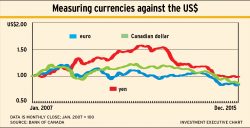

Modest gains for Canadian dollar?

As we head into 2016, the U.S. dollar is likely to remain around current levels against most currencies. But that does not preclude some ups…

- By: Catherine Harris

- January 15, 2016 November 9, 2019

- 00:00

As we head into 2016, the U.S. dollar is likely to remain around current levels against most currencies. But that does not preclude some ups…

Health care, consumer discretionary and telecommunications services stand out as favourites on Wall Street for 2016. Information technology, financial services, industrials and consumer staples also…

Corporate sector has benefited from "Abenomics," while quantitative easing has pushed down the yen vs the US$, making exports more profitable

As China's government faces several challenges, the world's second-largest economy is expected to grow by more than 6% this year. Investment opportunities are shifting from…

Despite market volatility, the region exhibits encouraging signs for investment - especially among domestically focused companies - as the economy begins to pick up steam

India's economy, which is self-contained and has little reliance on exports, is also a major importer of oil. Some say it has tremendous long-term potential

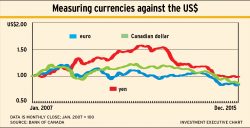

The baseline for fixed-income investments is sovereign debt, but beating those returns is possible by adding duration risk or default risk – usually using corporate…

As the Fed begins raising rates, investors are unsure whether to seek safety or brave the markets in the search of bargains and better returns…

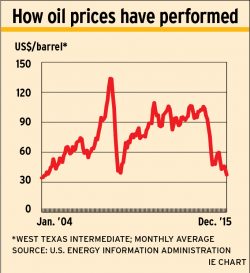

A complex interplay of factors, such as OPEC's policies and China's economic growth, make prices for oil and gas producers and base metals firms uncertain.…

Low interest rates will continue to hurt financial services firms, particularly the banks, which are looking for ways to supplement reduced earnings from narrow net…

Global economic growth this year is expected to be anemic

Growth in Asian economies are expected to slow slightly this year, but the overall pace remains healthy. However, the region remains vulnerable to the slowdown…

Outlook 2016Despite trouble signs in many regions and sectors, some investment strategists say there still is room for returns in 2016

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds