Investment advisors surveyed for this year’s Brokerage Report Card saw their take-home pay rise substantially over the past year. But, in general, they’re not any happier with their firms’ compensation packages.

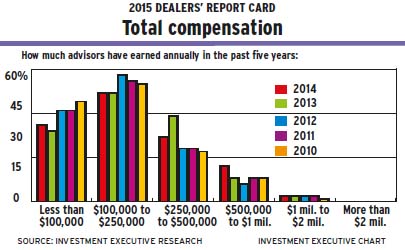

Among the advisors surveyed for this year’s Report Card, 45.4% said their total compensation in 2014 was $500,000 or higher, up significantly from 28.7% of advisors a year prior. Nonetheless, advisors gave their firms an average rating of 8.2 in the “firm’s total compensation” category, which is unchanged from last year. That rating falls considerably short of the importance rating of 9.1 that advisors gave to the category.

Much of the dissatisfaction is a result of several brokerage firms tweaking their payout grids and compensation programs over the past year. The overall trend appears to be toward raising grid thresholds to motivate advisors to boost production levels while implementing incentives that reward those advisors who are actively growing their practices.

“All the firms are cutting back on commissions,” says an advisor in Ontario with Toronto-based ScotiaMcLeod Inc. “It’s a little bit demotivating because if you don’t bring in new clients, they claw back – and we’re at capacity right now. “

Among the advisors affected by the changes, the reviews were mixed. Those who feel they have to work harder to maintain their current level of compensation were frustrated and, as a result, many advisors punished their firms with lower ratings for compensation.

However, some firms that implemented compensation changes were awarded higher ratings this year, with advisors indicating that they feel they’re being rewarded for their hard work.

Montreal-based National Bank Financial Ltd.‘s (NBF) compensation rating rose to 7.8 this year from 7.2 in 2014. The firm recently raised the minimum revenue threshold that advisors must produce – to $375,000 from $350,000 – to qualify for a payout percentage above the 20% base payout. NBF plans to raise that threshold to $400,000 later this year.

“On the lower end of grid, we’ve raised the minimum,” says Steve Galimi, vice president of strategy and performance, wealth management, with NBF. “We need to raise the bar.”

Advisors who felt the impact certainly were not thrilled with the changes. “I don’t think it’s fair that we have a new grid,” says an NBF advisor in Atlantic Canada. “They need to stop squeezing the little guys and let us make a living.”

But the change affects only about 3% of NBF advisors, Galimi says. And most NBF advisors indicated that despite the change, they feel well compensated. “We have the best compensation,” says an NBF advisor in Ontario.

ScotiaMcLeod also saw its compensation rating rise – albeit slightly, to 8.0 from 7.8 year-over-year – after the firm made minor changes to its compensation program that aim to reward advisors for new external growth and to encourage advisors’ focus on higher net-worth clients. Not all advisors were happy with the changes, but some gave positive feedback.

“The recently revamped bonus program has been well thought out,” says a ScotiaMcLeod advisor in Atlantic Canada. “It’s focused on growth and is working in incenting me.”

Other firms that tweaked their compensation structures were punished with lower scores. Mississauga, Ont.-based Edward Jones‘ compensation rating, for example, dropped to 8.2 this year from 8.8 as a result of the way the firm now calculates asset bonuses. Branches now are awarded bonuses based on new assets that they’re bringing in rather than on total assets under management, says David Lane, the firm’s managing principal in Canada.

“[We’re] not compensating just on the same assets month after month, but giving credit based on net new assets,” Lane says. “We want to recognize those who are growing their practices vs those who just stay at the same level.”

Edward Jones advisors certainly noticed the change. “It really impacts our earnings,” says an advisor in Ontario.

Advisors with Toronto-based Richardson GMP Ltd. also are grappling with changes, and rated their firm lower for compensation as a result. Specifically, the advisors who previously were with Macquarie Private Wealth Inc., which Richardson GMP acquired in late 2013, made the transition to the Richardson GMP grid last year – and lower-producing advisors felt the greatest impact, as payout levels at the low end of the grid are less generous than those in Macquarie’s model, says Andrew Marsh, Richardson GMP’s president and CEO.

“Those in the $500,000 to $1 million range would have seen a drop from the Macquarie grid onto ours,” he says. “For the top producers, which is what Richardson GMP has always focused on, there’s very little change.”

Advisors formerly with Macquarie also are adapting to Richardson GMP’s equity-ownership model and its cost structure, which gives advisors greater responsibility for their business costs. “We’re a culture of ownership, and it does take a little bit of time for people to understand what that means,” Marsh says.

Some advisors appear to be struggling to adjust to these changes. Says a Richardson GMP advisor in British Columbia: “Advisors are expected to pick up a significant share of costs associated with staffing, and that’s a fairly onerous financial burden.”

The key to keeping advisors happy about compensation, though, is a model that’s fair, easy to understand and consistent. Calgary-based Leede Financial Markets Inc. appears to have found the right formula, as advisors gave the firm the top rating in the compensation category, at 9.6.

“We have a fair and clear system,” says a Leede advisor in B.C. “Everyone is on a 50/50 grid.”

© 2015 Investment Executive. All rights reserved.