The majority of investment advisors surveyed for Investment Executive’s 2015 Brokerage Report Card don’t believe the implementation of the second phase of the client relationship model (CRM2) will have a dramatic effect on their businesses.

As a group, advisors who ply their trade at Canada’s major brokerages feel that the enhanced cost disclosure and performance reporting associated with CRM2 will align easily with the way these advisors already run their businesses. Advisors also believe they’ve made the necessary adjustments to ensure the transition to the new regulatory reality will be a smooth one.

“I don’t understand the fuss, truly,” says an advisor in Ontario with Toronto-based Raymond James Ltd. whose business primarily is fee-based and who thus feels that CRM2 will have no effect on his business.

Adds an advisor in Quebec with Toronto-based BMO Nesbitt Burns Inc.: “I welcome the [CRM2] changes. They will be great for clients and good for the industry as a whole.”

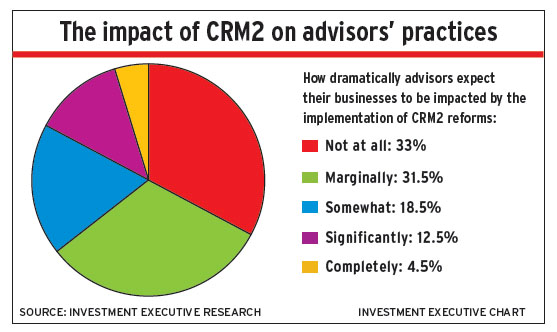

In fact, a remarkable 64.5% of advisors surveyed for this year’s Report Card say CRM2 would have either no impact on their business or only marginal impact at most. In contrast, the rest of the survey participants felt that the new regulatory regime would have somewhat of an impact, a significant impact or would completely transform their business.

Advisors who anticipate either minimal or no effect from CRM2 ascribed their confidence to the fact that their clients are fully aware of all costs already – in part because those advisors have been up front with their clients about the fees all along.

“I’m already transparent,” says an advisor in Ontario with Mississauga, Ont.-based Edward Jones. “The first thing I do with new clients is go over the fees.”

Adds an advisor in Alberta with Toronto-based TD Wealth Private Investment Advice (TD Wealth PIA): “I’ve always disclosed any investment costs to my clients anyway. Who wasn’t doing that? That’s what I’d like to know.”

Advisors whose businesses have long been fee-based expressed more comfort with the changes, while other advisors acknowledged that the changing regulatory landscape has forced them to adopt a fee-based model.

“I’m changing the nature of my business and increasing the percentage of fee-based business,” says an advisor on the Prairies with Toronto-based CIBC Wood Gundy who believes the new regulatory regime will have a significant impact on his business. “CRM2 was the main driver of that.”

Meanwhile, some advisors who believe that CRM2 will change the industry dramatically said their businesses will be affected favourably, noting that the implementation of CRM2 represents a golden opportunity to increase their business and pick up clients and assets from advisors who can’t or won’t adapt.

“The industry will be in for a wake-up call that will create opportunities for our business to gain more clients,” says an advisor in British Columbia with Toronto-based Richardson GMP Ltd.

Adds a TD Wealth PIA advisor in Ontario: “We stand to benefit as clients of other firms start to see the fees they’re paying and look for other options. I think we could win that fight.”

Some advisors singled out their firms for praise for the support those advisors receive to help them adapt their businesses to the new regulatory reality and for assisting in communicating with clients about the changes proactively.

“My firm and I have been working on this for years. Raymond James is way ahead on this,” says an advisor with that firm in Atlantic Canada.

The heavy lifting involved in transforming firms’ systems, educating advisors and preparing clients proactively in anticipation of the full implementation of CRM2 will pay off in terms of advisors thriving under the new reality, says Mario Addeo, senior vice president and national director of private client solutions with Raymond James.

“For the true professionals who have a wealth-management practice, [CRM2 is] a great opportunity,” he says. “It only benefits good advisors who are doing the right thing by their client.”

Advisors who believe that CRM2 will have a significant or negative effect on their business said that the new rules will be unnecessarily disruptive to existing client/advisor relationships, scaring away the very clients who might need financial advice the most.

“My high net-worth clients understand the value of what I do and are likely to have no problem [with fee transparency],” says an Edward Jones advisor in Ontario. “I believe that for my lower-net worth clients, fee disclosure will be a bigger issue. They are less involved and are likely to be surprised, even upset, by fees.”

Adds a Wood Gundy advisor in Alberta: “I expect a lot of clients will get out of the market [when CRM2 is implemented] because they’re fee-averse. They’d prefer to shoot themselves in the foot than pay fees.”

Some advisors said that educating clients about the new regulations will take time and effort, which is likely to harm productivity. Other advisors said that the negative effects of CRM2 may be amplified should the arrival of full fee transparency coincide with a correction in the market.

Furthermore, many advisors believe that CRM2, for all its good intentions, will not really achieve its goal of protecting clients.

“Disclosure is going to be thrown in people’s faces, which is not the right way [to go],” says a Nesbitt advisor in Ontario. “It’s going to satisfy [investor advocates] – and that’s about it.”

© 2015 Investment Executive. All rights reserved.