Web exclusive: Rethinking the 4% rule

The assumption that a retired client should withdraw 4% from his or her portfolio annually is losing credibility among advisors and economists

- By: David Israelson

- November 7, 2014 October 31, 2019

- 00:00

The assumption that a retired client should withdraw 4% from his or her portfolio annually is losing credibility among advisors and economists

Canadian clients who spend significant amounts of time outside the country every year risk losing their health benefits, as well as possibly facing negative tax…

Tax rules allow for inadvertent overcontributions to a client's RRSP, which can grow tax-free for decades. But there are strict limits on the amount -…

Clients worried about outliving their money can receive steady income, but these products are not all the same - some comparison shopping is recommended. And…

To offset inflation within an annuity, some insurers offer an indexing option, in which the payments that a client receives increase over time. But this…

More Canadians are retiring with debt than ever before. Although this situation is not ideal, it can make sense for some clients - but only…

There are many errors that clients make while planning for their retirement. Many are related to their finances - including poor cash-flow planning and taking…

Four ways to demonstrate your value to clients

Just 15 minutes can increase your profile with clients, prospects and COIs

In this week’s Ruta’s Rules, Jim Ruta, insurance industry consultant and managing partner, InforcePRO, explains the downside of selling yourself life insurance. He gives tips…

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, explains that Air Canada can teach advisors a lot about how to make top clients…

The managers discuss large-cap strategies in non-bank financials, energy, industrials and telecommunications.

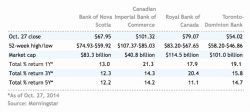

In part two of the roundtable, the managers share their views on Canada’s major banks and their top management.

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds