Economic recovery is underway in Europe, and it is gradually providing investment opportunities in the region, particularly in consumer and financial services stocks.

However, Peter Hadden, portfolio manager with Fidelity Investments Asset Management in Smithfield, R.I., warns that with a variety of headwinds facing the region, portfolio gains will be selective and investors will need to do their research to identify winning investments.

“It’s really a stock-picker’s situation, as opposed to a sector situation,” says Hadden, who manages Fidelity Europe Fund. “There are not going to be easy sector calls.”

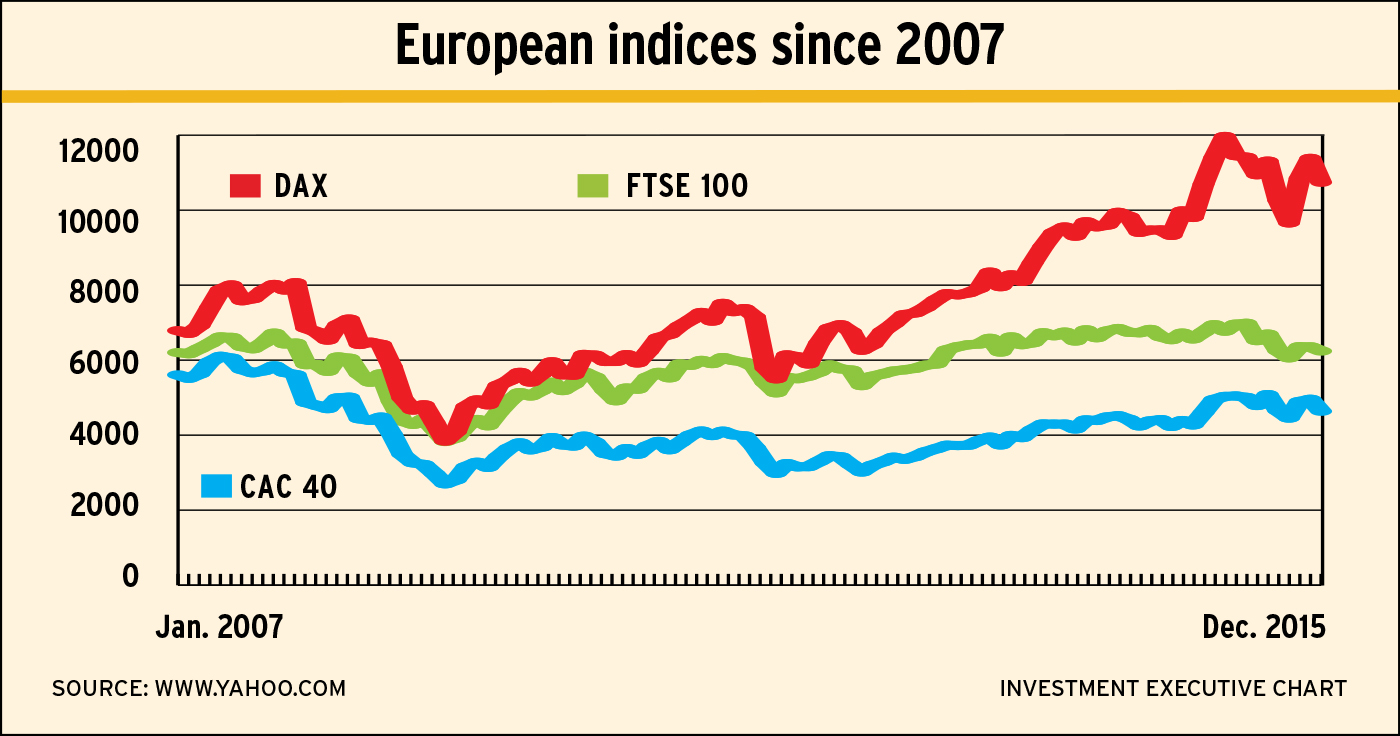

Following a strong start to 2015, Europe’s markets had a turbulent fourth quarter as investors reacted to such events as the Syrian refugee crisis, continued weakening of commodity prices and the slowdown in China’s economy (a key market for European exporters). These factors are expected to contribute to continued volatility this year.

“I think [this] year is going to be very volatile, so I think investors need to be aware of the risks and the opportunities of volatility,” says David Hussey, head of pan-European equities with Manulife Asset Management (Europe) Ltd., in London, U.K.

Despite the volatility, however, Martin Fahey, senior vice president and head of European equities with I.G. International Management Ltd. in Dublin, says there are encouraging signs for investors – particularly among domestically focused companies in Europe – as the region’s economy gradually begins to pick up steam. The European Commission (EC) estimates that real gross domestic product (GDP) in the eurozone grew by 1.6% in 2015, up from 0.9% in 2014.

“You can see a gradually strengthening trend,” says Fahey, who manages Investors European Equity Fund. “A recovery is happening, but it is relatively muted by historical standards.”

The European Central Bank (ECB) has played a big role in the economic recovery. Quantitative easing has facilitated more lending by banks and has deflated the euro considerably, which has benefited exporters.

In order for Europe’s economy to improve further, however, Fahey says, the economy must gain its own momentum and improve competitiveness.

“A lot more needs to be done in terms of reforms to make Europe more competitive at all levels,” he says. “The ECB by itself can’t solve all of the problems.”

For example, even though financial services institutions are in a far better position to lend now, there still is little consumer demand to borrow.

“[Lending] has improved, but it hasn’t improved to the extent we would want,” says Amber Sinha, portfolio manager with Kingston, Ont.-based Empire Life Investments Inc. and lead manager of Empire Life International Equity Fund. “It’s going to be a gradual process.”

