For an insurance strategy to succeed, a fundamental factor is required: a trusted and competent insurance advisor. Essential to that trust is the assumption that the client will be sold a product that suits their insurance needs.

A regulatory review of universal life (UL) sales at firms in Ontario with tiered recruitment models found that policies often didn’t align with clients’ needs. Further, insurance advisors conducted needs analyses that were often trivial or flawed, or sold policies without identifying an insurance need, the regulatory report said. In many cases, retirement planning advice was incomplete or inaccurate, and policy illustrations were misleading or unrealistic.

“The agent selling the product must be ethical and thoroughly knowledgeable about UL and all its components, and able to customize the product to fit the customer’s overall financial picture, risk tolerance and overall financial plan,” the report said.

You may not work for one of the firms analyzed in the report, but you are subject to a suitability obligation no matter where you’re licensed in Canada.

For a thorough consideration of that obligation, visit CEcorner.ca this autumn for an insurance suitability course presented by Meagan Balaneski, financial planner with Cup of T Financial Planning in Vermilion, Alta. The course’s goal, as Balaneski describes it, is to “take this intangible concept [of suitability] and make it tangible, specific and achievable.”

Here’s a peek at the video’s content:

What is suitability, anyway?

Suitability lies on a spectrum. At one end, a product is simply “not unsuitable,” while at the other, it achieves a fiduciary standard.

It’s natural to assume the fiduciary standard, as the highest level in that spectrum, would be better, Balaneski says in the video. But that’s not always the case if that standard results in recommending a complex “super insurance plan” that’s not useful or appropriate for the client, given their other saving and spending goals.

To determine suitability, Balaneski suggests you consider three time frames related to the pre-claim period, the triggering event and policy length. “A client who has a suitable premium and a suitable claim benefit and a policy that matches their suitable long-term goals is not going to raise the issue [of suitability],” she says.

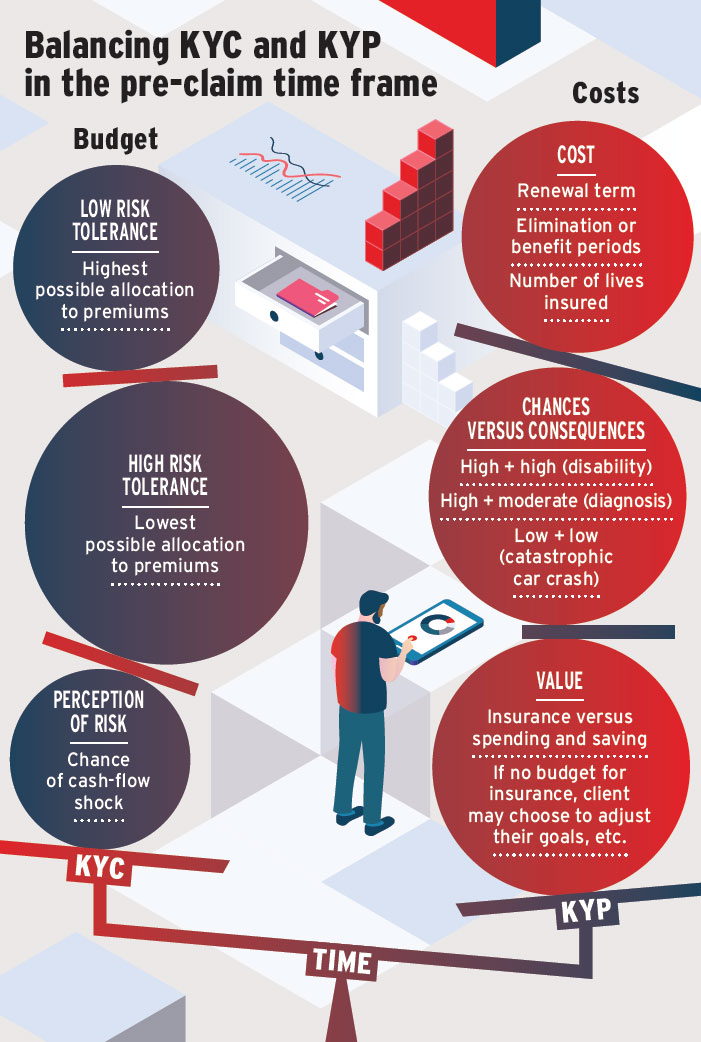

For each time frame, client goals are matched with product outcomes, using know-your-client (KYC) and know-your-product (KYP) processes.

During the pre-claim period, premium costs must fit within the client’s budget and cash-flow plan. When the triggering event for a claim occurs, such as an illness or death, the policy’s characteristics (for example, payout value or elimination period) must meet the client’s needs. And you must consider what happens to the policy over time versus the client’s evolving needs. For example, a policy may become less suitable once children grow up.

Each time frame analysis results in a suitable recommendation. Present the options to the client and let them decide, Balaneski says.

A deep dive into suitability during the pre-claim time frame

During the pre-claim period, KYC analysis centres on budgeting and cash flow. The analysis, covered more fully in the continuing education course, results in amounts allocated to insurance for both a low risk tolerance (a maximum allocation to insurance while still ensuring adequate levels of saving and spending) and high risk tolerance (a minimum allocation to insurance).

With these two benchmarks established, the right allocation for the client would be influenced by the client’s perception of risk, Balaneski says. For example, a self-employed client with a young family may prioritize saving for emergencies or prioritize spending to ensure a certain living standard.

But a client who is in a union and has a pension may not expect a cash-flow shock in their future.

Next, a KYP process pairs an insurance product’s qualities with the KYC analysis. Product costs can vary based on factors such as renewal term, elimination or benefit periods, and number of lives insured. Balaneski also considers the chances and consequences of a claim, and how they factor into premiums and the client’s priorities. For example, the chance of a disability claim is high relative to other claims, and its consequence on finances (the payout) is relatively high.

An additional consideration is how the client values the coverage in relation to their goals. This is where KYP meets KYC, Balaneski says. “What we really want to look at here is how does the client see their budget in relationship to the insurance category.”

She noted that some clients may have nothing to allocate to insurance, based on their cash-flow analysis. In such cases, “they are given the choice to adjust their goals, produce more income or reduce their expenses,” she says. “An advisor would be remiss in their responsibilities of suitability if they did not present an actual calculation for zero budget to insurance” in these cases.

Click image for full-size chart

This article appears in the May issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.