If you are thinking of investing using the Dogs of the Dow (DOTD) technique, start early. Don’t wait for yearend.

That investment strategy, like any other consistently practised strategy, has good years and bad years. Since the market crash a decade ago, one version of the DOTD has been successful.

The DOTD, in its original form, means buying at yearend the 10 highest-yielding stocks among the 30 in the Dow Jones industrial average (DJIA).

A version of this strategy has been successful since 2009. This version cuts the number of stocks to buy to a manageable five – the lowest-priced shares among the 10 high-yielding Dogs.

The second variation in the DOTD strategy is to buy early. Yale Hirsch, founder of New York-based Hirsch Organization Inc. and the Stock Trader’s Almanac, pioneered this strategy. He found that buying early in December, when the market often is at a low for the month, produces better portfolio returns.

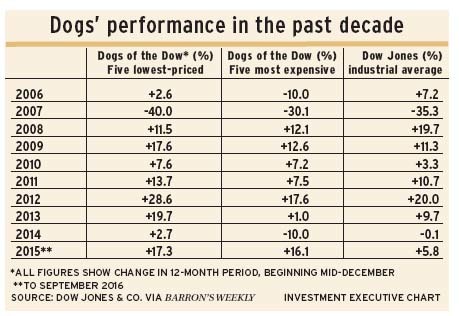

When we examined how the five-stock DOTD strategy has worked, we chose weekly closing prices and yields near Dec. 15 for each December since 2006, then calculated the subsequent 12-month price changes.

The key finding: this strategy has beaten both the DJIA itself and the other (higher-priced) five highest-yielding DJIA stocks each year since 2009. This examination includes results for the December 2015 selection up to late September 2016.

The DOTD strategy, in any form, admittedly is a short-term investment strategy. One year’s set of low-priced Dogs does not repeat, although individual stocks sometimes do.

The DOTD strategy has the virtue of selecting a portfolio of very large companies, as measured by corporate size and market presence. That these are conservative-grade stocks, dividend payers and stocks that usually show a pattern of price stability is axiomatic.

Not that these large companies escape the impact of bear markets: note what happened with the mid-December 2007 list. (See table, at right.)

Occasionally, a low-priced Dog will start on a multi-year price rise. Home Depot Inc. was a low-priced Dog in mid-December 2009, and continued rising each year for six years. General Electric Co. had a similar five-year series of annual gains beginning in 2011. Microsoft Corp. started a series of annual gains in 2012 continuing up to September this year.

Buying an equally weighted package of five low-priced Dogs is prudent because individual results can vary so much. For example, the mid-December 2012 group included AT&T Inc., which dropped by 5% in the following 12 months, while Intel Corp. rose by 49% and Cisco Systems Inc. gained by 33%.

A subsidiary, single-stock version of the DOTD strategy has not fared well recently. The strategy: buy the second-lowest priced Dog. Since 2006, only the 2011, 2013 and 2014 qualifiers beat the DJIA, as well as the average gain of the five lowest-priced Dogs.

There is a broader argument that a long-term portfolio can be chosen safely from the 30 DJIA stocks; this has been done successfully in the past. A portfolio manager choosing this course would be well advised to broaden the shopping checklist to include the 20 stocks of the DJIA’s transportation average and the 15 in the DJIA’s utilities average.

This checklist would be efficient, with a universe of only 65 stocks to monitor and analyze instead of hundreds or thousands. All 65 stocks are well known, thoroughly documented, leaders in their individual industries and – above all – the most liquid stocks.

Investing in these 65 stocks would, of course, eliminate any consideration of current hot stocks, such as today’s FANG group (Facebook Inc., Amazon.com Inc., Netflix Inc. and Google [a.k.a. Alphabet Inc.]). For a conservative, income-focused portfolio that would not be a bad thing.

The DJIA remains a fair representation of the U.S. stock market, consistently tracking the 500-stock Standard & Poor’s composite index, which accounts for 70% or more of the entire U.S. stock market’s capitalization.

© 2016 Investment Executive. All rights reserved.