This article appears in the 2023 ETF Guide issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

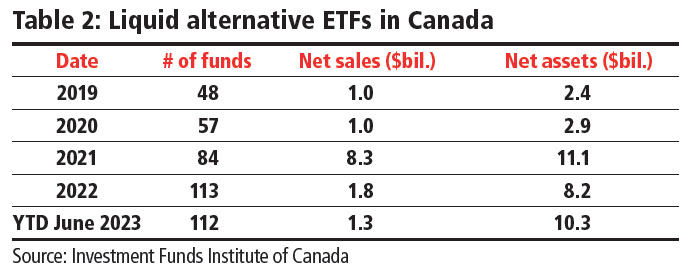

Almost five years after receiving approval from regulators, liquid alternative ETFs have amassed more than $10 billion in assets under management (AUM), with new categories outside the traditional hedge fund universe proving popular with investors.

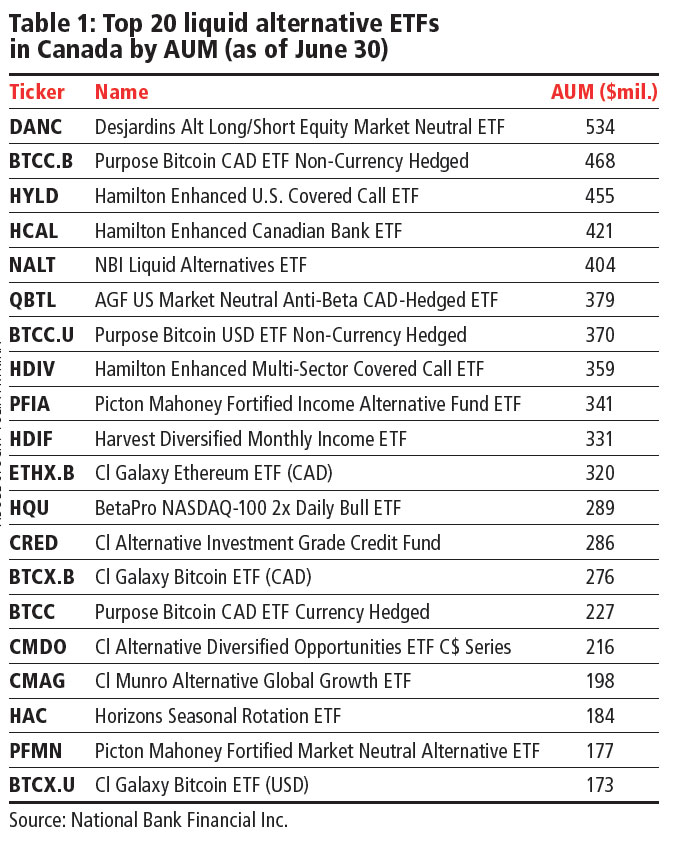

Changes to National Instrument 81-102 took effect in January 2019, permitting manufacturers to sell funds with alternative investment strategies to retail investors. That meant hedge fund strategies — such as long/short, market-neutral and leveraging up to 300% of a fund’s net asset value — could convert to the new format and reach retail investors, leading some traditional players such as Toronto-based Picton Mahoney Asset Management to gather significant AUM in several funds. (See Table 1.) The largest liquid alt ETF as of June 30 was the Desjardins Alt Long/Short Equity Market Neutral ETF, with $534 million in AUM.

The liquid alt category also includes non-traditional strategies, such as crypto. In the “bitcoin winter” of 2018, when the new regulations were finalized, few would have imagined crypto funds amassing billions from retail investors a few years later, said Claire Van Wyk-Allan, managing director and head of Canada with the Alternative Investment Management Association.

But when crypto ETFs received regulatory approval in 2021, billions flowed into funds from Purpose Investments Inc., CI Global Asset Management and others. By the end of that year, $5.8 billion was invested across 27 crypto ETFs, said Tiffany Zhang, vice-president of ETF research and strategy with National Bank Financial. Across its three currency versions, the Purpose Bitcoin ETF had more than $1 billion in AUM on June 30, 2023, even after a fresh crypto winter decimated net asset value last year.

Zhang said 2021 also was notable for the first crop of “lightly levered” ETFs that use cash leverage of between 25% and 33%. That category had more than $2 billion in AUM across 28 products on June 30 of this year, she said.

The category leader is Toronto-based Hamilton Capital Partners Inc. Rob Wessel, managing partner with Hamilton ETFs, said the products don’t use traditional alternative strategies but have landed in the liquid alts bucket for lack of another filing category.

“The liquid alts category, however it was originally envisioned, has now become the preferred structure for innovation,” Wessel said.

The Hamilton Enhanced Canadian Bank ETF puts 25% leverage on the Hamilton Canadian Bank Equal-Weight Index ETF. The leverage brings the fund’s volatility roughly in line with the volatility of holding an individual Canadian bank, Wessel said, while offering 1.25 times the dividends and the returns — if bank stocks go up. The fund is meant for long-term investors.

“The leverage is modest and it’s on low-beta underlying securities,” Wessel said. “We’re not putting 25% leverage on the tech sector, for example.”

The reason for using leverage on the Hamilton Enhanced U.S. Covered Call ETF and the Hamilton Enhanced Multi-Sector Covered Call ETF, which invest in underlying funds that use covered calls, is different. The covered calls provide extra yield but limit upside, so the leverage seeks to make up those returns.

The three enhanced funds had $1.2 billion in AUM altogether on June 30.

Wessel said the products launched in “opportunistic circumstances,” but he’s not worried about investors seeking easier yield elsewhere now that interest rates have risen so dramatically. The enhanced Canadian bank ETF yielded more than 7% at press time, while the U.S. and multi-sector covered call products both yielded more than 10%.

“There’s no question that, at 5.25%, the modest leverage is still your friend,” Wessel said.

The Desjardins Alt Long/Short Equity Market Neutral ETF falls into the more traditional alt category. The fund invests in pairs of correlated stocks, taking a long position in one and a short position in the other. It’s typically invested in 30 to 40 pairs at a time, with about 1% exposure to each security, said Philippe Martel, portfolio manager with Desjardins Global Asset Management.

The fund is focused on capital preservation and aims for little or no correlation to the broader market. “We have a tendency to do better when there’s volatility or shakiness in the market,” Martel said.

The fund has a low risk rating and Martel said some investors have used it as an alternative to cash, especially before last year, when yields on traditional fixed income instruments were so low.

Van Wyk-Allan said downside protection could continue to be a source of growth for the liquid alt category as investors worry about bank retrenchment and a long-anticipated recession, even as markets recovered this year.

As part of NI 81-102, balanced funds are permitted to allocate up to 10% of their portfolios to liquid alts. Five years in, as funds build track records through different market environments, Van Wyk-Allen said more balanced funds may add a liquid alt sleeve: “Alts’ place in portfolios has been proven.”

Click image for full-size chart

Click image for full-size chart