As consumers gain more confidence, Hussey anticipates that lending activity will increase in the year ahead: “I think credit demand is going to pick up.”

Overall, 2016 should be a slightly stronger year for Europe’s economy. Serge Pépin, investment specialist, European equities, with BMO Global Asset Management (EMEA) in London, U.K., predicts real GDP growth of 1.7%-1.8% in 2016 and 2% in 2017.

“There’s a lot of positive out there that should support the economy in 2016 and 2017,” Pépin says. “It will be positive, but definitely still relatively weak, historically speaking.”

Some of the strongest regions for economic growth include the peripheral countries that were hit hardest during the global financial crisis of 2007-08. In particular, Spain and Ireland have experienced healthy rebounds, with the EC estimating real GDP growth of 3.1% and 6.0% for these countries, respectively, in 2015.

“The economies that were at the centre of the crisis,” Sinha says, “have done remarkably well.”

Also performing well is the U.K., for which the EC estimates growth of 2.5% in 2015 and forecasts 2.4% in 2016. However, overall gains in U.K. equities could come under pressure this year, given the hefty weighting of resources stocks in that market.

In addition, businesses in the U.K. could be affected by a looming referendum on the U.K.’s membership in the European Union (EU), which is set to take place by the end of 2017. If the population votes against EU membership, some businesses could take a hit.

The U.K. has “very strong trade ties with the eurozone,” Sinha says. “From an economic impact [standpoint], I think [a vote against EU membership] would hurt the U.K. more than it would hurt continental Europe.”

Other regions in Europe are facing their own challenges. Greece, for example, continues to struggle with severe fiscal strains and slow economic growth. However, the issue is far more contained than it was a few years ago, and presents a considerably smaller risk to the broader eurozone region, says Hadden: “The central banks and the governments have figured out a way of ring-fencing the issue. So, now, it’s pretty much a Greek problem. There’s no longer the threat of contagion that there was.”

The Syrian refugee crisis also presents certain challenges. Germany is grappling with a particularly large influx, having taken in almost one million refugees already. Building the infrastructure to accommodate such a large number of people in a short span of time presents a challenge.

“There will be a few years of strain in terms of dealing with the crisis, dealing with the influx of people, setting up the institutions [and] the mechanisms to deal with this,” says Sinha.

Longer term, however, the boost to the population could be a positive factor for Europe’s economy.

“Europe is generally an economy in which there is not lot of population growth,” Sinha says. “So, I believe more people will eventually be a positive.”

Given the gradual pickup taking place in Europe’s economy, attractive investment opportunities have emerged among companies with a strong domestic presence. Financial services stocks, for example, are poised to benefit from the strengthening economy and a pickup in consumer borrowing.

“If the economy does continue to deliver positive real GDP for the next one or two years, there could be a lot of upside for financials,” Sinha says. In particular, he recommends Italian bank Intesa Sanpaolo SpA. “It’s quite profitable – even at current levels – and there is still a lot of upside because what [the bank] is earning right now is only a small fraction of its true earning power in a normal economy.”

A regional bank that Pépin likes is Norway-based DNB ASA. “It has a very simple model of taking in deposits and making loans,” he says. “We feel that DNB is an extremely well-managed bank.”

Larger core banks and global banks also are popular picks. Hadden, for example, likes U.K.-based Lloyds Bank PLC.

Pépin favours Switzerland-based UBS AG, which recently ramped up its wealth-management operations and shifted away from the investment-banking side of the business, a move that has been profitable. “It’s an extremely well-managed company – great return on equity,” Pépin says. “And we’re really seeing the benefit of its ‘restrategizing’ into wealth management.”

Also set to benefit from a growing domestic economy is the construction sector.

“New-home demand is 30%-40% below where it should be at this point in the cycle,” Hussey says. “So, there is definitely potential for top-line recovery in Europe.” In particular, he likes Austria-based Wienerberger AG, a supplier of building materials and infrastructure solutions.

The utilities sector presents some defensive investment opportunities that provide domestic exposure. Sinha favours Red Electrica Corporacion SA in Spain, which owns the national electricity grid and operates the national power transmission system.

“[Red Electrica] gives you some upside from the eventual improvement in Spain’s economy,” he says. “And you get the downside protection from being a regulated utility with guaranteed revenue.”

Another attractive utility, Hadden says, is France-based Veolia Environnement SA, which benefits from more favourable government regulations and improvements in earnings.

Consumer stocks also are finding favour. “We’re seeing consumer sentiment improving for the better, as well as consumer spending,” Pépin says. “We still see the consumer discretionary [sector] of the market doing quite well.”

Although consumer demand from Asia has softened in lockstep with the economic slowdown in China, Pépin says, there still is appetite in Asia for luxury goods from companies such as Switzerland-based Swatch Group SA and Compagnie Financière Richemont SA; the latter owns such luxury brands as Cartier and Montblanc.

Opportunities also are seen in consumer staples stocks. Hussey likes Svenska Cellulosa SCA AB, a Swedish consumer goods company and pulp and paper manufacturer, which, he says, is undervalued compared with its U.S. peers.

Sinha recommends multinational consumer staples companies such as Switzerland-based Nestlé SA and France-based Danone SA.

“These are stocks that are really long-term franchises,” Sinha says. “And they have proven that they have sustainable competitive advantages, very high return on equity and high margins, and they are selling stuff that people want.”

Europe’s health-care sector also continues to be popular.

Pépin likes major global pharmaceutical companies such as Novartis International AG and Roche Holding AG, both based in Switzerland.

“[Those two companies] have huge pipelines in terms of projects and new drugs coming onto the market,” he says. “That could continue to present some opportunities for investors.”

© 2016 Investment Executive. All rights reserved.