The U.S. federal reserve board finally raised its key overnight interest rate this past December after years of dithering. This action has long-term significance, signalling the end of a 34-year drop in interest rates and the start of a new secular increase in interest rates.

But this situation may not affect the 2016 outlook for the U.S. much because other factors weigh more heavily on the country’s economy now than interest rates do. Specifically, the U.S. economy has a long-term growth problem. Over the past 15 years, peaks in growth rates have been successively lower. In 2000, real gross domestic product (GDP) rose by 5% over the preceding year. The next peaks in real GDP growth were 4% in 2003 and 3% in 2010. The Fed expects real GDP growth of 2.5% in 2016, 2.3% in 2017 and 2% in 2018.

After-tax corporate profits have dropped to 8.3% of GDP vs the record high of 12.5% in 2011. The net profit margin for companies in the S&P 500 composite index peaked at almost 9% early in 2015 and has since dropped below 8.4%, a move that in the past indicated impending trouble.

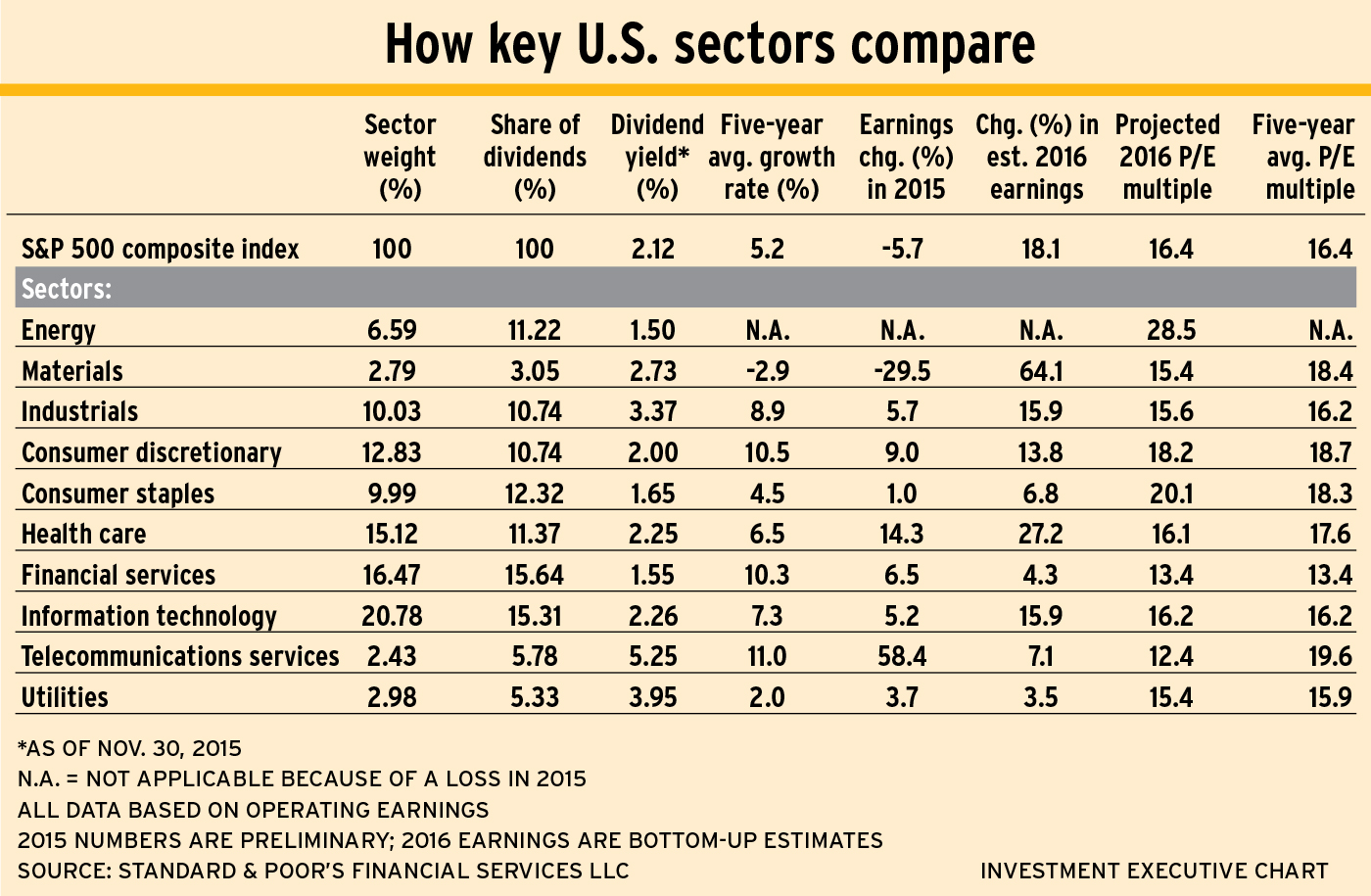

On Wall Street, though, opinions are strongly bullish. The stock market is expected to rise in 2016, with 10% being the average figure touted. New York-based Standard & Poor’s Financial Services LLC’s Capital IQ unit is even more bullish, reporting that earnings may rise by 18.1% in 2016 on Wall Street’s benchmark index, the S&P 500 composite.

