Creating a well-diversified portfolio composed solely of Canadian stocks has never been easy, but it’s even more difficult now due to low oil and weak base metal prices. The S&P/TSX composite index is dominated by energy, mining and financial services firms, so there are a relatively small number of other Canadian stocks from which to pick.

These limits can result in investors piling into those “other” stocks and pushing some of them to unreasonably high valuations during times such as now, when few investors are interested in energy or mining stocks. Although this piling in has been happening, portfolio managers such as Ted Whitehead, senior managing director and senior portfolio manager with Manulife Asset Management Ltd. in Toronto, still are finding good investment opportunities, particularly in companies that will benefit from both the expected strength in the U.S. economy and the low value of the Canadian dollar (C$) vs the U.S. dollar (US$).

Exports are expected to be the main engine of growth for Canada in 2016. The Bank of Canada is forecasting Canada’s real gross domestic product (GDP) to increase by only 2% or so this year; however, exports are expected to rise by at least 4% and perhaps by as much as 6%. Most of those exports will be to the U.S., which usually accounts for about 75% of Canada’s total foreign sales. The U.S.’s GDP growth is expected to be 2.5%-3% in 2016.

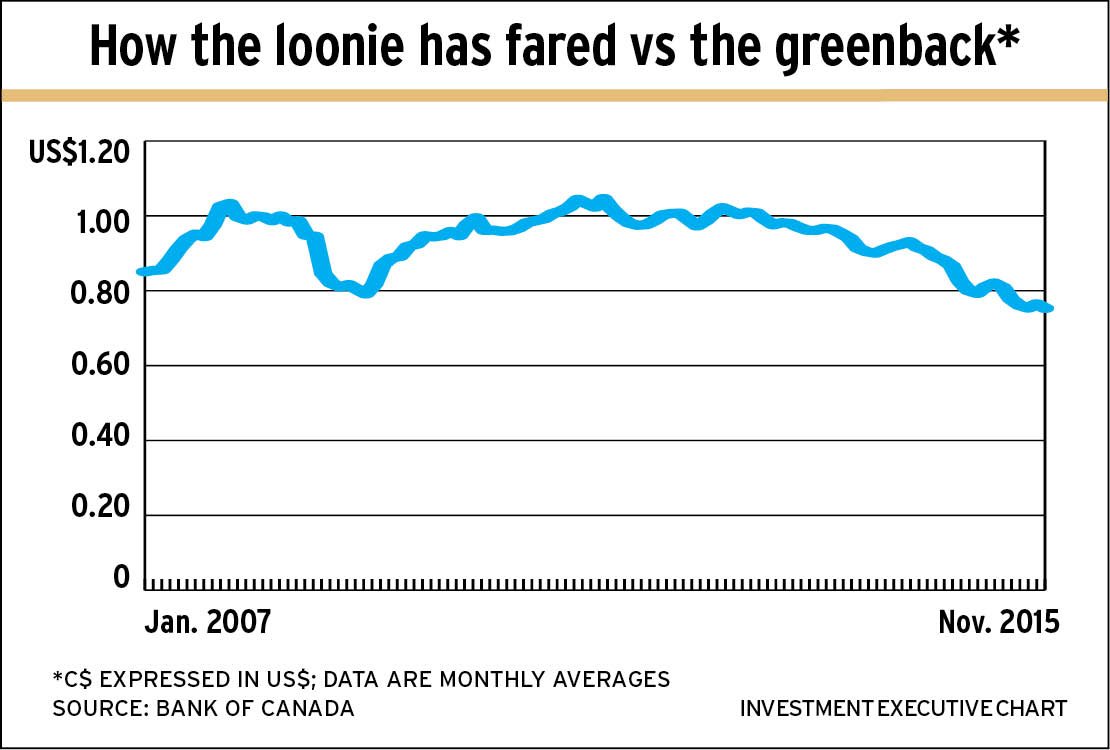

At the same time, the low value of the loonie increases revenue and earnings for Canada-based companies when translated into C$. That is, US$100,000 in revenue was worth $100,000 when the C$ was at parity in 2013; however, with the C$ now worth around US75¢, US$100,000 now is worth $133,000. Most of that increase will drop to the bottom line if a firm’s costs are in C$. If costs are $95,000, the profit on the US$100,000 sale will be $38,000 vs $5,000 when the loonie was at parity. However, if costs are in US$, they would be $126,350 in C$ and the profit would be only $6,650.

