Transport firms in good shape

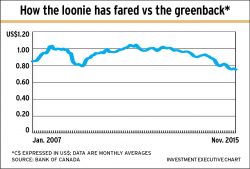

The drop in the loonie vs the U.S. greenback is saving the day, as are cost-cutting, margin expansion and major acquisitions

- By: Catherine Harris

- February 12, 2016 October 31, 2019

- 00:00

The drop in the loonie vs the U.S. greenback is saving the day, as are cost-cutting, margin expansion and major acquisitions

Sovereign debt, the safest part of the bond market, continues to thrive - and U.S. treasuries are the best of the bunch

Investment-grade corporates offer yield boosts vs government bonds of equal term

There is no clear or certain guide to determine when a bear market will end. But there are clues based on past market action

Stable consumer demand in the U.S. and Europe, as well as just-in-time delivery, may boost revenue in this industry while protecting against competition from offshore…

As the yuan joins the elite circle of reserve currencies, more investors will be using Chinese bonds for fixed-income

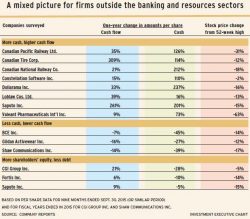

With banks and oil companies facing headwinds, firms in other sectors may hold more promise for investment returns

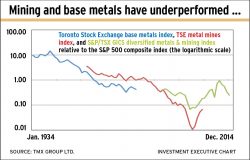

Comparing Canadian stocks' performance to the S&P 500 is key as it better represents the international industrial structure

Manage the short and longer terms with this approach in times of interest rate divergence

Companies that will benefit from both the anticipated strength in the U.S. economy and the low C$ deserve particular attention

Sliding currencies and high debt levels are causing investors to head for the exits when it comes to emerging-markets bonds

Although balance sheets and dividends continue to improve, many firms are struggling to use their assets effectively to improve profitability

In a climate of low single-digit yields for government bonds, junk bond yields are around 7%-11%

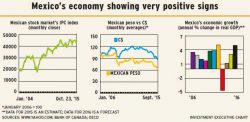

Mexico faces another watershed, as the government has pushed through reforms to improve productivity

There is a wide range in performance among the most stable stocks on the S&P/TSX 60 index

Recovery could do much for real-return bonds, which pay more as the consumer price index rises

Institutional and wealthy clients focus on medium- and longer-term performance rather than quarterly statements as retail clients do

What term premiums don't reveal, and what you can do about it

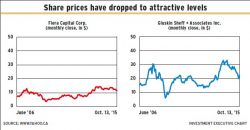

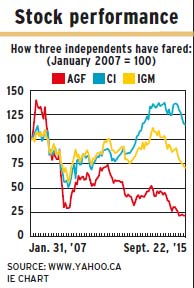

Non-bank mutual fund firms have it tough against the big banks, but investment opportunities exist

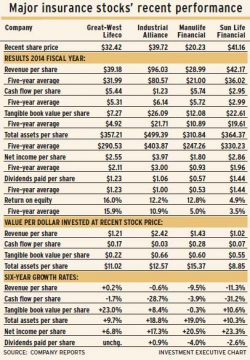

All four leading life insurance companies recently posted the largest earnings per share since the financial crisis

Recent reforms designed to transfer risk from banks to bond investors have made bond trading more difficult

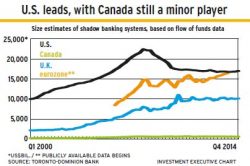

Shadow banking practices were at the heart of the 2008 financial crisis. Will they trigger another meltdown?