This article appears in the December 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert

Alex Nayyar, vice-president and portfolio manager with Treegrove Investment Management Inc. in Toronto.

The Philosophy

Treegrove uses a value screen to select North American securities and performs detailed analysis of each company’s cash flow, competitive advantages, future earnings potential and share price. Portfolio managers also hold discussions with management, research analysts and competitors. Treegrove uses ETFs to invest outside of North America.

The scenario

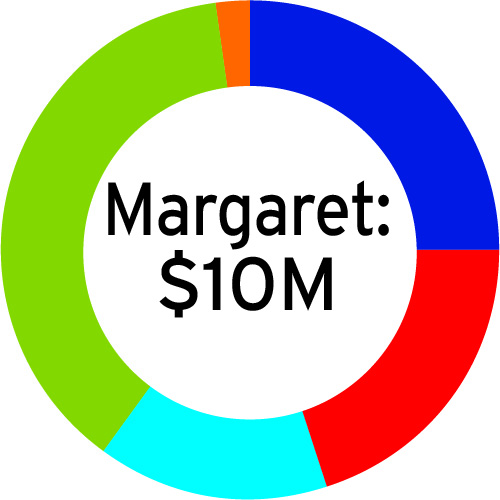

Margaret, 47, inherited $10 million. She takes a long-term investment approach and is seeking capital preservation with steady income.

The allocation

Nayyar suggested a 60/40 portfolio that will generate cash flow through dividends and income. “We seek to diversify our clients’ portfolios over 20 to 30 positions, with each position ranging from 3%–4% of the total invested funds,” he said. “Our target is out-of-favour companies selling at a significant discount to our targeted value.”

25% to Canadian equities, such as:

- Canadian National Railway Co. (TSX: CNR)

- TC Energy Corp. (TSX: TRP)

- Sun Life Financial Inc. (TSX: SLF)

- Bank of Montreal (TSX: BMO)

- Nutrien Ltd. (TSX: NTR), a large provider of crop inputs and services

- Linamar Corp. (TSX: LNR), an international producer of engineered products

- Rogers Communications Inc. (TSX: RCI.B)

- Manulife Financial Corp. (TSX: MFC)

- Enbridge Inc. (TSX: ENB)

20% to U.S.equities, such as:

- Wells Fargo & Co. (NYSE: WFC)

- Johnson & Johnson (NYSE: JNJ)

- General Motors Co. (NYSE: GM)

- Pfizer Inc. (NYSE: PFE)

- Eli Lilly and Co. (NYSE: LLY)

- IBM Corp. (NYSE: IBM)

- Microsoft Corp. (Nasdaq: MSFT)

15% to international equities, through ETFs such as the:

- Vanguard FTSE Europe ETF (NYSE Arca:VGK)

- Vanguard FTSE Emerging Markets ETF (NYSE Arca: VWO)

38% to fixed income, through ETFs such as the:

- Vanguard Canadian Short-Term Bond Index ETF (TSX: VSB)

- Vanguard Canadian Short-Term Corporate Bond Index ETF (TSX: VSC)

- Vanguard Short-Term Bond ETF (NYSE Arca: BSV)

- Vanguard Short-Term Inflation-Protected Securities ETF (Nasdaq: VTIP)

2% to cash, held in the NBI Altamira CashPerformer account.

The scenario

Margaret received an unexpected $10,000 bonus.

The allocation

- 100% to the NBI Altamira CashPer former account to take advantage of future opportunities.

The expert

John Baynham, president of Retirement Income Group Inc. and financial planner with Carte Wealth Management Inc. in Ajax, Ont.

The philosophy

Baynham focuses on constructing well-diversified portfolios of global securities using strategic allocation.

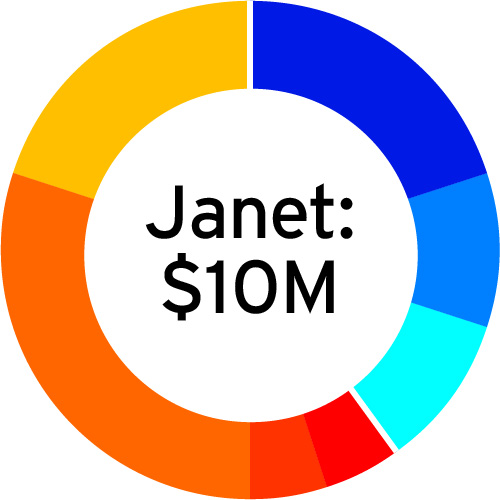

The scenario

Janet, 60, inherited $10 million. She has a medium risk tolerance and wants to maintain a traditional 60/40 allocation. She would like long-term growth, but is nervous about a potential recession.

The allocation

40% to fixed income

“As we approach a potential recession, we want to be wary of credit spreads widening,” Baynham said. As such, he recommends:

- 20% to the CI Alternative Diversified Opportunities Fund, a bond fund that may use leverage. “The fund’s duration is actively managed, so you can expect a lot less volatility than [in] a traditional long-duration bond ETF,” Baynham said.

- 10% to the CI Enhanced Short Duration Bond Fund ETF (TSX: FSB). This ETF is “less interest rate-sensitive than core fixed income,” Baynham said.

- 10% to the Lysander-Canso Corporate Value Bond Fund, a high credit quality, high-yield fund.

60% to equities

“With higher interest rates, we want to be wary of investing in companies that have higher P/E multiples. As well, we want to have some holdings that have negative or low correlations to traditional indexes,” Baynham said. He recommends:

- 5% to the Forge First Conservative Alternative Fund, which Baynham described as a long/short fund with a low correlation to Canadian and U.S.indexes.

- 5% to the Fidelity Global Value Long/Short Fund, a high-risk value fund.

- 30% to the NCM Global Income Growth Class fund, which focuses on companies that grow their dividends at a pace higher than inflation.

- 20% to the Canoe Equity Portfolio Class fund, which Baynham said offers a great way to own stocks that could lead markets over the next few years.

The scenario

Janet received a bonus of $10,000.

The allocation

Baynham recommended the same allocation as for Janet’s inheritance.