The push toward fee-based advice is increasingly prevalent in the financial services industry.

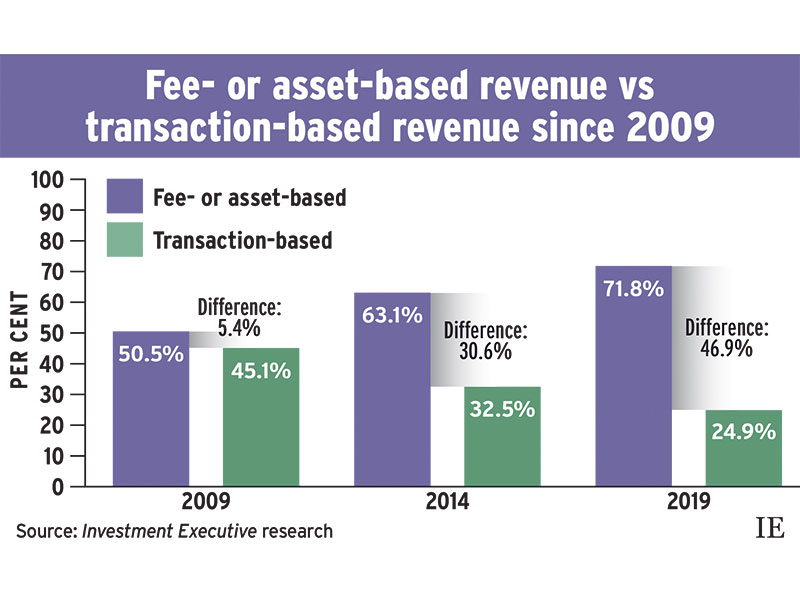

In the 2009 Dealers’ Report Card, financial advisors said they derived 50.5% of their revenue from fee- or asset-based sources, and 45.1% from transaction-based sources. Ten years later, the revenue gap has widened considerably: for the 2019 Dealers’ Report Card, advisors said 71.8% of their revenue came from the fee- or asset-based model, while 24.9% was from transaction-based.

The results of this year’s Report Card also reveal mixed experiences with the move toward fee-based, with some advisors struggling throughout the transition. Three firms’ ratings dropped significantly (by more than half a point) year-over-year in the “firm’s support for advisors operating within a fee-based model” category, while three firms rose significantly over the same period.

“There is no support. They are changing the way they’re doing things [and] it’s confusing,” says an advisor from Quebec about Winnipeg-based Investors Group Inc., one of the three firms with a significantly lower rating in 2019. That rating, 6.9, was the second-lowest in the category.

One leader at Investors Group is more optimistic about the shift. “The new world that we’re in is really [focusing] on fee-based advice, transparency with clients and making sure that our advisors focus on putting the right solutions in place for our clients,” says Brent Allen, senior vice president of distribution operations at Investors Group.

His sentiment mirrors that of executives at other firms included in the Report Card. Reggie Alvares, executive vice president of Mississauga, Ont.-based Investment Planning Counsel Inc. (IPC), says the fee-based approach is “good for everyone. It’s good for the clients, good for advisors, good for the industry.” IPC received a rating of 7.5 in the fee-based support category, unchanged from last year and just below the category’s overall average performance rating of 7.6.

That overall average performance rating was the same as last year. However, the overall average importance rating increased to 8.4 from 8.2, widening the gap in advisor satisfaction.

Advisors say the disconnect is not in the dealers’ adoption of the model, but in the lack of support and accessibility.

The fee-based support performance rating for Lévis, Que.-based Desjardins Financial Security Independent Network (DFSIN) decreased significantly, from 7.2 to 6.1 year-over-year, and was the lowest in the category. DFSIN advisors said they would like more information sessions on how the fee-based platform operates.

“They need to make it easy for the advisors if they want us to go with this option. They’re not there yet,” says a DFSIN advisor in Ontario. (DFSIN executives were unable to comment before Investment Executive went to press.)

