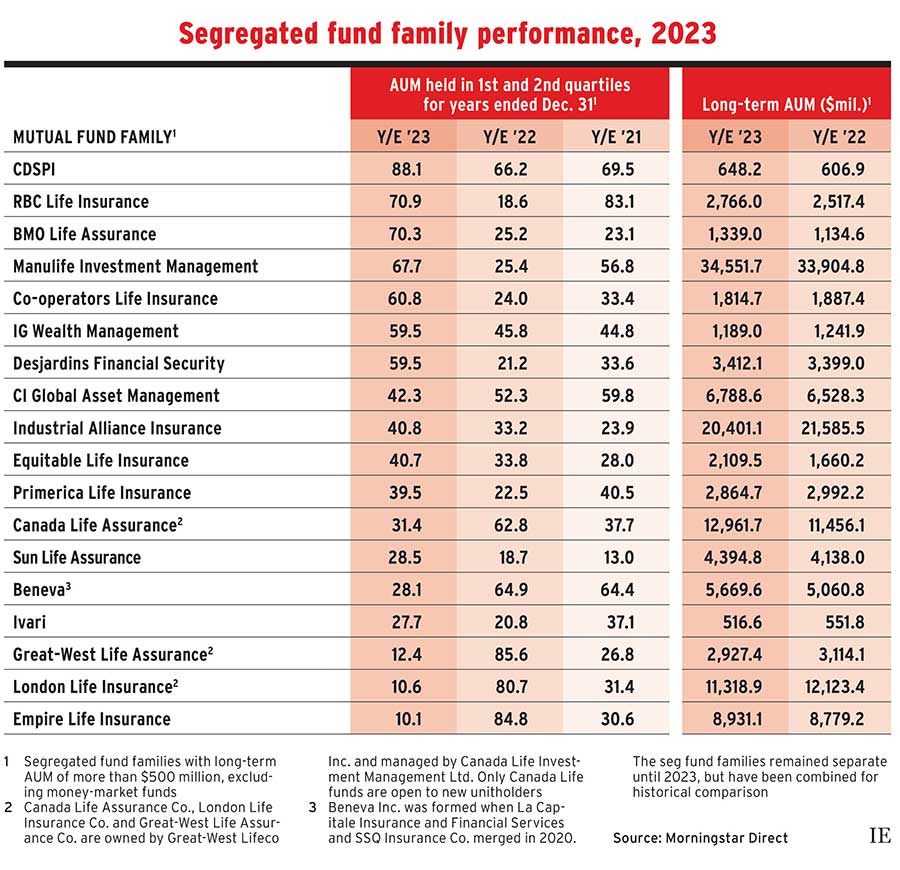

Segregated fund families had difficulty earning superior investment returns in both 2022 and 2023. Only CDSPI Advisory Services Inc., the small seg fund family sold only to dentists, was able to do so. Most of the other families did well in only one of the two years — and a few had a pair of weak years.

CDSPI had 88.1% of long-term assets under management (AUM) in the first or second quartile for the year ended Dec. 31, 2023, according to Chicago-based Morningstar Direct. (All investment management firms are based in Toronto unless otherwise noted.) That proportion was 66.2% in 2022, for a two-year average of 77.2%.

The next highest two-year average was 52.7%, which was achieved by IG Wealth Management’s seg fund family. Another eight families had two-year averages between 44.8% and 49%.

Among the biggest seg fund families, Manulife Investment Management Ltd. did well in 2023 with 67.7% of long-term AUM in the first or second quartile, up from 25.4% in 2022. Canada Life Investment Management Ltd.’s three families all had weak performance in 2023 after a strong 2022. Quebec City-based Industrial Alliance Insurance and Financial Services Inc. (iA) saw lacklustre performance both years.

The threat of recession, inflationary pressures and rising interest rates were common to both 2022 and 2023. What was different was investor sentiment and the opportunities in fixed income as interest rates increased.

Last year, investors climbed aboard the artificial intelligence train with the Magnificent Seven tech stocks responsible for most equities gains, particularly in the first half.

“Quality and stock picking weren’t rewarded,” said Brent MacLellan, vice-president of portfolio construction and analysis with Canada Life Investment Management.

On the fixed-income side, active management was very helpful in 2023. Strategies such as increasing duration and quality of securities, and adding high yield, paid off.

