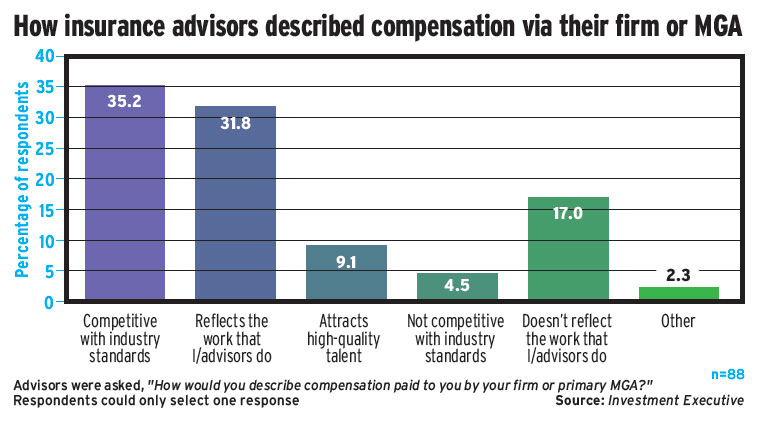

Insurance advisors generally consider their pay competitive and reflective of the work they do, according to Investment Executive’s (IE) first Insurance Advisor Report. Yet, a notable percentage of surveyed advisors felt otherwise.

More than one-third of surveyed advisors said their compensation was competitive (35.2%), with nearly as many saying their pay reflects the work they do (31.8%). One advisor who works through a managing general agent (MGA) in Ontario said their compensation “is both activity- and results-driven, and in line with the industry.”

However, 17.0% of respondents said their pay doesn’t reflect their work, and only 9.1% said compensation on its own is enough to attract high-quality talent.

An MGA advisor in Alberta placed some responsibility on advisors for their compensation. “[You have] the ability to make whatever you want,” the advisor said.

Advisor pay in the life insurance segment is based on several factors, which differ depending on the type of advisor and the company or MGA through which they work or process business. For example, while all insurance advisors are paid first-year commissions as well as subsequent, ongoing product-tied commissions based on industry guidelines, additional bonuses vary.

Sun Life Financial Inc., for example, works with both captive and independent contract advisors, with both groups earning sales-based commissions. But career advisors with Sun Life Financial Distributors (Canada) Inc. (SLFD) also can collect certain bonuses from the company.

“We recently revised our compensation structure for our SLFD advisors, in April 2023, to align with our strategy to increase client-centricity, reward advisors for growth, and increase alignment with industry,” said Rowena Chan, president of SLFD and senior vice-president of retail advice and solutions. No changes were made to compensation for independent advisors, she said. (Chan and other executives spoke to IE without seeing the survey data and weren’t responding to the report.)

In the MGA sphere, advisors typically collect overrides paid through the agents they work with. Amounts depend on factors such as the business relationships between MGAs and carriers, and the advisor’s relationship with the MGA.

PPI Management Inc., for example, takes a “holistic view of the advisor’s business,” including all of their sales and planning activity, said president Cathy Hiscott. An advisor might sell segregated funds and annuities in addition to insurance, she said, and the firm considers how many of its tools and services the advisor uses.

“We have a conversation and we set an override rate with the advisor,” Hiscott said, adding that the firm has for many years offered levels of compensation rather than one set rate.

Still, insurance advisors who sought improvement in compensation commented in the survey that carrier-based policy commission schedules can be problematic.

“Servicing existing clients takes a lot of time and energy, and the compensation for this is almost zero, or is zero, in many cases,” said an MGA advisor in British Columbia. The compensation model, which overweights first-year commissions, “compels advisors to focus on new sales and generate new commissions, and does not adequately reward us for retaining clients over the long haul.”

Another insurance and estate planning advisor in B.C. described servicing long-term policies as “effectively charity work,” impeding their ability to grow their income and business.

Others reflected on rising regulatory standards for client care amid static insurance industry pay: “The level and quality of work being done is not reflected by the commission level,” said an MGA advisor in Ontario. This advisor said they must perform more thorough needs analyses than others in the industry in order to sell product.

Change in this arena would depend on industry consultation, Hiscott said. “This is one of those industry age-old things. Are carriers going to look at levellized commission? [MGAs] don’t control anything.”

While insurance companies have previously mused about moving to levellized commissions — which spread out compensation on a life insurance policy sale over many years — both the Canadian Life and Health Insurance Association and the Canadian Association of Independent Life Brokerage Agencies said no such discussions are currently taking place.

Investor advocates have argued that spreading out commissions could foster better long-term service, but the industry has countered that a shift could be disruptive for advisors who structure their businesses based on the current model.

Click image for full-size chart

This article appears in the February issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.