This article appears in the March 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Last year was challenging for investors, including segregated fund managers. With the prices of most equities and fixed income securities down, winning was a matter of minimizing losses and preserving as much capital as possible.

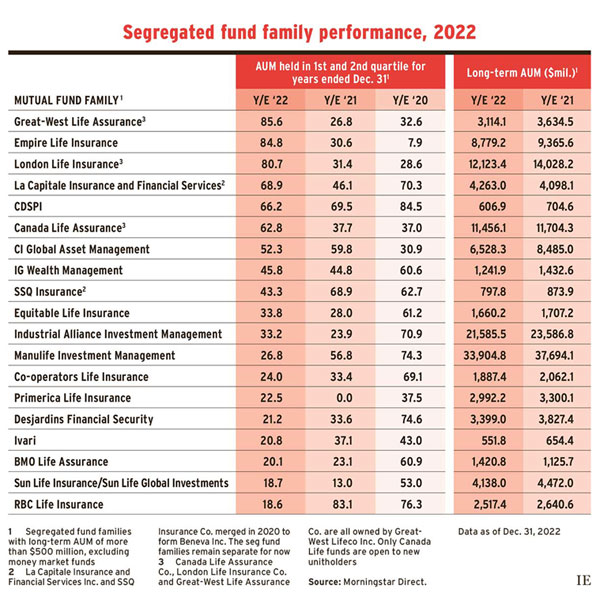

Canada Life Assurance Co.’s three seg fund families did this well, with Great-West Life Assurance Co. (GWL) recording the highest percentage of assets under management (AUM) ranked in the first or second quartile by Chicago-based Morningstar Direct for 2022 at 85.6%. London Life Insurance Co. had the third-highest percentage at 80.7% and Canada Life’s branded funds had the sixth-highest, 62.8%.

Canada Life’s vice-president of portfolio construction and analysis, Brent MacLellan, attributed this performance to strong stock selection and active management. Last year was a “risk off” period that favoured value investing, low-volatility stocks, the energy sector and higher dividend-yielding stocks.

The other stellar performer was Empire Life Insurance Co., which ranked second with 84.8%. Its seg family benefited from stock picks that came to fruition in 2022, said Paul Holba, senior vice-president and chief investment officer.

Here’s a closer look at some seg fund families:

Canada Life Assurance

The firm’s internal asset-allocation manager had “a strategic lower duration profile” for fixed income, MacLellan said. The underlying fixed income managers “were tactical in ensuring bond yields were higher than the benchmark.”

MacLellan attributed GWL’s and London Life’s strong showing to their large amount of AUM in five target-risk asset-allocation funds, all of which ranked in the first or second quartiles. He noted that these funds have “diversified exposure,” including to private credit and real estate. Those asset classes generally did better than public equities and credit in 2022.

The Canada Life family held proportionately less AUM in the asset-allocation funds. Nevertheless, its sixth-place finish was driven in part by above-average performance from three risk-managed funds. (This family is the only one open to new investors.)

Empire Life Insurance Co.

Empire Life’s managers focused on U.S. and Canadian equities, overweighting energy and underweighting tech.

Two winning stocks in 2022 were Maxar Technologies Inc., a space intelligence company based in Colorado, and Ross Stores Inc., a discount clothing retailer based in California, Holba said. Maxar’s stock doubled in December, when private equity firm Advent International Corp. announced it was acquiring Maxar. As for Ross Stores, Empire’s managers bought its stock in May, when low inventory pulled the price to around US$70. When inventory replenished, the price bounced back to US$115, about where it’s been trading since late November.

As for fixed income, managers held bonds with shorter duration than the benchmark and had a “very meaningful yield pickup” in corporate bonds, thanks to deep research into companies, Holba said.

Beneva Inc.

The company was formed when SSQ Insurance Co. and La Capitale Insurance and Financial Services Inc. began merging in 2020, a process completed on Jan. 1. Each insurer’s products will be rebranded as Beneva later this year.

Beneva uses only external managers for its products. This strategy, combined with rigorous manager and fund selection processes, contributed to Beneva’s 2022 investment performance, said Mathieu Roy, investment product development and strategy advisor.

Funds that performed well included La Capitale Low Volatility American Equity (TDAM) Fund, which outperformed its benchmark on a gross-returns basis by 15.5%; SSQ TD Global Dividend Equity GIF Fund, which outperformed by 13.6%; La Capitale Diversified Income Fund (Fidelity), which outperformed by 7.1%; and La Capitale Global Equity (AGF) fund, which outperformed by 4.2%.

On the fixed income side, strategies with short durations tended to outperform due to the rising interest rate environment. For example, the SSQ AlphaFixe Bond and Bank Loan GIF Basic fund outperformed its benchmark by 5.3%.

Industrial Alliance Investment Management Inc.

This fund family only had 33.2% of net long-term assets in funds ranked in the first or second quartile. Pierre Payeur, senior vice-president and head of fund management and oversight, said this was partly because the family has relatively more seg funds with higher guarantees — thus higher fees — than many of its peers. Payeur said if calculations are made using gross returns, the family had about 50% of its AUM in funds with above-average returns.

Payeur said 2022 was an active year for managing fixed income. Holdings of short-term municipal bonds and floating-rate notes helped boost returns, as did using short positions on short-maturity Treasury bills.

Some of iA’s holdings on the equities side did well — specifically Bombardier Inc., Canadian Pacific Railway and Cenovus Energy Inc. Bombardier reported strong revenue growth due to increased demand and prices for regional jets, and Cenovus benefited from high oil prices. These factors allowed both firms to decrease their corporate debt, which some investors had viewed as too high. CP benefited from regulatory approval of its merger with Kansas City Southern Railway Co.

iA offers a series of global asset-allocation funds that invest in illiquid assets such as commercial mortgages, private debt, private equity and infrastructure, as well as publicly traded fixed income and equities. “In addition to earning a certain liquidity premium, several of these securities are less exposed to market sentiment and benefit from stable revenues or income through long-term contracts or business models,” Payeur said.

Manulife Investment Management Ltd.

Manulife, which placed 12th, is a bottom-up stock-picking firm. Managers don’t chase short-term gains, but position themselves for the next five to 10 years, head of product management Sanjiv Juthani said, so 2022 was a year to buy or add to holdings of high-quality companies.

“Managers focus on companies with strong recurring revenue and cash flow,” Juthani said. A few examples are Toronto-Dominion Bank, CGI Inc. and Amazon.com Inc.

Juthani said TD is a “high-conviction holding” where managers see “lots of future upside.” CGI is a Canadian multinational IT consulting firm with a strong management team. The stock has performed well in the past six months. Amazon has strong opportunities across the board and the big drop in its stock price in 2022 provided a buying opportunity.

As for fixed income, Manulife’s managers “were quite active to take advantage of market dislocations,” Juthani said. That will continue. For example, as central banks pause rate hikes, the teams may reduce exposure to floating-rate loans.

Click image for full-size chart