Insurance advisors across Canada are largely positive about the business and planning support they receive from the companies and managing general agents (MGAs) they work with, according to research from Investment Executive (IE). These advisors — mainly independent professionals who use MGAs to coordinate with carriers and process transactions — said the added guidance is important to them.

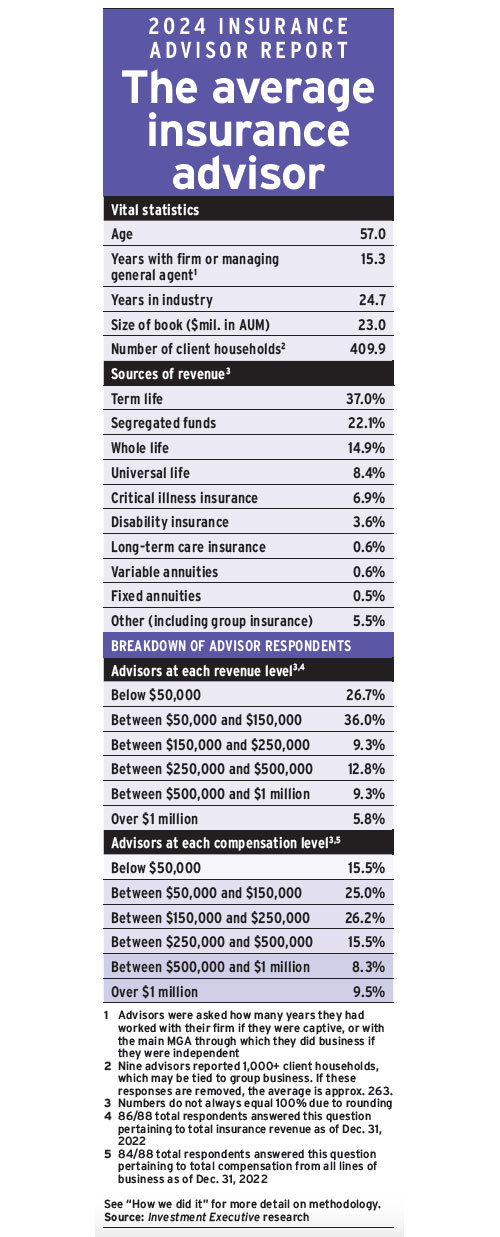

IE conducted a web survey this past autumn regarding insurance advisors’ experiences with their primary company or MGA, leading to the first Insurance Advisor Report. Participants (88 in total) were surveyed across 11 categories related to their work throughout 2023. (See “How we did it” and “The average insurance advisor”.)

One key area of satisfaction among advisors was the insurance planning support offered by companies and MGAs. Two-thirds of advisors (66.9%) indicated that these firms provide access to insurance experts who may help with complex cases, and almost as many (61.2%) said firms offered access to digital tools and portals.

On top of that, more than half (54.1%) said planning guides and resources were offered to help advisors work with clients. (Respondents could choose all answers that apply to them for survey category questions; total responses do not add up to 100%.)

The few suggestions for improvement were related to the need for companies and MGAs to be clear about minimum premium thresholds required for advisors to receive support services. “They are not open about [the] resources available to each tier of advisor,” said one MGA advisor in Alberta.

Holistic planning support was also highlighted. More than half of advisors said their company or MGA offered broad planning support through training focused on financial planning (55.2%), tools tied to holistic planning (52.9%), and access to planning experts (50.6%).

While a few advisors said they prefer to seek outside help for complicated planning, several appreciated their agencies’ investments in software and training.

“[The MGA is] always creating more ways to help the client,” said one advisor in Ontario. An advisor in Alberta from a different MGA said planning experts offered “great” assistance.

The survey found general approval when it came to resources for wills, estate and tax planning, with only about one-quarter (23%) of respondents saying they would like greater access to in-house experts for such planning.

According to one MGA advisor in Ontario, “If you aren’t doing large cases, there is no support.” An advisor in Atlantic Canada with a large insurer said support could be improved but that an estate division was available. Help from planners tended to be “really good” when they had direct conversations, the advisor added.

Business planning and skills development resources also were appreciated by advisors. Nearly three-quarters (73.6%) cited support for obtaining continuing education credits, and 69.0% had attended in-house learning conferences or seminars.

One MGA advisor in Quebec said, “Copious amounts [of content is] offered daily, weekly,” and there are webinars from industry representatives. The advisor added their agency helped them keep on top of compliance and insurance education credits.

A boon for many advisors (55.2%) was leadership teams that they described as “knowledgeable and transparent.” The strategies of these leaders were tagged as “clear and innovative” by 46.0% of participants. One MGA advisor in Ontario noted that management was “very focused on learning from the past and moving forward into the future.”

But there was room for improvement here as well. A fifth of advisors (20.7%) said leaders could be more supportive, while 19.5% felt unclear on strategy. Not one respondent indicated they received general support from management or mentors across the industry, and several expressed frustration that their primary firms or agencies had changed leadership or strategy without notice.

Advisor compensation also received mixed reviews. (See “Are insurance advisors paid properly?”.) For example, only 31.8% of respondents described compensation as reflecting the work they do, with slightly more (35.2%) saying their compensation was competitive.

What’s important to advisors, the survey results indicate, is that companies and MGAs demonstrate respect for advisors while recognizing the increasing demands from clients and investing in enhanced support.

A couple of advisors suggested that means more than primarily backing large producers and earners. One advisor with an MGA in Alberta said firms should not be “all over the map,” and should be focused regarding goals and recommended tools.

Still, most advisors (75.0%) said they were either “very likely” or “likely” to recommend a career in the insurance industry; only 4.5% said they would not.

Click image for full-size chart

This article appears in the February issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.