This article appears in the June 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The possibility of recession looms as central banks around the world raise interest rates in an attempt to bring down soaring inflation. This, along with the war in Ukraine, has made financial markets very edgy.

“Given record global debt levels, we remain skeptical that these [expected] rate hikes can be carried out without triggering a recession or otherwise destabilizing financial markets,” said Peter Grosskopf, Sprott Inc.’s outgoing CEO, in the firm’s recent financial report.

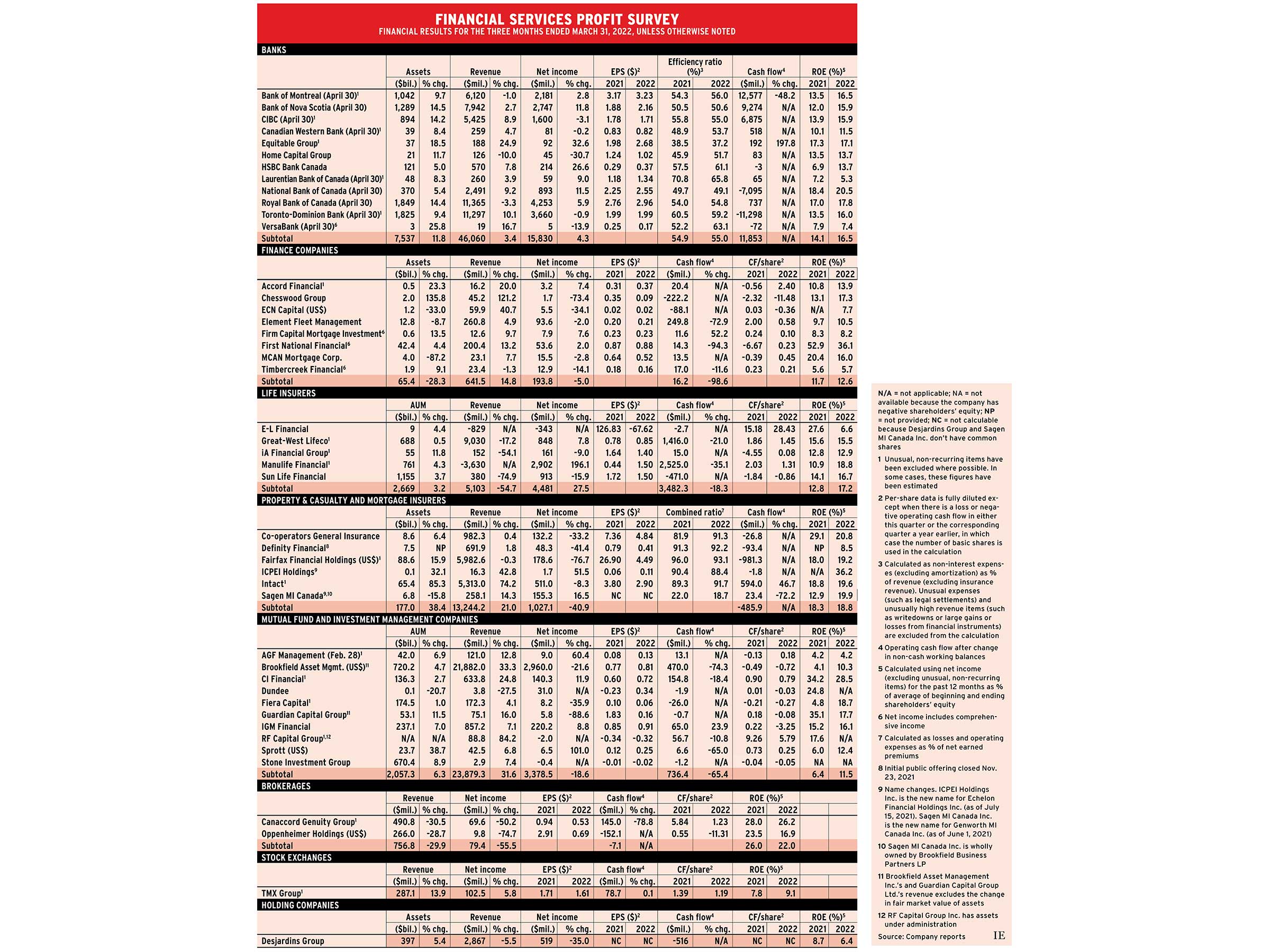

Financial results for Canadian financial services companies have already deteriorated. Fewer than half of the 45 firms in Investment Executive’s Profit Survey had higher earnings than a year earlier in the quarters ended between Feb. 28 and April 30. On average, the 45 firms saw their combined net income decline by 1.0% year over year.

That decline came even as the banks saw virtually no change in their loan-loss provisions (LLPs), which improved their profitability. When the economy is growing well, the 12 deposit-taking institutions in the survey usually add between $1.5 billion and $2.5 billion to their LLPs each quarter. When recession is a risk, banks usually increase provisions by even more. If the banks had raised their LLPs by $2 billion in the past quarter, the decline in combined net income for the 45 companies would have been 8.7% on average.

In 2020, the banks added almost $20 billion of LLPs to their books in response to the pandemic. Because of this cushion, the 12 banks saw their LLPs decline cumulatively by $166 million over the past five quarters.