The positive impact of the low C$ can work in a few ways: Canadian firms can simply take the added profit; lower their prices in US$, which would make their goods more competitive in the U.S. market and probably increase sales; or do a combination of both.

Given the importance of the value of the C$, investors need to keep an eye on it. If the C$ starts rising, you and your clients should discuss whether to keep stocks in Canadian firms that have significant US$ revenue.

Among the companies that should benefit from both the strength of the U.S. economy and the low C$ and that are reasonably priced are: banks with significant U.S. operations; transportation companies that cross the Canada/U.S. border; and autoparts manufacturers. Stocks in these industries include Montreal-based Canadian National Railway Co., Calgary-based Canadian Pacific Railway Ltd., Guelph, Ont.-based Linamar Corp., Royal Bank of Canada, Toronto-Dominion Bank (both based in Toronto) and Montreal-based TransForce Inc.

However, there are other possibilities. Here’s a look at some, by sector:

– Consumer cyclical. Whitehead suggests two mid-cap companies: Winnipeg-based Boyd Group Inc. and Quebec-based Richelieu Hardware Ltd. Their stocks aren’t cheap, but he foresees growth for both firms.

Boyd owns a chain of autobody repair shops, 80% of which are in the U.S. Whitehead says Boyd’s business has good margins in a market in which brand is important because insurance companies prefer to deal with a known brand. Boyd is tapping into that situation by gobbling up independents.

Richelieu manufactures and distributes specialty hardware, such as kitchen accessories, lighting systems and storage solutions. The firm manufactures in Canada, but gets 27% of revenue in the U.S. and will benefit as the U.S. housing market continues to recover.

– Consumer defensive. Two possibilities in this sector are Montreal-based dairy company Saputo Inc. and Regina-based AGT Food & Ingredients Inc., which processes pulses (lentils, chick peas, beans and so on).

Saputo has spent 10 years building its U.S. platform, which now generates more than 50% of the company’s revenue. Saputo’s success is partly from disseminating its culture into acquisitions. Paul Musson, senior vice president, investment management, with Mackenzie Financial Corp. in Toronto, believes Saputo has good growth potential as the firm continues to expand through both internal growth and acquisitions.

About 10% of AGT’s revenue comes from the U.S., but that’s going to grow through sales of flours, proteins, starches and fibres used in gluten-free foods and pet food. AGT produces these in a North Dakota plant and the products will be marketed by U.S.-based Cargill Inc. and Ingredion Inc.

– Resources. With oil priced in US$, Canadian companies are getting higher prices in C$. That’s not enough to make most oil companies profitable, but, Whitehead says, Calgary-based Raging River Exploration Inc. is an exception as it’s a very low-cost producer.

Forest products is a more promising sector because of the U.S. housing recovery. Saint-Laurent, Que.-based Stella-Jones Inc. makes utility polls and railway ties, mostly for the U.S. market. Darren Lekkerkerker, portfolio manager with Fidelity Investments Canada ULC, a subsidiary of Boston-based FMR LLC (a.k.a. Fidelity Investments), in Toronto, calls Stella-Jones a “quality company with good growth potential.”

– Industrials. Three companies are suggested in this sector: Calgary-based DIRTT Environmental Solutions Ltd., Vaughn, Ont.-based Progressive Waste Solutions Ltd. (PWS) and Edmonton-based Stantec Inc.

DIRTT uses proprietary software to design and provide components for offices, schools, hospitality, retail and health-care facilities, says Whitehead, and sells its products predominantly in the U.S.

PWS collects, transfers, recycles and disposes of garbage; it gets almost 60% of its revenue in the U.S.; has a good mix of residential, commercial and industrial customers; and has improved operating efficiency, including “better aligning compensation with outcomes,” says Musson.

Aubrey Hearn, vice president and senior portfolio manager with Toronto-based Sentry Investments Inc., likes Stantec, a small-cap engineering firm that consults on major infrastructure projects and gets about 50% of its revenue from the U.S.

© 2016 Investment Executive. All rights reserved.