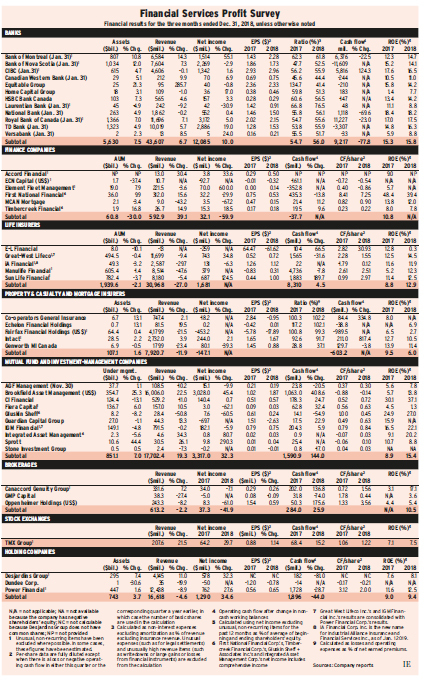

Turmoil in the financial markets at the end of 2018 affected Canadian financial services firms, although not as much as might have been expected.

The three brokerages were hit the hardest, with earnings down by an average of 41.9%. But the banks, which also are major players in the capital markets, had an average increase in net income of 10%.

Looking ahead, a report from credit-rating agency DBRS Inc. states it “expects earnings growth for the large Canadian banks to be tempered, given the weaker than expected start to the year and slowing economic growth.” But the report also notes the “highly diversified core earnings power of the large Canadian banks.”

Twenty-one of the 43 firms in Investment Executive’s financial services profit survey had improved results in the most recent fiscal quarter, which ended between Nov. 30, 2018, and Jan. 31, 2019, compared with the corresponding period a year earlier.

In addition, Manulife Financial Corp. and Echelon Financial Holdings Inc. reported positive net income vs a loss. That left 12 firms with lower earnings and eight with losses. (These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., as the results of both are consolidated in Power Financial Corp.’s.)

There still is optimism in the industry, however, as 15 companies increased their dividends, including six banks. Bank of Nova Scotia increased its quarterly dividend to 87¢ from 85¢; Canadian Imperial Bank of Commerce’s (CIBC) dividend rose to $1.40 from $1.36; Canadian Western Bank’s rose to 27¢ from 26¢; Equitable Group Inc.’s rose to 30¢ from 28¢; Royal Bank of Canada’s rose to $1.02 from 98¢; and Toronto-Dominion Bank’s (TD) dividend rose to 74¢ from 67¢.

Other companies that raised their dividends include: ECN Capital Corp., to 2¢ from 1¢; GWL, to 41.3¢ from 38.9¢; Manulife, to 25¢ from 22¢; Intact Financial Corp., to 76¢ from 70¢; Brookfield Asset Management Inc., to 16¢ from 15¢; Fiera Capital Corp., to 21¢ from 20¢; Guardian Capital Group Ltd., to 15¢ from 12.5¢; TMX Group Ltd., to 62¢ from 58¢; and Power Financial, to 45.55¢ from 43.3¢.

Interestingly, four of the firms that increased their dividends did so despite earnings declines or a loss in the quarter. Scotiabank’s net income was down by only 2.9%, but Fiera’s earnings were down by 62.1%. ECN and Guardian Capital both had substantial losses as well.

In Fiera’s case, it still is growing and acquisitions can take time to become integrated.

ECN’s loss comes from discontinued business. The company is changing its business model to provide services to consumer finance companies rather than providing financing directly to consumers. This move involves selling off most of the firm’s previous businesses and building up its consulting expertise.

Guardian Capital’s loss came from paper losses from holdings of a large number of Bank of Montreal’s common shares. Changes in the value of investments is included the calculation of net income.

Another company hit hard by the stock market plunge was Fairfax Financial Holdings Ltd., which reported a loss of $453 million. This firm aggressively invests the assets backing up its insurance liabilities.

