This article appears in the April 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Financial services firms have coped well with big increases in interest rates, volatile equities markets and the possibility of recession so far. But the recent bank failures in the U.S. spooked already edgy financial markets as they waited to see how much higher interest rates might go in the wake of disappointing inflation figures.

The failure of Silicon Valley Bank (SVB) and Signature Bank caused the 10 largest Canadian bank stocks to lose 4.7% in value over the two weeks following SVB’s collapse on March 10, but they’ve since recovered.

Following the failures, Toronto-based DBRS Morningstar Inc. stated it would “closely monitor liquidity positions and exposure to fixed-income securities” for the Big Six and four medium-sized banks: Canadian Western Bank, EQB Inc., Home Capital Group Inc. and Laurentian Bank of Canada.

Nonetheless, DBRS Morningstar stated in March that Canadian banks should be able to navigate market turbulence because they “generally have a lower exposure to fixed-income securities, diversified and stable funding, sufficient liquidity, prudent risk/liquidity management, and capital buffers.”

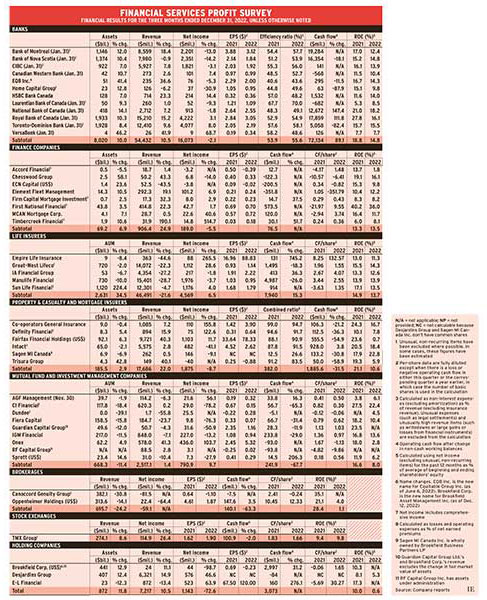

That’s generally borne out in the results of Investment Executive’s quarterly Profit Survey, which looks at quarters ended between Nov. 30 and Jan. 31. About half of the financial services companies in the survey — 20 of 44 — had higher net income than a year earlier. Dundee Corp. and RF Capital Group Inc. had positive net income versus a loss, while 18 saw earnings declines and four reported losses. On average, net income was down by 12.1%. These figures exclude Empire Life Insurance Co., whose results are included in E-L Financial Corp. Ltd.’s, and Sagen MI Canada Inc.’s results, which are included in Brookfield Corp.’s.

Brokerages were most affected by financial market jitters in the previous quarter, with earnings for Oppenheimer Holdings Ltd. declining steeply and Canaccord Genuity Group Inc. seeing a loss. Many mutual fund and investment management firms were also hit, but TMX Group Ltd. reported a 26.4% increase.

Life insurers and finance companies increased their net income overall while the banks and the property & casualty and mortgage insurer group had small declines.

Here’s a look at the industries in more detail:

Banks

Only five banks had higher net income in the quarter year over year, while seven saw earnings decline. Most of the percentage changes were single-digit, but Bank of Montreal and Bank of Nova Scotia were down by 13% and 14.2%, respectively, and Home Capital saw a drop of 30.9%. In terms of increases, HSBC Bank Canada’s was 14.4% and tiny VersaBank’s was 68.7%.

Only EQB increased its quarterly dividend, to 35¢ from 33¢.

Loan-loss provisions (LLPs) across all the banks were $2.5 billion in the quarter, within the normal $1.5 billion–$2.5 billion range. However, that’s up by $2.1 billion from $383 million a year earlier and pulled down earnings.

The big banks’ results exclude increases in deferred taxes to cover the five-year 15% Canada Recovery Dividend. The dividend is payable over five years beginning in the 2022 tax year for banks and lifecos reporting an average net income of at least $1 billion in fiscal 2020 and 2021.