Here’s a look at some of the seg fund families in more detail:

CDSPI

Twenty-nine of CDSPI’s 41 funds ranked above average, with two ranked best in their categories: the CDSPI Aggressive Equity Fund, managed by Montreal-based Fiera Capital Corp., and the CDSPI Emerging Markets Fund, managed by Brandes Investment Partners & Co. All of CDSPI’s funds are managed externally.

Manulife Investment Management Ltd.

This family’s managers are known for stock picking. In 2023, they stuck to their processes and weren’t distracted by market dislocations, allowing the team to find good opportunities, said Sanjiv Juthani, head of product management. He noted that higher interest rates provided “a very nice parking lot” where managers could wait for those opportunities.

Manulife’s seg funds had a strong focus on companies tied to AI, but stayed diversified without big bets on a single area or name. Canadian equities the family owned did well, including Shopify Inc., which had a 118.3% increase after a challenging 2022, and Constellation Software Inc., which was up by 52.9%.

On the fixed-income side, fund managers made a big tactical shift. They slowly increased duration and quality, Juthani said: “Upping quality allowed managers to get more yield, but not more risk.” Managers favoured corporate over government bonds and added high-yield securities.

Co-operators Life Insurance Co.

The family had 60.8% of AUM held in funds with above-average performance. “It was a year with many twists and turns but a strong finish,” said Matt Fettes, associate vice-president of implementation and operations for wealth management.

The family includes three Aviator and five Navigator asset-allocation funds. The portfolio base is the same for both brands, but the Aviator funds can add real estate, preferred shares, U.S. small caps, energy markets and global bonds. Global bonds contributed to performance with gains from currency movements, Fettes said. Emerging markets and real estate also were outperformers.

Desjardins Financial Security

The family had 59.5% of AUM held in above-average performing funds last year, up from 21.2% in 2022. Philippe-Olivier Dumas, section manager of product development for guaranteed investment funds and annuities, said the family benefited from underweighting emerging markets and global small-cap stocks in the first half. The fixed-income side also had a good year due to being overweight in high yield, emerging markets and global fixed income.

Industrial Alliance

These seg funds have higher guarantees than their peers and thus higher management expense ratios. Pierre Payeur, senior vice-president and head of fund management and oversight, said that 54% of the family’s AUM was held in funds with above average performance when calculated using gross returns, vs. 40.8% using net returns.

Payeur said a lot of iA’s managers were more defensively positioned as 2023 started, causing them to miss out on early equities gains. They adjusted their holdings and ended the year strongly. Two stock picks that performed well were Celestica Inc., up by 158.6% in 2023, and United Rentals Inc., up by 60.3%.

Outside manager PIMCO Canada Corp. made a major contribution on the fixed-income side.

Canada Life

Of the firm’s three seg fund families, only the Canada Life Assurance Co. funds are open to new investors. Great-West Life Assurance Co. (GWL) and London Life Insurance Co. seg funds are being wound down, although current unitholders can switch among the families.

Canada Life’s family had just 31.4% of AUM ranked in first or second quartile, while GWL and London Life had 12.4% and 10.6%, respectively.

MacLellan said the families’ approach is to focus on the quality of fund managers and stock selection to minimize downside risk and participate in upside markets — and 2023 wasn’t a year when that worked.

Nonetheless, several subadvisors did well, MacLellan said, including J.P. Morgan Asset Management, Putnam Investments, C Worldwide Asset Management and Great-West Lifeco Inc.’s subsidiary, Irish Life Assurance PLC. On the fixed-income side, MacLellan mentioned the contribution of subadvisor Mackenzie Investments, which increased duration and emphasized credit quality.

Empire Life Insurance Co.

The family had only 10.1% of AUM in above-average performing funds, down from 84.8% in 2022. Paul Holba, chief investment officer, said the family underweighted the Magnificent Seven in 2023, which explained 80% of overall weakness. He added that the same technology underweight boosted performance the previous year.

Empire’s managers are known as stock pickers, but Holba said they are diversifying by adding several funds with a growth bias. These funds are still small, but they’re doing well. The Empire Life Multi-Strategy Global Growth Equity Fund and the Empire Life Global Growth Balance Portfolio were second- and third-best, respectively, in their categories.

Click image for full-size chart

This article appears in the March issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.