The fair value of E-L Financial Holdings Corp. Ltd.’s corporate investments also dropped dramatically, producing both a large loss of $259 million and negative revenue because life insurers include changes in investments’ fair value in revenue.

Here’s a look at the sectors in more detail:

> BANKS

Nine of the 12 deposit-taking institutions had increased earnings. Of the three laggards, Scotiabank and Equitable Group had very small drops – 2.9% and 0.8%, respectively – but Laurentian Bank of Canada’s dropped by 30.9% due to a significant drop in capital market revenue.

However, Laurentian Bank didn’t increase its loan-loss provisions in the quarter; it dropped them to $10.5 million from $17.6 million. But many other banks increased theirs, for a cumulative total of $2.7 billion vs $2.2 billion in the previous quarter and $2 billion a year earlier. This reflects expectations of slower economic growth for Canada than previously assumed, but the DBRS report states that “overall credit quality remains strong” for the sector.

> FINANCE COMPANIES

Accord Financial Corp., Element Fleet Management Corp. and Timbercreek Financial Corp. had strong earnings gains. First National Financial Corp. and MCAN Mortgage Corp. had lower earnings and ECN was in a loss position.

Element and ECN were created when Element Financial Corp. split into two parts in October 2016. Element took the commercial fleet business and ECN took the rest. Like ECN, Element has been selling non-core assets. However, unlike ECN, Element isn’t changing its business model, although it is transforming itself into a “client-centric” company.

First National was affected by the rise in interest rates, which shrank mortgage funding spreads. MCAN had paper losses on its securities holdings.

> LIFE INSURERS

In addition to E-L’s loss, iA Financial Corp. Inc. reported lower net income. But GWL and Sun Life Financial Inc. had higher earnings, while Manulife reported positive net income.

Manulife’s results are less impressive than they appear. The loss in the corresponding quarter a year earlier was due to two big charges: $2.2 billion related to U.S. tax reform and $1.3 billion related to a decision to change the portfolio asset mix supporting Manulife’s legacy businesses. If those charges are excluded, net income would have been $1.9 billion, about five times as high as this quarter’s $379 million.

Sun Life’s big increase in earnings also reflects weak results in the corresponding quarter a year earlier, when it also had a charge related to U.S. tax reform, of $251 million.

> P&C INSURERS

Only Intact Financial Corp. had higher earnings, although Echelon had positive net income vs a loss in the corresponding quarter a year earlier. This sector is dominated by Fairfax, which reported a huge loss, but Co-operators General Insurance Co. also was in the red.

Echelon has been selling off non-profitable insurance businesses and expects to be more profitable soon.

> MUTUAL FUND AND INVESTMENT-MANAGEMENT COMPANIES

Brookfield, CI Financial Corp., Integrated Asset Management Corp. and Sprott Inc. had higher earnings, while AGF Management Ltd., Fiera, Gluskin Sheff + Associates Inc. (which Onex Corp. has agreed to purchase) and IGM saw net income drop. Stone Investment Group Ltd. and Guardian had losses.

Brookfield is an owner/operator of real estate, renewable power infrastructure and private equity assets; thus, it is not hit hard by stock market plunges. Sprott, a precious metals specialist, did well when gold became attractive as stock prices dropped in December.

Among the three big mutual fund companies, AGF had positive net sales, but its quarter ended on Nov. 30 – before the stock market turmoil. CI and IGM were in net redemptions.

> BROKERAGES

This wasn’t a good quarter for brokerages, as they were directly affected by the slide in equities. Canaccord Genuity Group Inc. fared best because of its significant exposure to resources.

> EXCHANGES

Because investors trade more in volatile markets, TMX Group had a 29.7% increase in net income.

> HOLDING COMPANIES

Desjardins Group had a strong, 32.3% increase. Dundee Corp.’s loss was smaller than a year earlier, as the value of its resources investments rose. Power Financial’s results reflect GWL’s earnings gain, offset only a little by IGM’s decline.