Borrowers are winners in this market

With government bond rates nearing zero - or less in Europe - demand for corporate debt has surged

- By: Andrew Allentuck

- October 11, 2019 October 31, 2019

- 00:22

With government bond rates nearing zero - or less in Europe - demand for corporate debt has surged

Editorial, sales and support teams will remain the same under the new ownership, publisher says

National Bank's Daniel Straus reflects on the proliferation of ETFs and what to expect in the years ahead

The Ontario government still opposes the ban

The self-regulatory organization says its proposal is being “purposely misinterpreted”

Ontario hasn't reviewed securities regulations in 16 years

Turmoil in capital markets and slowing economic growth are having an impact on some financial services companies

Industry asks the regulator for greater clarity on a proposal that would allow mutual fund reps to perform limited discretionary portfolio management

BoC report states climate change is a threat to the economy

With the price of real estate skyrocketing, Ottawa is concerned that Canadians are accessing the PRE inappropriately

Rowena Chan brings 30 years of experience and a degree in sociology to her role as president of Sun Life Financial Distributors

The Dept. of Finance releases draft legislation concerning the "allocation to redeemers" methodology and extends the capital gains-related timeline for ETFs

Companies in B.C collectively raised $19.1 billion in 2018, which is 27% more than in the previous year, according to a BCSC report

Manulife Financial is looking to streamline, innovate and expand

Negative rates have already hit Germany. Could below-zero rates come to Canada?

Firms want regulatory certainty in the cryptoasset space

Cross-border clients likely will require portfolio changes

Neither product nor sales volume fell

Infrastructure-type equities tend to have a low correlation to other equities

David Stephenson, director of ETF strategy at CIBC Asset Management, says the parent bank's strong relationships with clients are an advantage

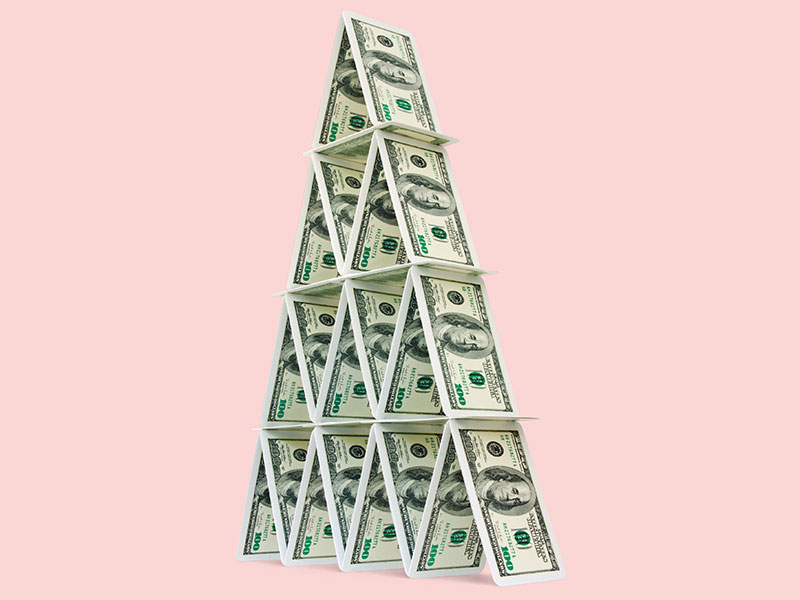

Bond issuing companies are borrowing more but promising less

Investors are beginning to focus on more established companies that could benefit from the forecasted wave of growth in the sector

Amid trade wars and geopolitical tension, global fundamentals are strong and recent market losses are not alarming

Positive factors cited include oil recovery and jobs growth

Dodig appointment part of broad strategy to link brokerage, private-wealth services