Canadian railways and trucking firms that criss-cross the U.S./Canada border are obvious beneficiaries of the big drop in the Canadian dollar (C$) because these companies’ revenue in U.S. dollars (US$) are enhanced when translated into C$. This exchange rate has made a big difference in financial results and makes these firms worthy considerations for your clients’ portfolios.

For example, Montreal-based Canadian National Railway Co.’s (CN) net income would have increased by only 1.8% in fiscal 2015, ended Dec. 31, 2015, had the C$ remained at 2014’s level. But with the loonie dropping by 13.8% during 2015, CN’s earnings rose by 11.7%.

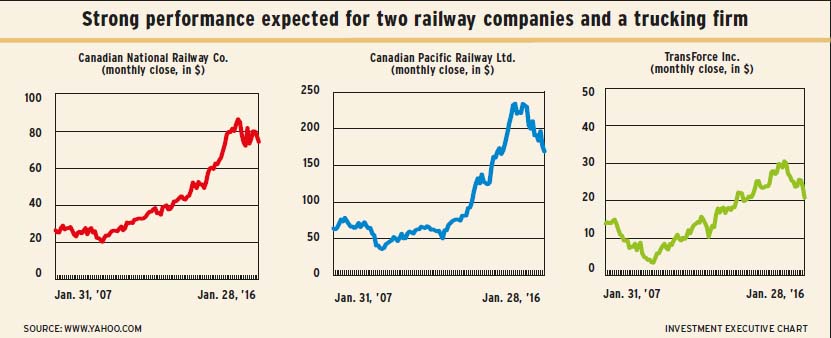

Further earnings gains are expected. David Tyerman, managing director, transportation and industrials, with Canaccord Genuity Group Inc. in Toronto, anticipates CN’s earnings per share will increase by 5% this year. He also foresees double-digit increases for Calgary-based Canadian Pacific Railway Ltd. (CP) and Montreal-based trucking firm TransForce Inc. Tyerman has a “buy” rating on all three companies.

These gains are impressive in a challenging economic environment in which the Canadian economy is weak, U.S. industrial production (aside from automobiles) is sluggish and weak prices are depressing commodities volumes.

Commodities are particularly important for railway firms, as they account for about 70% and 75% of CN’s and CP’s revenue, respectively. TransForce isn’t as vulnerable on the commodities front, and the firm sold its energy-rig moving business; however, the firm still struggles with weak volumes.

What’s saving the day for these firms is cost-cutting and margin expansion; and, in the case of TransForce, major acquisitions.

“CN was able to offset a significant amount of the hit through rapid cost actions,” says Tyerman.

CN is a very efficient railway that has long had the lowest operating ratio (OR; calculated as operating expenses as a percentage of revenue). CN’s OR was 58.2% for 2015.

CP’s OR was 61% last year (excluding unusual items). That metric is way down from 77% in 2012, and further declines are expected. CP expects its OR to be below 59% next year – and Tyerman agrees.

Tyerman also believes that there will be efficiency gains at TransForce, although they’ve been slower coming than he expected.

Here’s a look at the three companies in more detail:

– Canadian National Railway Co. is the biggest of the three companies, with extensive railway lines in the U.S. reaching the east, west and Gulf coasts. CN’s network also extends to both the east and west coasts in Canada, while CP’s runs only from Vancouver to Montreal.

CN’s mix of business is less commodities-based than CP’s; within the resources sector, CN carries much more forest products – 14.5% of revenue in 2015 vs 3.8% for CP. Thanks to continuing recovery in U.S. housing markets, forest products was the only commodities sector with strong double-digit volume increases last year.

“We believe CN will still outperform U.S. peers due to its diversified network, which results in lower exposure to commodities and higher potential to capture market share from intermodal,” states a recent report from Desjardins Financial Group’s (DFG) capital markets division in Toronto. “We expect management to remain aggressive on cost-cutting initiatives and maintain a disciplined approach to capital allocation.”

Tyerman’s 12-month price target for CN stock is $83 a share, while recent reports from DFG and Montreal-based National Bank Financial Ltd. (NBF) have targets of $81 and $77, respectively. The 796.3 million outstanding shares closed at $74.17 on Jan. 28.

Net income was $3.5 billion on revenue of $12.6 billion for the year ended Dec. 31 (excluding gains on asset sales), up from net income of $3.1 billion on revenue of $12.1 billion in 2014.

CN recently raised its quarterly dividend to 37.5¢ from 31.25¢, but the dividend yield still is quite low, at 2%.

– Canadian Pacific Railway Ltd.‘s impressive efficiency gains have come under CEO Hunter Harrison, formerly CEO of CN, who was hired in mid-2012.

Harrison also is spearheading CP’s attempt to acquire Norfolk, Va.-based Norfolk Southern Corp. This acquisition would give CP a bigger railway network and access to the U.S. east coast and provide opportunities for further efficiency gains, given Norfolk’s OR of 71.2%.

The potential acquisition is not a factor in any of the “buy” recommendations on CP’s stock, being a long shot. Norfolk has rejected all offers; even if the two firms came to an agreement, it would need the approval of the U.S. Surface Transportation Board, which may be influenced by objections from Norfolk’s customers, other railway firms and politicians.

NBF’s price targets for CP stock is $182 a share; DFG’s is $213; and Tyerman’s is $220. The 152.8 million outstanding shares closed at $169.14 on Jan. 28.

Net income was $1.4 billion on revenue of $6.7 billion in the 12 months ended Dec. 31, vs net income of $1.5 billion on revenue of $6.6 billion in 2014. (Several unusual items affected the financials in both years. If excluded, net income rose to $1.6 billion in 2015.)

CP’s dividend yield is low, at 0.8%. If the firm doesn’t pursue the Norfolk acquisition, CP may raise its dividend and buy back some shares. A factor to keep in mind is CP is highly leveraged, with a debt/capital ratio of 65.1%. That’s the highest among the big North American railways; CN’s is 42.3%.

– Transforce Inc. is a company built on acquisitions. Trucking is a more fragmented and competitive industry than railways, so size is important.

“[TransForce] has been reasonably successful in not only getting some economies of scale, but also in cutting costs and increasing efficiencies,” says Alan Pasnik, vice president, investment management, all-cap value team, with Mackenzie Financial Corp. in Toronto.

Adds Brandon Snow, co-chief investment officer with Cambridge Global Asset Management, a unit of CI Financial Corp. in Toronto, who also likes CP’s stock: “This is one management team in a really tough industry that has created a lot of value.”

NBF’s price target is $29 a share; DFG’s is $30; and Tyerman’s is $32. The 100.8 million outstanding shares closed at $20.79 on Jan. 28.

Net income, excluding acquisition costs, was $165.7 million on revenue of $4.3 billion for the 12 months ended Sept. 30, 2015 vs net income of $62.8 million on revenue of $3.3 billion a year earlier.

As an acquisitor, TransForce is highly leveraged, with a debt/capital ratio of 70.4%; dividend yield is 3.3%.

© 2016 Investment Executive. All rights reserved.