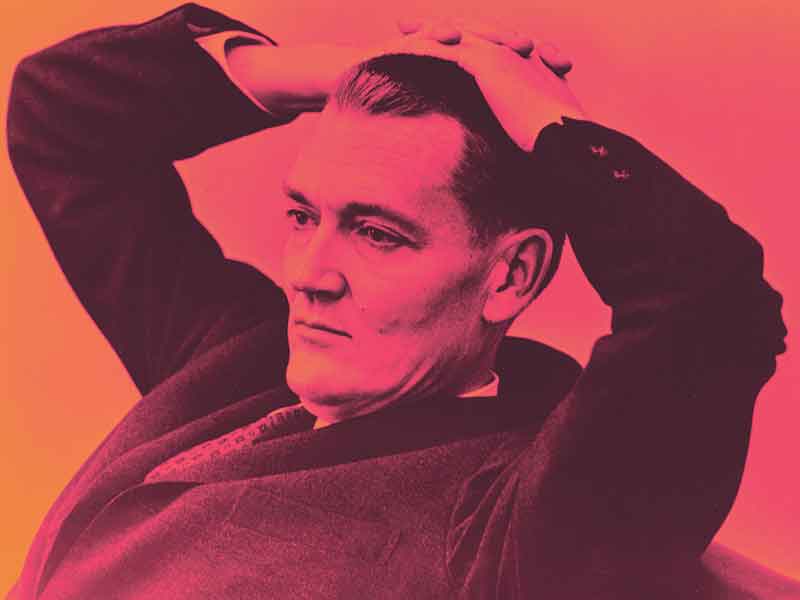

When John Bogle died in 2019, the tributes poured in for the Vanguard Group Inc.founder and index fund pioneer. Eric Balchunas, senior ETF analyst with Bloomberg Intelligence, wrote a book based on several conversations with Bogle. The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions was published by Penguin Random House in April. The following interview was edited for length and clarity.

Why did you decide to write a book about John Bogle?

As an analyst who covers funds, I’m blown away by just how much Vanguard has taken in: a billion dollars a day for a decade. All of that can be traced back to the mutual ownership structure in 1974. [Ed. note: Vanguard is owned by its family of funds, which is owned by its U.S. shareholders.] It’s amazing how big of a deal that was because it allowed Vanguard to keep fees low.

I was blown away by the fact that somebody would set up a company where they would basically sign away all future profits. You never become rich owning a mutually owned company. And he did that on purpose. It’s a rare attribute for someone who goes to Wall Street and works that hard. He wanted adulation more than he did money. He had enough money, but he could never get enough adulation.

What is the “Bogle effect”?

I use this phrase called the “Vanguard effect.” When you see a company lower its fees, it’s essentially a by-product of Vanguard and having to compete with them. But I can’t know what Vanguard is going to do and I just thought, at the end of the day, it’s really about Bogle. There is no way that Vanguard exists without this guy. Bogle, in my opinion, created a religion. He created the products, but he also protested what was going on and created a religion around it. He did it in an abrasive way, against the grain, and now there are people — called Bogleheads — who get together and talk about his philosophies. It’s really fascinating.

How did Bogle transform the investment industry?

My main conclusion is that index funds needed Vanguard more than Vanguard needed indexing. Index funds are only a hit because they are cheap, and they are only cheap because of Vanguard’s structure, Bogle’s structure.

I think indexing gets too much credit. It’s really about low cost — that is the mother of all trends. There is a lot of nuance in active to passive, mutual fund to ETF, etc., but there is crystal clear data across the board that things are going from high cost to low cost, and that gravity is all Bogle. He set that chain reaction and spent years and years pounding the table about it.

Today, nearly every dollar invested in America goes to either Vanguard funds or Vanguard-influenced funds. Since 2010, Vanguard has taken in approximately US$2.6 trillion in flows. In second place is BlackRock, with about half of that (and nearly all of it going to low-cost ETFs). Bogle’s impact and this “great cost migration” reaches well beyond index funds. And ultimately, he unleashed a populist revolt that has saved the average investor trillions of dollars, all while reforming the entire financial industry.