This article appears in the Mid-October 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

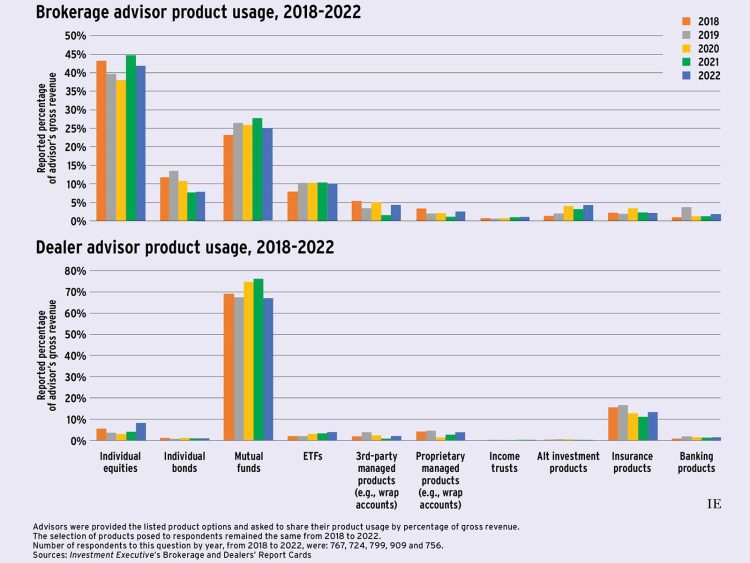

Mutual funds have constituted the vast majority of dealer advisors’ product-based gross revenues since 2018, but have consistently placed second to individual equities for brokerage advisors.

ETFs cracked 10% of brokerage advisors’ revenues in 2020, but have plateaued since. In 2022, ETFs rose to 3.7% of dealer advisors’ product-based revenues, up from 3.2% in 2021.

But not every dealer advisor has access to ETFs.

“The ability to offer ETFs needs to happen,” said a dealer advisor in Ontario. (This may change once the new self-regulatory organization launches.)

Advisors in the retail bank channel also expressed an interest in ETFs.

“I would love to have more access to ETFs. It allows us to put better portfolios in place. You can’t really compete if you don’t have access to everything,” said a retail bank advisor in Ontario.

Below is a look at advisors’ product-based gross revenue over the past five Dealers’ and Brokerage Report Cards.

For more on advisors’ experience with products, read What advisors had to say about products.

Click image for full-size chart