Prior to the economic disruption caused by the Covid-19 pandemic, the regulatory landscape for the insurance sector was transforming due to a combination of structural changes, ongoing pressure to improve consumer protection and a nascent pushback against rising compliance costs.

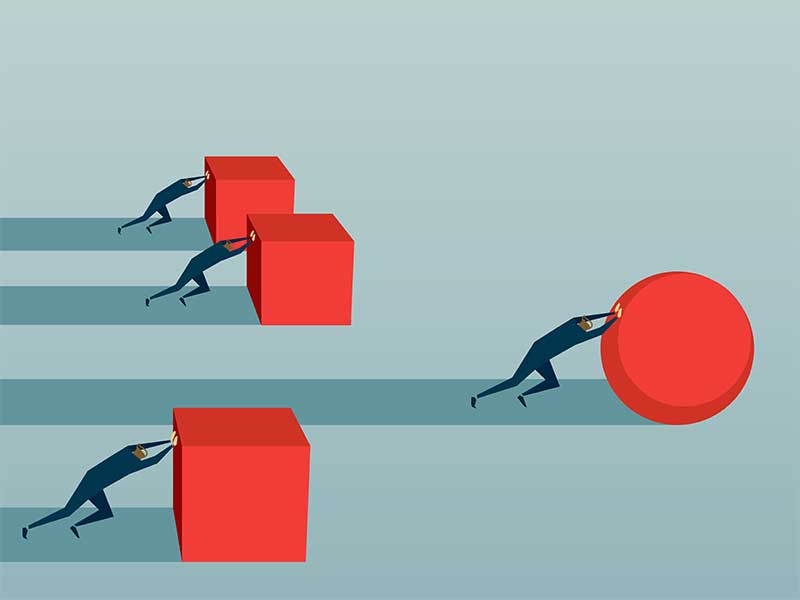

The financial services industry, including the insurance sector, has seen a relentless rise in regulatory obligations in recent years. Following a series of crises and scandals that exposed poor customer treatment at the hands of financial services industry firms, regulators around the world have toughened their requirements.

In Canada, insurance regulators are responding to these global trends with initiatives such as the principles for the fair treatment of customers (FTC), which aim to ensure that clients are treated fairly by both insurance companies and distribution firms.

This guidance — developed jointly by the Canadian Council of Insurance Regulators (CCIR) and the Canadian Insurance Services Regulatory Organizations — sets out the regulators’ overarching expectations for dealing with clients.

The CCIR’s strategic plan establishes a policy agenda for 2020 to 2023. It indicates that enhancing consumer protection is regulators’ top objective for the next couple of years — with FTC principles at the heart of that effort. First on the regulators’ hit list are conflicted sales practices, such as contests that reward top salespeople with trips or other incentives.

Another regulatory priority is adopting recommendations for improving the treatment of clients who buy segregated funds. In 2018, the CCIR set out a series of associated recommendations for enhancing disclosure, conduct standards and supervisory practices. The council would like to see those recommendations adopted over the next couple of years.

Many of the recommendations close the regulatory gap between seg funds and mutual funds, a move motivated by the client relationship model reforms for investments, which raised the bar for cost and performance reporting.

The Canadian Securities Administrators (CSA) has launched other major investor protection initiatives — the client-focused reforms (CFRs) and the planned elimination of deferred sales charges (except in Ontario) — that threaten to widen the regulatory gap between mutual funds and seg funds, a gap that can exacerbate the potential for regulatory arbitrage.

Given that many insurance reps are dually licensed to sell both products, the concern is that some reps will abandon mutual funds for seg funds if the regulatory differences become too great.

Whether the CSA’s latest protection efforts lead to any policy response from insurance regulators remains to be seen.

In the meantime, the regulatory landscape in the insurance sector also is being altered by the recent launch of two provincial agencies: the Financial Services Regulatory Authority of Ontario (FSRA) and the BC Financial Services Authority.

While insurance regulators focus on enhancing consumer protection, FSRA approaches its mandate with a heightened commitment to reducing regulatory burden too. Already, the regulator has slashed the existing mountain of guidance it oversees — cutting existing guidance overall by 51% and slashing the directives focused on the insurance sector by 73% — and that’s just its first pass.

FSRA also is charged with cracking the long-standing issue of title regulation as it develops an approach to restrict the use of “financial planner” and “financial advisor” to qualified reps. What those qualifications will be and who will be grandfathered into the new regime or forced to acquire credentials to keep using those titles are still to be determined.

FSRA’s policy objectives also include enhancing advisor oversight. The Canadian Life and Health Insurance Association Inc. has proposed a licensing regime for insurance distribution firms that would create supervisory responsibilities for them, such as monitoring advisors’ compliance with conduct standards, overseeing sales practices and handling client complaints.

While that proposal didn’t gain much traction, FSRA plans to consider the industry’s proposals for enhancing oversight in the year ahead. To begin, FSRA will research existing conduct issues and consider how to address possible gaps in oversight. These efforts will include FSRA developing an approach to supervising the managing general agent channel, which has been the focus of the insurance sector’s concerns about oversight.

Inevitably, fallout from the Covid-19 pandemic will delay regulatory policy efforts, but the dual underlying objectives of both enhancing consumer protection and easing regulatory burden appear likely to persist in the insurance sector.