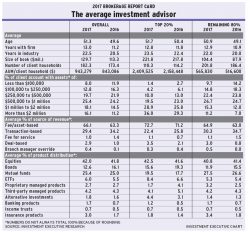

Brokerage Report Card 2017 main chart

How advisors rated their firms

- By: IE Staff

- April 28, 2017 November 9, 2019

- 00:07

How advisors rated their firms

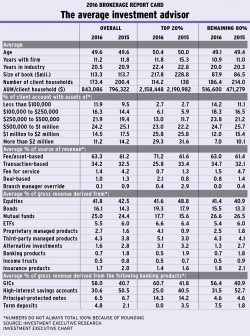

Other key metrics also shifted: higher-value accounts now make up a growing proportion of the average book fee- and asset-based sources of revenue continue to…

Ratings for TD Wealth Private Investment Advice, BMO Nesbitt Burns and ScotiaMcLeod swung dramatically this year for a variety of reasons. Corporate culture, strategy and…

The difference between how advisors with bank-owned dealers and their counterparts with independent firms feel about their corporate culture is more pronounced

A remarkable 71% of investment advisors support the CSA's proposal to introduce a best interest standard due to the need to elevate industry standards across…

There is growing sentiment that financial advice is increasingly available only to high net-worth investors

The enhanced performance and fee disclosure included in client account statements have yet to make the impact many advisors expected - although some advisors point…

The brokerage business is going through profound change, and advisors are counting on their firms to help them navigate through the new twists and turns

Firms have adjusted their pay structures to reward advisors with larger or faster-growing books at the expense of advisors with modest-sized books, many of whom…

The emergence of online financial services isn't a threat to most advisors' businesses because their clients prefer a personal touch

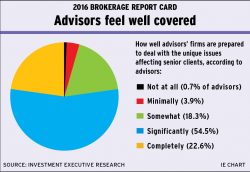

More than 75% of advisors surveyed said their firms are prepared for the unique issues affecting this demographic

Assets under management have remained steady over the past year, ending a string of successive gains that advisors have enjoyed this decade, while productivity has…

How advisors rated their firms

As social media gains prominence as a marketing tool for advisors, access is more critical than ever. The firms that provide access to the online…

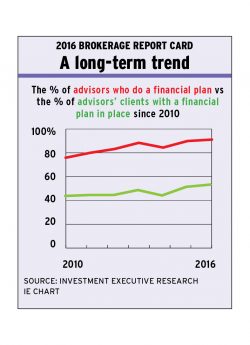

Advisors consider financial planning to be more important than ever, and more advisors are creating financial plans with their clients. However, challenges remain in getting…

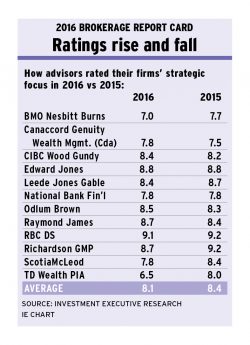

With strategic focus becoming more important for advisors, many are questioning their firm's efforts to attract and serve high net-worth clients while other advisors praise…

Quick response times, consistency, reliability and a client- and advisor-focused approach by back office staff are critical

Firms' greater focus on operating within a fee-based compensation model makes the transition easier for advisors

How advisors rated their firms

Not only do advisors want access to management, they also want their leaders to make changes based on advisors' suggestions

Most advisors favour having non-producing branch managers, but there are some who say the old approach still has value

Whether or not advisors are satisfied with their firms' offerings, several brokerages are bringing in more specialists and making major steps to improve the support…

Many advisors say their firms can't always be counted on to follow through on their promises

Some advisors clamour for their firms to make greater efforts so that their brands become better known among the public

Technology woes continue