This strength in the index would be a big change from recent experience. In 2015 alone, the S&P 500’s earnings dropped by an estimated 5.7% – and grew at only a compound 5.2% rate in the five years ended Dec. 31, 2015. However, New York-based www.valueline.com’s Value Line Investment Survey is signalling a sluggish market at best in the next few years – and this survey has a record of getting long-term trends correct.

The collapse in energy and other commodity prices cut into the U.S.’s economic growth as well as into stock market returns in 2015. The risk is oil and gas prices may not have reached bottom. In addition, there are other signs that U.S. economy is slowing. Industrial production growth slowed through 2015 and dropped from a year prior in October and November 2015. The unemployment rate is steady at 5%, but that excludes nine million people who have stopped looking for work.

Consumer confidence also moved downward sharply through 2015, according to www.Gallup.com daily surveys. Other recent surveys, conducted for Fox News and NBC News, found that 57%-58% of Americans think their country still is in recession.

Despite these concerns, U.S. stocks are attractive for Canadian investors. The reason: Canada’s market has been dropping relative to Wall Street since mid-2010; and if the Canadian dollar (C$) continues to lose ground against the U.S. dollar, gains will be enhanced when translated into C$.

Three sectors stand out as favourites on Wall Street for 2016: health care, consumer discretionary and telecommunications services. S&P Capital IQ recommends overweighting these sectors and the Value Line Investment Survey’s top industry ratings are broadly similar.

Here’s a look at the sectors:

– Health care. Despite the confusion surrounding the Obamacare legislation, demand for health-care services increases. Earnings estimates project a 27% gain in 2016.

There are opportunities in medical-device manufacturers, and those that have stable price histories have added appeal. These include ICU Medical Inc. (disposable connections in vascular-care equipment), Steris PLC (infection prevention) and Henry Schein Inc. (medical, dental and veterinary office support). Other favoured companies include Edwards Life Sciences Inc. (heart valves), Natus Medical Inc. (newborn care) and Cantel Medical Corp. (infection prevention).

Medical services is another field of interest. Recommended firms include Cerner Corp. (information systems), Mednax Inc. (pediatric physician services) and Centene Corp. (managed care programs).

CVS Health Corp. also is favoured because of the expansion of its retail pharmacy and pharmacy benefit-management operations.

– Consumer discretionary. This sector’s earnings rose by 9% in 2015, led by Internet retailers. Restaurants and footwear also were big gainers. For 2016, a rise of 14% is projected.

Amazon.com Inc., the giant among internet retailers, has had low margins while growing rapidly, but its profitability is starting to rise now. Other companies on the rise in the Internet retailing field include eBay Inc., Stamps.com Inc., Liberty Interactive Corp. and Blue Nile Inc.

Home-improvement sales also continue to grow, with Home Depot Inc. and Lowe’s Cos. Inc. leading these stocks. However, auto retailing has softened.

– Telecommunications services. This is a tiny part of the market because the giant telephone/mobile phone providers are considered to be high-tech businesses. Sector earnings may rise by 7%, and an historically low price/earnings multiple is anticipated.

J2 Global Inc. is favoured because of its rapid growth by acquisitions in cloud computing and communications services. American Tower Inc., a stock with high price stability, is a real estate investment as it owns and leases cellphone towers.

– Other sectors. S&P Capital IQ recommends four industries – information technology (IT), financial services, industrials and consumer staples – to be market-weighted.

Despite this tepid outlook, IT earnings’ growth is forecasted at 14% for this year. The gains are expected to be led by Alphabet Inc., which owns Google; Equinix Inc.; Expedia Inc.; Red Hat Inc.; Priceline Group Inc.; Cognizant Technology Solutions Corp.; and Automatic Data Processing Inc.

For financial services, only a slight 4% gain in earnings is forecasted for 2016. Rising interest rates will widen spreads for banks and help insurance companies’ revenue. Among property and casualty insurers, Travelers Cos. and Markel Corp. have appeal. In financial services, Visa Inc., Fidelity National Financial Inc. and Global Payments Inc. are favoured.

Industrials track the broad market closely, and there is an anticipated 6% earnings increase for 2016. Industrial services – notably, Rollins Inc. (pest control) and Cintas Corp. (uniform rentals, safety services) – attract interest.

Consumer staples could be attractive should there be a swing to value stocks. The sector’s earnings outlook is for a 7% rise in 2016.

That leaves energy, materials and utilities as recommended to be underweighted in portfolios.

With the collapse in oil prices, the energy sector reported a loss, and share prices dropped by 24% in 2015. Energy is expected to be modestly profitable in 2016.

Materials suffered from similar commodity price drops last year and earnings plunged. Analysts expect a 64% jump – due to lower costs and higher earnings for chemical companies – but that’s from 2015’s very low base and is not a return to healthy profits. Utilities earnings gained 4% in 2015, with a similar gain expected in 2016. These shares have stopped dropping relative to the market despite rising interest rates, which usually are a negative factor for this sector.

© 2016 Investment Executive. All rights reserved.