This article appears in the Mid-October issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Financial services companies have so far manoeuvred through a difficult environment, but with interest rates expected to stay higher for longer, the risk of recession and loan losses may be increasing. That’s particularly so given the U.S. auto strike and the possibility of a U.S. government shutdown in November.

In a recent report on the large Canadian banks, Toronto-based DBRS Morningstar said it expects “further deterioration in asset quality metrics in ensuing quarters as interest rates remain elevated for a longer period.”

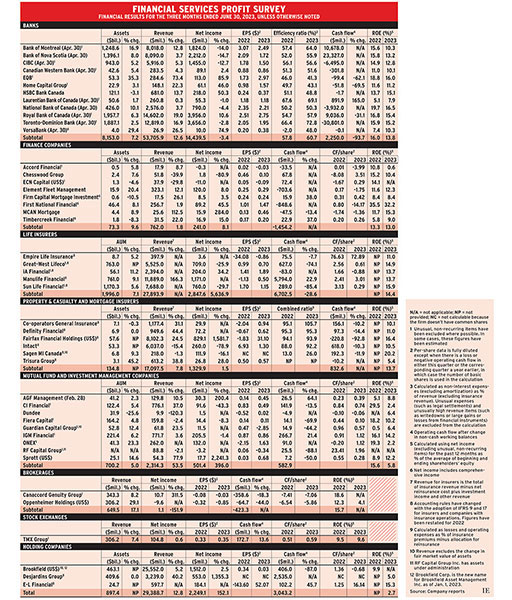

The banks are taking precautions: the 12 deposit-taking institutions in Investment Executive’s (IE) quarterly Profit Survey significantly increased their loan-loss provisions (LLPs) in the quarter ended between April 30 and June 30, booking a total $3.8 billion, up from $1.7 billion a year ago.

What have improved in the past year — at least until recently — are equities markets. The S&P 500 was up by 17.6% for the 12 months to June 30, boosting earnings for mutual fund and investment management companies. However, financial markets have since been edgy, with the S&P 500 ending September down by 7% from its July 31 peak.

Of the 44 companies in IE’s Profit Survey, 20 reported higher earnings in the most recent quarter than a year earlier. Seven companies reported positive net income compared to losses a year earlier, while 13 saw profits shrink and four reported losses. (This list excludes Sagen MI Canada Inc., whose results are consolidated in Brookfield Corp.’s, and Empire Life Insurance Co., whose results are included with E-L Financial Corp. Ltd.’s.)

Only three companies increased their dividends in the quarter: EQB Inc., MCAN Mortgage Corp. and TMX Group Ltd.

Here’s a look at the sectors in more detail for the financial quarter ended June 30.

Banks

Six of the 12 deposit-taking institutions increased their earnings while the rest reported lower net income. Among the Big Six, only Royal Bank of Canada (RBC) increased its profit. As a group, the banks averaged a 3.4% decline in net income.

Some of the smaller companies reported strong earnings gains, including 85.9% for EQB, 74.9% for VersaBank, 50.3% for HSBC Bank Canada and 46% for Home Capital Group Inc.

EQB’s big increases in assets, revenue and earnings are mainly the result of acquiring Concentra Trust on Nov. 1, 2022. EQB raised its quarterly dividend in each of the past seven quarters, to 38¢ this quarter from 18.5¢ in Q4 2021, indicating optimism about its prospects.

Alternative mortgage provider Home Capital, a star until 2017, when concerns about verification on some of its mortgages caused a run on deposits, reinstated its dividend at the end of 2021. It was acquired by Smith Financial Corp. on Aug. 31 of this year.

The Competition Bureau approved RBC’s acquisition of HSBC on Sept. 1, and reviews by the Office of the Superintendent of Financial Institutions and the Department of Finance are ongoing.

Finance companies

Five of the eight companies reported higher earnings, while Chesswood Group Ltd. saw profit decline. Accord Financial Corp. and ECN Capital Corp. reported losses.

