Connecting the work-anywhere advisor

Mobile tech is key, advisors say, but some firms fall short

- By: Surina Nath

- May 1, 2020 June 10, 2020

- 00:12

Mobile tech is key, advisors say, but some firms fall short

Wellington-Altus tops standings in a variety of categories while BMO plummets

Firms say they are putting resources into RI education and support

Advisors share their views on the CSA's client-focused reforms

Firms share their plans for both fee-based and discretionary platforms

An overview of the 2019 Brokerage Report Card results

Products and services for wealthy clients could be bolstered

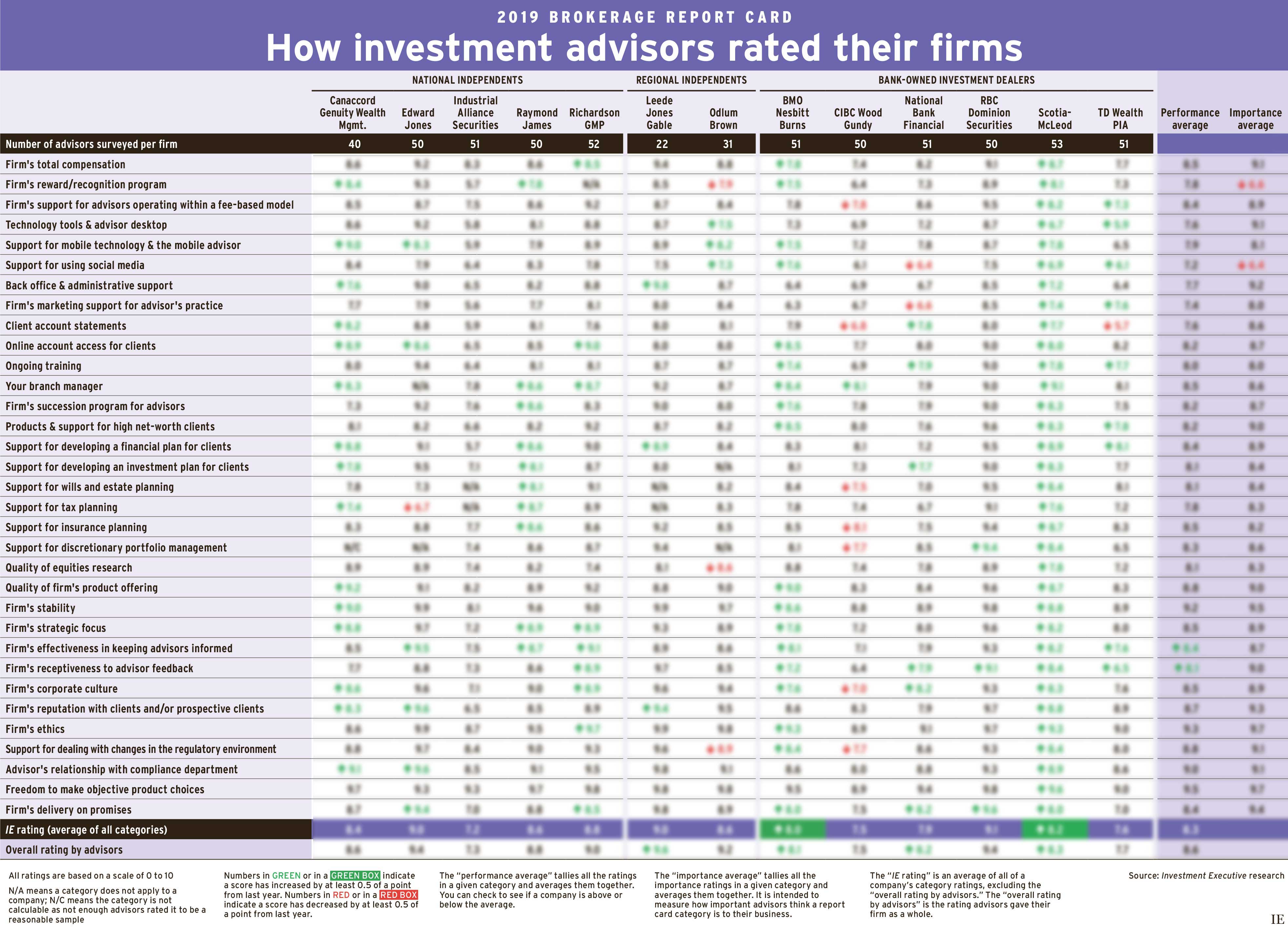

How investment advisors rated their firms

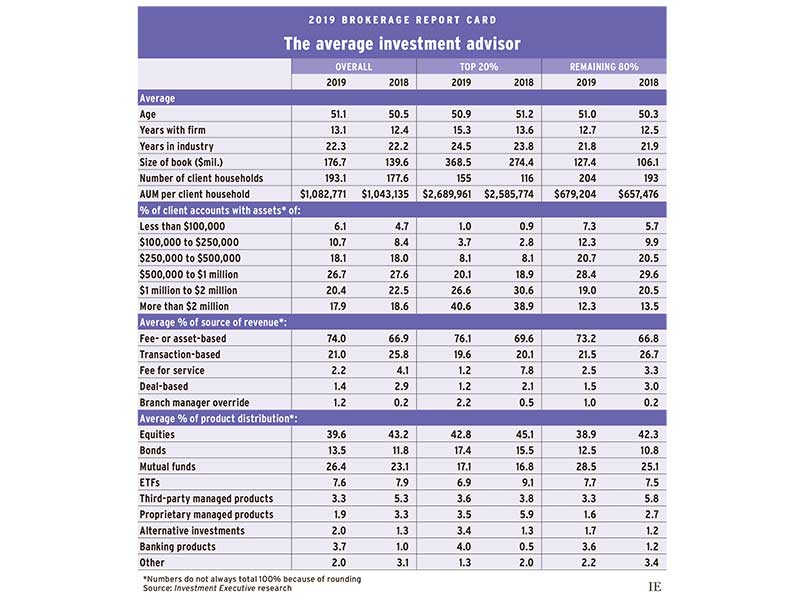

The average advisor saw higher AUM and productivity, and more client households

Whether or not a firm will thrive or dive depends on whether executives act on advisor feedback

Clarity from firms on available options may be the key to change

Advisors aren't prioritizing online tools as much as firms may think

As investor needs shift, advisors are embracing a comprehensive look at their clients' finances

Advisors also shared how firms could help further

Although advisors reported another all-time high average book of business, they're dealing with much uncertainty due to the major changes their firms and the industry…

How investment advisors rated their firms

Many of the trends seen in last year's Report Card have picked up steam, with assets under management and productivity rising at a healthy pace…

After a rough showing in 2017, BMO Nesbitt Burns and ScotiaMcLeod faced very different assessments from their advisors this year

A firm's standing in the eyes of clients and prospective clients is one of the most important issues for advisors, but some firms have work…

Advisors at four firms cited recent changes that have made the experience of dealing with their back office more difficult

Advisors with bank-owned brokerages were split in their opinions of the roles their branch managers fulfil. Some oppose the producing branch manager model others said…

Advisors with five of the 12 firms in the Report Card rated their brokerages lower by half a point or more in the "online account…

There are several reasons why advisors with bank-owned investment dealers are unhappy this year, but the shift from being "bank-owned" to "bank-run" is the most…