This article appears in the 2023 ETF Guide issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The 2022 bear market in stocks and bonds upended longstanding assumptions as investors learned to live with higher interest rates.

In April this year, New York-based BlackRock Inc.’s investment institute released a paper stating that the decades-long period of stable inflation, multi-asset rallies and bonds providing diversification for occasionally slumping stocks was over.

“We don’t see the return of a joint stock/bond bull market like we saw in the Great Moderation,” the authors stated, warning that the “traditional” balanced approach of broad public indexes isn’t suited to a new investing regime.

Do investors need to adjust? We asked two experts how they’re constructing ETF portfolios in the current market.

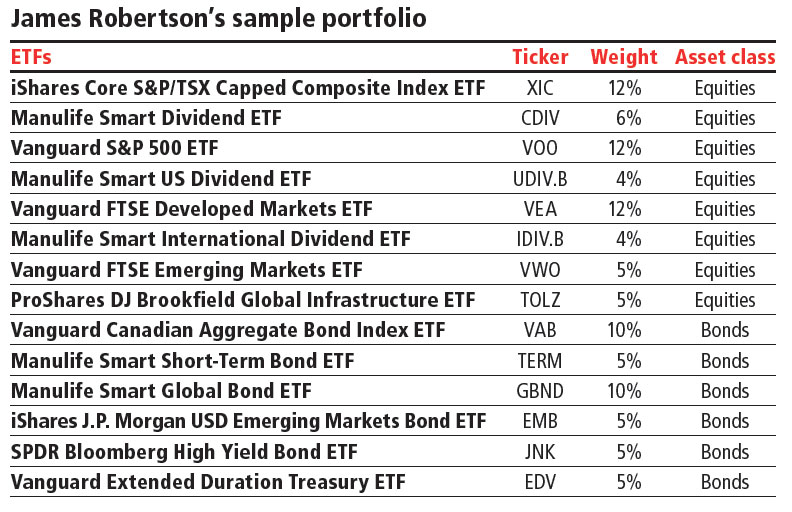

A case for active management

In a high-rate environment, active manager James Robertson is focused on secular growth, strong cash generation and high-quality stocks — including U.S. tech, which he said has “been largely immune to higher rates so far.”

Meanwhile, on the fixed-income side, high-yield and emerging-market debt have the potential to perform well, said Robertson, senior managing director and head of asset allocation for Canada with Manulife Investment Management in Toronto.

“If rates are actually moving up for the right reason — economic strength, for instance — those high-yield and emerging-market bonds start to be attractive from the perspective that they’ve got significant yield protection.”

The key is to build portfolios with the highest risk-adjusted returns, Robertson said. “From a risk-adjusted standpoint, fixed-income securities are more compelling than they have been in the last five years and can compete more favourably with equities.”

Now that interest rates are not suppressed, investors won’t have to lean as heavily on asset classes that rely on low real yields, such as gold, Robertson said.

“We also have a consistent level of income in the portfolio, which has been largely absent in the past, so that allows us to construct a portfolio that can address the various scenarios the world may present going forward,” he added.

With inflation still a risk, he likes short-duration bonds and infrastructure as an asset class.

Robertson also includes longer-duration fixed income, which he said provides downside protection during periods of economic weakness or market dislocation. And being diversified ensures the portfolio can perform well in all markets.

“We’re trying to build a portfolio that’s going to be sustainable, while also having that active component that allows us to be flexible as we manage portfolios through the current cycle,” he said.

“We actively search for opportunities to add value by changing the equity/bond mix, searching for regions and styles, finding new asset classes to improve outcomes and using active underlying building blocks when we believe they will benefit the portfolios.”

Click image for full-size chart

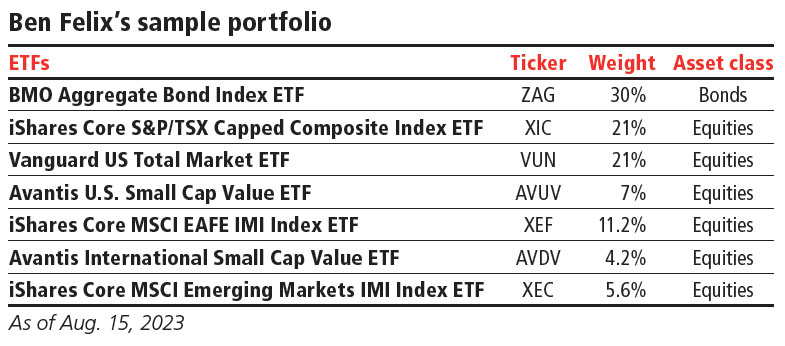

Strategic asset allocation is key

Benjamin Felix, head of research with PWL Capital Inc. in Ottawa, said strategic asset allocation that’s designed to be resilient in multiple economic environments is important.

“Changing portfolios based on the macroeconomic environment is going to be very difficult,” he said. “Having a strategy that you can stick with in any environment tends to be more sensible and effective.”

For example, there are funds that attempt to time exposure to asset classes based on fundamentals, asset prices and economic analysis. But making tactical changes to portfolios may do more harm than good, Felix said.

So how does he create a portfolio that’s resilient in all environments?

Felix doesn’t consider specific sectors because predicting which will do well can be difficult. Instead, he tilts based on four factors: value stocks, smaller stocks, more profitable stocks and companies that invest more conservatively.

“We use products that tilt toward these factors,” he said, with an exclusion for small firms that grow by reinvesting in their business. “This type of portfolio aims to capture multiple systematic expected return premiums, which are risk premiums associated with certain types of stocks. For example, value stocks deliver the value risk premium.”

Felix also doesn’t rely on back-testing portfolios. Instead, he focuses on stocks and bonds that have historically had independent risk premiums. “For example, market risk does not explain the higher historical returns of value stocks, so value stocks deliver an independent risk premium,” he said.

There may be opportunities to vary bond duration based on the shape of the yield curve. “If it’s flat, maybe you take a little bit less duration risk. If it’s upward sloping, maybe a little more,” he said.

Felix added that instead of worrying about which asset class will perform best, investors need to focus on their own behaviour.

“ETF products launch to cater to investors’ worries and predictions. But these types of ETFs tend to lag market trends,” he said. “So the key for investors is to remain disciplined with a sensible, strategic asset-allocation strategy, which is far more rewarding than chasing trends or making tactical calls.”

Felix said market-cap weights are a great starting point for portfolios, but systematically increasing weights of stocks with higher expected returns can improve portfolios.

“This is not traditional active in the sense that it’s still not stock-picking or market-timing,” he said, “but it’s not passive since it’s not fully relying on market-cap weights.”

Click image for full-size chart