The biggest gain was mortgage provider MCAN’s 284% jump, but MCAN’s earnings are volatile due to swings in investment income. The company’s net income in the quarter was $15.9 million, compared with $4.1 million a year earlier and $19.1 million in 2021. MCAN’s profit was down from $23.3 million in the previous quarter.

Fellow mortgage providers Firm Capital Mortgage Investment Corp., First National Financial Corp. and Timbercreek Financial Corp. also reported higher earnings, as they benefited from the increase in interest rates for new mortgages.

Chesswood significantly increased LLPs and ECN continues its review of strategic alternatives to increase shareholder value. More optimistically, Accord’s quarterly report stated the company had stronger deal flow.

Life insurers

iA Financial Corp. Inc. reported higher earnings and both Empire and Manulife Financial Corp. reported positive net income versus a loss the year before.

Great-West Lifeco Inc. (GWL) and Sun Life Financial Inc. reported lower earnings, but both said their base or underlying net income was higher than the same quarter in 2022. In GWL’s case, reported earnings included $121 million in losses from asset rebalancing to reduce future interest rate sensitivity.

In April and May this year, GWL announced the acquisition of Investment Planning Counsel Inc. from IGM Financial Inc. and the sale of Putnam Investments Inc. to Franklin Resources Inc. GWL and IGM are both majority-owned by Power Corp. of Canada.

Property, casualty and mortgage insurers

Intact Financial Corp.’s steep earnings decline was due to higher than expected natural catastrophe claims. Intact reported $295 million in fair market value (FMV) losses in its investment portfolio compared with a gain of $221 million a year earlier.

The other insurers saw positive changes in FMV— except Trisura Group Ltd., which reported $6.9 million in FMV losses versus a gain of $1.4 million the previous year.

Co-operators General Insurance Co. was the only firm with an underwriting loss in the quarter.

A recent DBRS report found Fairfax Financial Holdings Ltd., Intact, Definity Financial Corp. and Trisura “benefited from consistent premium rate increases, less-volatile financial markets and higher interest rates.” The rating agency said it expects “premium rates to keep rising, especially for property insurance.”

Mutual fund and investment management companies

AGF Management Ltd. and Sprott Inc. reported increased earnings. Dundee Corp., Guardian Capital Group Ltd. and ONEX Corp. reported positive net income versus losses a year earlier.

In contrast, CI Financial Corp., Fiera Capital Corp. and IGM saw lower net income, and RF Capital Group Inc. reported a loss.

The earnings gains at AGF and Sprott were huge — 200.4% and 2,241.3%, respectively — but don’t necessarily indicate significant momentum. AGF had higher revenue and lower expenses, the latter due to the ban on selling mutual funds with deferred sales charges (DSC) as of June 1, 2022, which brought AGF’s DSC commissions expense to zero.

In Sprott’s case, Q2 2022 was particularly weak. In CI’s case, Q2 2022 was unusually strong.

Both Dundee and Guardian reported losses in the fair value of investments.

Among the Big Three independent mutual fund companies, AGF had net sales while CI and IGM both reported net redemptions.

Brokerages

Both Canaccord Genuity Group Inc. and Oppenheimer Holdings Inc. are struggling due to weak investment banking activity. Oppenheimer reported a loss and Canaccord’s 311.5% increase in net income was due to a weak quarter a year earlier.

Exchanges

TMX’s net income was up by only 0.6%, but the firm was optimistic enough to raise its quarterly dividend to 18¢ from 17¢.

Holding companies

Brookfield reported a 2.5% increase in net income while Desjardins Group’s earnings soared by 1,355.3%, although the latter was because of a weak Q2 2022 on the back of substantial losses in Desjardins’ P&C division and a small loss in its wealth management and life and health divisions.

E-L Financial’s move to profitability reflects gains in FMV in both its own corporate investment portfolio and subsidiary Empire, compared with losses in Q2 2022.

Click image for full-size chart