A major development in the quarter was Royal Bank of Canada’s proposed friendly takeover of HSBC. (HSBC Holdings PLC has decided to exit Canada.) RBC’s wealth management division also has agreed to hire all of Gluskin Sheff + Associates Inc.’s financial advisor teams as Gluskin Sheff’s parent company, Onex Corp., winds down that subsidiary. RBC also will distribute Onex’s investment products.

Finance companies

Five of the eight companies reported earnings increases, Chesswood Group Ltd. had a decline and Accord Financial Corp. and ECN Capital Corp. reported losses. Accord had a goodwill impairment charge of $1.9 million and ECN’s results were affected by the sale of a major subsidiary a year ago that caused revenue to drop by 43.5%.

ECN is doing a strategic review to determine how to maximize long-term growth and value for shareholders.

Chesswood increased its monthly dividend to 5¢ from 4¢.

Life insurers

Three companies increased earnings and two saw small drops. Higher interest rates are generally good for lifecos because they decrease the amount of capital required to support long-term liabilities. Both Great-West Lifeco Inc. (GWL) and Manulife Financial Corp. raised their quarterly dividends: to 52¢ from 49¢ for GWL and to 36.5¢ from 33¢ for Manulife.

DBRS Morningstar is less worried about the lifecos than the banks, but noted lifecos could be affected in the event of a “broader market panic.”

Property & casualty and mortgage insurers

Three companies had increased earnings, two reported drops and Trisura Group Ltd. was in a loss position because of a $64.4-million writedown of reinsurance recoverables in the U.S. Intact Financial Corp. increased its dividend to $1.10 from $1.00.

Fairfax Financial Holdings Ltd. dominates the category and is as much an investment company as it is an insurer. In this quarter, much of its activities involved selling equity interests and consolidating several insurance subsidiaries. That yielded an after-tax gain of around US$1 billion, which is excluded from net income in this survey as it isn’t part of its core business.

DBRS Morningstar noted that the insurance pricing environment continues to be favourable, with premium rates continuing to increase for most property & casualty insurance products globally.

Mutual fund and investment management companies

This wasn’t a good quarter for four of the firms, which reported lower net income. The group as a whole reported a 9.7% increase in net income thanks to Onex’s 103.3% gain, which came from increases in the fair value of investments.

Among the three big independent mutual fund companies, AGF Management Ltd. and CI Financial Corp. had positive net sales of $251 million and $1.3 billion, respectively, while IGM Financial Inc. saw net redemptions of $1.8 billion.

Brokerages

Investment banking activity is way down. Revenue was $47.5 million at Canaccord Genuity compared with $151 million a year earlier. Oppenheimer reported US$34 million in the quarter, down from US$117.6 million a year earlier.

Canaccord has proposed going private. In response, four directors who didn’t support the company’s cash offer to shareholders resigned.

Exchanges

TMX Group benefited from purchasing a controlling interest in BOX Options Markets LLC in January 2022. TMX’s dividend increased to 87¢ from 83¢.

Holding companies

Both Desjardins Group and E-L had strong earnings gains. Desjardins’ wealth management and life and health insurance group reported net income of $227 million compared with a loss of $6 million a year earlier. The improvement was mainly due to the favourable impact of changes in actuarial assumptions.

E-L’s results reflect subsidiary Empire Life’s big jump in net income and a large gain in the fair value of its corporate global investments, to $451 million from $303 million a year earlier. E-L upped its dividend to $3.75 from $2.50.

Brookfield Corp. (formerly Brookfield Asset Management Inc. [BAM Inc.]) reported a 98.7% drop in net income. The company’s assets in the quarter dropped by US$1.8 billion in fair value versus increasing by US$2 billion a year earlier — a swing of almost US$4 billion. But its cash flow rose by 31.2% .

BAM Inc. changed its name to Brookfield Corp. in December and spun off 25% of its asset management business into a new public subsidiary, Brookfield Asset Management Ltd. (BAM Ltd.).

Existing BAM Inc. shareholders received a full share of Brookfield Corp. and quarter-share of BAM Ltd. Both companies pay dividends: 7¢ for Brookfield Corp. and 32¢ for BAM Ltd. That means BAM Inc. shareholders will receive 15¢, which is 1¢ more than BAM Inc.’s dividend in the previous quarter.

Click image for full-size chart