New tools from IIROC

SRO aims to speed up settlements

- By: James Langton

- May 3, 2019 October 31, 2019

- 00:26

SRO aims to speed up settlements

Dealers large and small see healthy growth in profits

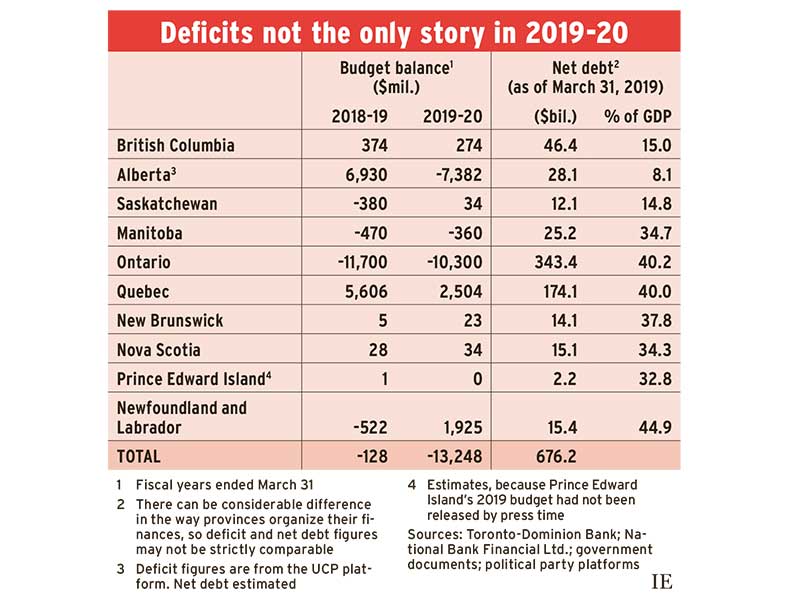

While Ontario and Alberta grapple with big deficits, Quebec and B.C. boast surpluses

An inverted yield curve does not necessarily herald hard times

Feds create new annuity options, enhance Homebuyers’ Plan

So far, securities regulators have been reluctant to sign off on regulated crypto-based ventures

Investment Executive Regulators’ Report Card 2019

Advocacy group calls on banks to recognize technology risk and other ESG issues

Brokerages took a hit, but banks remained solid and can expect tempered earnings growth

The 2019 federal budget includes several lower-profile tax changes that could affect your clients

Central bankers worry that their ability to use normal monetary policy would be limited in the event of a shock

Decision may encourage more frequent use of these clauses in wills, estate practitioners say

Matthew Latimer becomes the new executive director of the Federation of Mutual Fund Dealers as the industry faces numerous challenges

Regulator plans to study the effects of curbing trading venues’ fee/rebate structures

Supreme Court makes decision in Henson trust case

IAP wants regulatory sanctions against individuals to apply across regional and industry jurisdictions

Gap between independent and bank channels could be more perception than reality, however

AUM dropped in 2018, thanks to flagging markets

Central bankers seek to steady markets as deficits rise and trade frictions escalate

Technology is important, but understanding client needs begins with advisors, says Jeff Macoun

Can policy-makers lighten regulation and still protect investors?

Clients who invest in RRSPs should think long-term and diversify

Wealth-management firms compete for the business of health-care professionals

A little default risk may be acceptable as Bank of Canada eases back on rate hikes

Often considered a conservative investment, preferreds remain subject to equity market movements