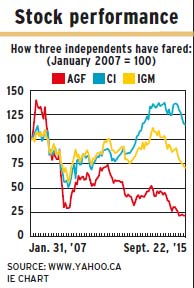

The mutual fund business is highly competitive, and the mutual fund arms of the big banks are winning market share. Among the large independent fund firms, only Toronto-based CI Financial Corp. is holding its own.

That does not, however, mean that AGF Management Ltd. and IGM Financial Inc. aren’t worth investing in. Robin Cornwell, president of Catalyst Equity Research Inc. in Toronto, has a “buy” recommendation on AGF; and both he and Scott Chan, analyst with Canaccord Genuity Corp. in Toronto, have “buys” on IGM.

These recommendations partly reflect the relatively low share prices. However, IGM is a strong company and is likely to remain so. Its Investors Group Inc. subsidiary has in-house distribution and investment performance at its other major subsidiary, Mackenzie Financial Corp., is likely to turn around.

Furthermore, IGM is backed by deep-pocketed Power Financial Corp.

AGF is more of a question mark, but there are signs of improved investment performance that could stem the many years of net redemptions. AGF also has a high net-worth business that has been doing well.

Cornwell and Chan both have “buys” on CI. The firm, while watching costs, offers a broad range of funds that generally have above-average performance. CI also made good acquisitions in 2003: Assante Corp. gave CI access to distribution through Assante advisors; Synergy Asset Management Inc. broadened CI’s investment-management capability.

Here’s a look at the three fund companies in more detail:

> AGF MANAGEMENT LTD. Assets under management (AUM) were $33.3 billion as of Aug. 31, 2015, vs a peak of $55.8 billion as of May 31, 2007. (In that same period, IGM’s AUM rose by 10%; CI’s, by 64%.)

The outflow of AGF’s AUM came from both mutual fund redemptions and loss of institutional business. Mutual fund AUM was $19 billion as of Aug. 31 this year vs $30.6 billion in 2007, while institutional AUM fell to $10.5 billion from $21.1 billion over the same period.

Only the high net-worth business has grown, to AUM of $4.4 billion vs $4.1 billion over the same period.

AGF has made a number of missteps in recent years. Its attempt to build a trust business was an expensive proposition that didn’t work; AGF sold AGF Trust Co. to B2B Trust in 2012.

AGF Management’s acquisition of Acuity Funds Inc. in 2010 also was a disappointment, with Acuity’s strong investment performance in 2008-10 reversing after AGF purchased Acuity. AGF’S choice of Martin Hubbes as chief investment officer (CIO) wasn’t successful, with investment performance remaining weak and good portfolio managers leaving during his tenure. Hubbes was let go at the end of 2013.

AGF’s new president and CIO is Kevin McCreadie. He joined the firm in 2014 and investment performance has been good so far this year, with 65.5% of long-term AUM in funds with first- or second-quartile ranking in the first eight months of 2015. This improvement in performance is decreasing net redemptions. If that continues, net sales will result.

AGF cut its quarterly dividend to 8¢ from 27¢ last autumn to pay for initiatives to develop the business and increase shareholder value.

Cornwell’s one-year target price is $7 a share, up considerably from the $5.83 at which the 82.9 million shares outstanding closed on Sept. 22. Chan’s target is only $5.25 a share, and he’s recommending that investors sell.

For the six months ended Aug. 31, AGF had net income of $24.8 million on revenue of $227.2 million, excluding non-recurring items. That’s down from net income of $29.3 million and revenues of $236 million for the same period a year earlier.

> CI FINANCIAL CORP. CI remains popular with analysts. Says Chan: “[CI] offers anything investors want at very competitive fees.” He notes that CI has strong relative investment performance.

Although Shubba Khan, research analyst at National Bank Financial Ltd. in Toronto, rates CI merely as “sector perform,” he also likes the firm: “It’s somewhat remarkable. It lost its preferred access to Sun Life customers a year ago, but is still holding its own. There has been no indication that increased market volatility has hurt CI’s sales momentum.”

Cornwell’s target for CI stock is $36 a share; Chan’s is $37. The 279 million shares outstanding closed at $29.80 each on Sept. 22.

CI’s net income was $282.8 million in the six months ended June 31, up from $249.5 million in the corresponding period a year earlier. Revenue was $1 billion, up from $910 million.

> IGM FINANCIAL INC. Mackenzie’s loss of a $10.3-billion investment-management contract in June doesn’t worry analysts because subadvisory contracts generate low fees. Mutual funds account for most of IGM’s revenue – and mutual fund AUM has been relatively stable. Mackenzie has been in net redemptions for much of the past seven years. However, Investors Group’s AUM has been much stickier because of the parent firm’s extensive, in-house financial advisor network.

As a result, IGM’s total mutual fund AUM rose, albeit modestly, to $120.7 billion as of June 30 vs $109 billion at the end of 2007.

Mackenzie’s fund performance was weak in 2014 and in January to August of this year: less than 40% of long-term AUM was in above-average performing funds.

However, Chan thinks a turnaround at Mackenzie is “in sight.” He points to new products, a “revamped” wholesaler team and a competitive fee structure.

He also notes that IGM is increasing support for its consultant base.

Chan’s share price target is $41; Cornwell’s is $48. The 248 million shares outstanding closed at $35.43 on Sept. 22.

IGM’s net income was $398.8 million in the six months ended June 31, vs $398.3 million in the corresponding period a year earlier, excluding restructuring charges in 2014. Revenue was $1.5 billion, up from $1.4 billion.

© 2015 Investment Executive. All rights reserved.