Defensive stocks look expensive, managers say

Part two of an equity-income round table

- By: Sonita Horvitch

- January 21, 2015 October 21, 2019

- 14:00

Part two of an equity-income round table

Part one of an equity-income roundtable

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, discusses how advisors can beat the robo-advisor competion by delivering services that can’t be commoditized.

Although yield spreads for corporate issues over government bonds have tightened, the premiums still are attractive. But you and your clients must remember that when…

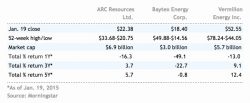

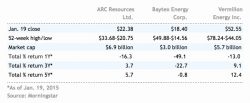

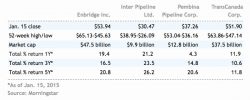

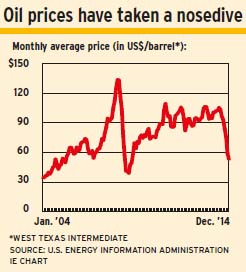

The drop in oil prices has precipitated a decline in energy stocks. However, they could rebound if oil prices begin rising. In contrast, no quick…

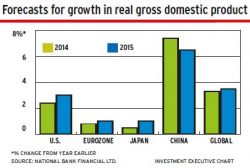

With high stock valuations in attractive sectors and commodities in a slump, Canadian investors are treading carefully

As the world's second-largest economy assumes a more sustainable rate of growth, fund portfolio managers remain optimistic. The government has chopped lending rates and announced…

Most portfolio managers have their eyes set on equities, but their enthusiasm is tempered by rich valuations for U.S. stocks and the potential that the…

Most portfolio managers suggest that gold prices won't generate much excitement this year, but there is a school of thought that runs contrary to that…

The amount of money Japan's government can spend to stimulate that economy is limited by its monumental public-sector debt. Thus, the government needs to find…

New head of Sprott Assett Management wants to pursue a more conservative strategy in stock-picking for the firm's funds

What central bankers do in 2015 will affect your clients' portfolios

Most economists have predicted rate increases annually since 2009, but those predictions have not come true and rates have remained low. Once again, the consensus…

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds