Financial advisors who work within a retail branch of a Big Six bank are feeling pretty secure, both in terms of the recent growth in their books of business and the level of support they receive from their bank, according to the results of this year’s Report Card on Banks.

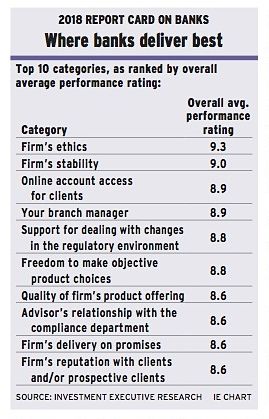

In fact, these results generally were quite positive: 26 of the ratings that advisors gave their banks in the main ratings table improved by at least half a point or more year-over-year. In contrast, 20 of the ratings advisors gave their banks declined by that margin. (See table on page 10.)

Many advisors surveyed for this year’s Report Card praised their bank for its solid reputation, strong communication efforts and the level of support the bank provides to its advisors to run their individual businesses – especially for clients who have more complex financial needs.

“We have an easy job because there’s so much confidence in our products and our support,” says an advisor in Ontario with Toronto-based Bank of Montreal. “Management is very open to feedback and looking for everybody to succeed.”

Advisors’ businesses do appear to be succeeding, given the increase in their assets under management (AUM) this year on average. Specifically, advisors reported an average AUM of $90.6 million this year, up from $85.2 million in 2017. (See story on page 11.)

One thing advisors continue to feel secure about as they grow their businesses is the strength of their banks’ reputation with clients and prospective clients – even when faced with some negative media coverage. (See story on page 14.)

Several of the big banks had their fair share of that in 2017, following high-profile media reports regarding unfair sales practices at most of the banks, which in turn led to a review by the Financial Consumer Agency of Canada.

Although some advisors admitted that their bank’s reputation took a hit in light of that investigation, many more advisors believe that, overall, the reputations of Canada’s oldest financial services institutions remain intact because of their client-centric approach and community outreach initiatives. (See story on page 14.)

“I believe that our brand is strong,” says an advisor in Alberta with Toronto-based Royal Bank of Canada. “Even though we screw up sometimes, the brand is [why clients] come to us.”

One way in which banks are backing up those strong reputations is through their well-known advertising campaigns. In fact, advisors gave their “firm’s consumer advertising” efforts an overall average performance rating of 8.5 this year, up from 8.1 last year; three banks’ ratings increased by half a point or more year-over-year in this category. Indeed, many advisors were impressed with the pervasiveness of their banks’ brand-building efforts through marketing campaigns such as television commercials or sponsorship of sporting events.

“When you see the commercials, [they] hit home. They relate to the average Canadian home [and] the average family,” says an advisor in Ontario with Toronto-based Bank of Nova Scotia. “[The bank] also does a lot of stuff with hockey, which I appreciate.”

Advisors also lauded their bank’s efforts in providing information advisors need, and for being open to advisors’ feedback and taking it seriously. In fact, advisors gave the banks higher overall average performance ratings year-over-year in both communication categories in the Report Card: “firm’s effectiveness in keeping advisors informed” and “firm’s receptiveness to advisor feedback.” (See story on page 13.)

The advisors most pleased with their bank’s communication said that they’re kept up to date regarding changes within the organization and that management actively seeks advisors’ feedback and acts upon those recommendations.

“It’s much better now. They have annual surveys [to see] how employees are feeling – what’s working and what’s not working,” says an advisor in Ontario with Montreal-based National Bank of Canada. “Upper management has addressed that and spoken directly to advisors. They’re listening.”

Advisors also felt well connected to other divisions within their respective banks, which comes in handy when trying to serve the needs of high net-worth individuals. Indeed, although advisors at bank branches focus on mass affluent clients, many advisors feel confident that the banks’ wealth specialists and strong referral networks can help them with wealthier clients. (See story on page 12.)

“There are certain [internal] partners we can count on for more complex situations,” says an advisor with Toronto-based Canadian Imperial Bank of Commerce in Ontario.

Still, there are many situations in which advisors need the skills necessary to help clients, which is why having strong ongoing training programs is key.

However, banks have some work to do in this area – as is evident in the mixed ratings advisors gave their banks in the “ongoing training” category. Some advisors praised their banks for providing strong support, such as in obtaining professional designations, while other advisors wished their training programs were more targeted. (See story on page 10.)

“Sometimes, there’s some stuff that either I don’t find as relevant for the job or is just unnecessary,” says a Scotiabank advisor in Ontario.

Advisors’ feelings are not at all mixed when it came to the level of support they receive from the banks’ back offices. This is one area in which advisors see plenty of room for improvement.

In fact, the “back office and administrative support” category garnered the lowest overall average performance rating this year, at 7.1, and the difference between it and the overall average importance rating of 9.4 resulted in the widest satisfaction gap in the survey. (See story on page 12.)

The most common complaints from advisors pertaining to their back offices is that the staff tend to be chronically inexperienced.

“If I need to get something done, I have a group of people who I get help from, but they don’t know how to do anything,” says an advisor in Alberta with Toronto-based TD Wealth Financial Planning, a division of Toronto-Dominion Bank. “They have nothing but rookies working there.”

How we did it

Investment Executive’s (IE) annual Report Card on Banks aims to explore how financial advisors who work at the Big Six banks feel about the way their individual businesses are supported at their bank’s retail branch level.

To do this, IE research journalists Sophie Allen-Barron, Anthony Burton, Ramona Leitao and Curtis Panke spoke with 301 advisors across the country.

To participate, these advisors – many of whom operate under the title of “financial planner” – must work in a bank branch; have long-term relationships with mass affluent clients; and focus primarily on providing investment products as opposed to credit products.

Survey participants typically are employees of their bank’s retail division. The exceptions are the financial planners surveyed at Toronto-Dominion Bank (TD). These advisors work in the bank’s branch network, but are part of TD Wealth Financial Planning.

The advisors who were surveyed were asked to provide two ratings for each of the 31 categories on the Report Card’s main table (see page 10): one for their bank’s performance and another to indicate the importance of that category to the advisor’s business.

The ratings were given on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “very important.”

Advisors also were asked to share their thoughts on industry trends in two supplementary questions added to this year’s survey. The first question asked advisors if they’re in favour of the Canadian Securities Administrators taking regulatory action to address the concerns related to the use of embedded commissions. The second question asked advisors if they felt their bank’s cybersecurity efforts are adequate to ensure that their data – as well as those of their clients – are protected properly.

As well, this year’s Report Card includes two slideshows, which will be published on IE’s website in late June and early July.