The banks are generally optimistic about their prospects because of this cushion and the rising interest-rate environment, which will increase their net interest margins (the difference between what banks charge on loans and what they pay on deposits).

As a result, eight of the banks increased their quarterly dividend: Bank of Montreal’s (BMO) rose to $1.39 from $1.33; Bank of Nova Scotia’s rose to $1.03 from $1.00; CIBC’s rose to 83¢ from 80.5¢ after accounting for a two-to-one stock split on May 13; Canadian Western Bank’s (CWB) rose to 31¢ from 30¢; Equitable Group Inc.’s rose to 29¢ from 28¢; Laurentian Bank of Canada’s rose to 45¢ from 44¢; National Bank of Canada’s (RBC) rose to 92¢ from 87¢; and Royal Bank of Canada’s rose to $1.28 from $1.20.

The other companies that increased dividends were Chesswood Group Ltd. (to 4¢ a month from 3¢); Sun Life Financial Inc. (to 69¢ from 66¢ a quarter); and AGF Management Ltd. (to 10¢ from 9¢ a quarter).

Here’s a look at the sectors in more detail:

Banks

Seven of the deposit-taking institutions reported higher year-over-year earnings while five saw lower net income.

Four of the declines were moderate:by 0.2% for CWB, by 0.9% for Toronto-Dominion Bank, by 3.1% for CIBC and by 9.7% for Laurentian Bank. But Home Capital Group Inc.’s net income fell by 30.7% mainly due to lower net interest income, but also because the company reversed only $138,000 of LLPs this quarter, compared with $12.1 million a year earlier.

Net income was down in the capital markets divisions of the Big Five banks except CIBC, reflecting financial markets’ edginess. However, BMO, RBC and Scotiabank reported higher overall earnings.

Finance companies

Three of these firms had higher year-over-year net income, while five saw earnings drop. Most of the increases and decreases were in the single digits, but Chesswood Group saw a 73.4% drop in earnings, ECN Capital Corp.was down by 34.1% and Timbercreek Financial Corp.’s decline was 14.1%.

Unlike the banks, Chesswood, which provides equipment and auto financing, reported a big increase in LLPs in the quarter, to $16.7 million from $460,000 the year before.

ECN sold its rail, aviation and commercial and vendor finance businesses in December 2021 and now focuses on business services to North American financial services companies. Earnings from the discontinued businesses amounted to $10 million in Q1 2021, explaining the big year-over-year drop. However, the continuing business recorded net income of $5.5 million this year versus a loss of $1.7 million a year earlier.

Timbercreek reported a small drop in revenue while expenses rose.

Life insurers

Results were mixed, with two companies reporting higher income and two reporting lower earnings. E-L Financial Corp. Ltd. was in a loss position.

E-L has a large corporate investment portfolio on top of assets backing up its insurance liabilities. The quarter saw a $1.2-billion drop in the fair value of its investments — much more than the $407.5 million decline a year earlier.

On the other hand, Manulife Financial Corp.reported a 196.1% increase in net income. That was mainly because of a particularly weak quarter a year earlier due to investment-related losses. The company does not consider such financial market impacts to be “core” to its underlying performance, however, and provides core earnings figures. In this quarter, Manulife’s core net income was $1.55 billion, down by 4% from the corresponding quarter last year.

Property & casualty and mortgage insurers

Only tiny ICPEI Holdings Inc. and Sagen MI Canada Inc. reported increases in earnings.

ICPEI is in growth mode. The firm expanded into Quebec in Q4 2020, and recently received authorization to do business in Newfoundland and Labrador and Alberta.

Mortgage insurer Sagen is wholly owned by Brookfield Business LP, but still has publicly owned preferred shares.

The other four companies were negatively affected by financial markets and most had lower underwriting profits.

Mutual fund and investment management companies

Four firms reported higher earnings and Dundee Corp. reported positive net income versus a loss the year before. Three of the other six reported lower earnings, and both RF Capital Group Inc. and Stone Investment Group Ltd. were in loss positions.

The biggest increase in net income was for precious-metal specialist Sprott, at 101%.

The biggest drop in earnings in this sector was by 88.6% for Guardian Capital Group Ltd. The company has a substantial investment portfolio that dropped by $8 million in fair market value after reporting an increase of $42 million a year earlier.

All three big independent mutual fund companies reported increased earnings. AGF and IGM Financial Inc. reported net sales of $330 million and $2.5 billion, respectively, but CI Financial Corp. saw net redemptions of $1.6 billion.

Brokerages

The financial market turmoil didn’t help brokerages. Canaccord Genuity Group Inc. and Oppenheimer Holdings Inc. had drops in net income of 50.6% and 74.7%, respectively. The main reason was big drops in investment-banking revenue, which dropped to $151.0 million from $213.4 million a year earlier for Canaccord, and to $38.5 million from $124.5 million for Oppenheimer.

Exchanges

TMX Group Ltd. reported a 5.8% increase in net income. The firm saw a 37% drop in equities trading volumes, which was partially offset by a change in product mix. In addition, results also included revenue from BOX Holdings Group LLC, in which TMX now has a controlling interest.

Holding companies

Desjardins Group reported a 35% drop in net income. The company’s financial report attributed most of this to “larger amounts invested in strategic projects, especially in relation to the digital shift and security” and weaker results in its property & casualty insurance division.

Click image for full-size chart