The majority of Investors Group advisors were similarly frustrated, despite Allen’s emphasis on moving toward a fee-based model.

As it stands, “[The platform] is so preliminary and just not user-friendly,” says an Investors Group advisor in Alberta.

An Investors Group advisor in the Prairies adds, “I think they are doing all of the right things, but [the] growing pains are outrageous. Non-stop errors.”

Allen says his firm will try to quell this discontent with national education days, where the firm will really “go deep” into the topic of fee-based advice. “There [are] a few [advisors] who still prefer embedded, because that’s maybe what they knew. But we’re going to work with them one-on-one to make sure they have the information they need. Our future is 100% fee-based.”

Investors Group and DFSIN were two of three firms whose ratings in this category dropped significantly from last year; Montreal-based Peak Financial Group was the third. While most Peak advisors remain satisfied with the support they received for using a fee-based model, some were hesitant about the transition, citing a lack of flexibility and transparency in the systems used.

For this reason, Peak was rated 8.1 in the fee-based support category, down from 8.6 last year. The firm remains one of the top firms in the category, however, with multiple advisors noting “strong” and “excellent” guidance.

Robert Frances, Peak’s president and CEO, says the firm has offered training to help ease the transition to a fee-based model, and feedback has been good. “We are now second amongst all dealers in Canada in terms of percentage of assets moved to fee-based,” he says.

The three firms whose ratings rose significantly in 2019 from 2018 were Windsor, Ont.-based Sterling Mutuals Inc. (to 8.9 from 7.8), Markham-Ont.-based Worldsource Wealth Management Inc. (to 7.1 from 6.6) and Oakville, Ont.-based Manulife Securities (to 7.8 from 7.3). But even advisors at these dealers expressed dissatisfaction with their respective platforms.

“They are pushing fee-based, but there are still some problems,” says a Manulife advisor in Alberta. “It’s a good platform; I really like it, but it needs a little more support.”

Similarly, a Worldsource advisor in Ontario says the dealer strongly supports the fee-based model, but is struggling with implementation. “We want to go this way, but we need more structure and processes; it’s just not there yet.”

“They are a hands-off company, not so much offered in terms of full service,” says a Worldsource advisor in B.C.

An advisor from Sterling Mutuals says, “I think generally it can always be improved, but industry-wide [we have] one of the better [platforms] out there.”

Rick Annaert, president and CEO of Manulife, says the fee-based model is the way of the future. “You’re giving unbiased advice that way, and hopefully there’s a perception that it’s in the client’s best interest, because it is.” Annaert adds that 38% of all Manulife’s assets are in the explicit fee-based program, and that the percentage is “growing dramatically.”

For his part, Richard Rizi, senior director of investment services at Worldsource, also sees growth: “Currently, approximately 20% of every new dollar that comes into our mutual fund dealer is invested into the fee-based solution.” That’s up from 3% six years ago, he says.

“[We are] seeing growth in both [our] fee-based and asset-based platforms,” says Michael Stanley, president of Sterling Mutuals.

When dealer executives were asked what role firms should play in shaping advisors’ practices as the industry shifts, answers varied. Some firms don’t provide business development tools, preferring that advisors purchase and utilize the programs that are best for them and their clients. Others offer more services and support, but charge a fee for use.

The same goes for fee-based platforms. While the majority of dealers offer such a platform, some, like IPC, charge advisors. But, says Alvares, “The fee is just for the cost of the platform, which is not a margin play […] It just covers the cost of the platform itself.”

After all, says Annaert, “a business model isn’t economically viable if you offer everything to everybody.” At Manulife, he says, the focus is on allowing advisors to run their own businesses. “We want to give people a core value proposition and then à la carte services that they can pay for as they define the needs of their practice,” he adds.

The advisors surveyed seemed to understand and even appreciate this policy, with a few conceding, “You get what you pay for.”

As an advisor with Worldsource in Ontario says, “The dealer does an amazing job for someone like me. All they do is provide access and compliance, [but] they provide a great framework for me to build my business and do what is best for my clients.”