The Big Short, the 2015 Hollywood movie about the U.S. housing bubble, opened with a quote from Mark Twain: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

In the case of the housing bubble, the thing everyone thought they knew for sure that just wasn’t so was the assumption that U.S. house prices would never decline. Financial models built on this faulty assumption influenced investors to make decisions that exposed them to more risk than they expected.

Today, many investors base their portfolio construction approach on the assumption that government bonds deliver outsized positive returns when stocks decline. If this assumption were faulty, then it could mean that, like real estate and mortgage investors during the great financial crisis, investors today may be making decisions that expose them to more risk than they expect.

I decided to test this “what you know for sure” assumption about the relationship between stocks and bonds.

Conventional wisdom holds that a portfolio of 60% equities and 40% fixed income is a dependable, well-balanced investment portfolio. But has that always been the case? Can advisors and investors reasonably expect that stocks and bonds will always serve as good diversifiers for one another?

Certainly, if you look at stock and bond performance from 2000 to 2020, the conventional wisdom holds true for the most part. But what if the first 20 years of the 21st century represented an outlier in which bonds were unusually effective at diversifying equity risk? What if the higher correlations we’ve seen since 2020 were here to stay?

A brief history lesson

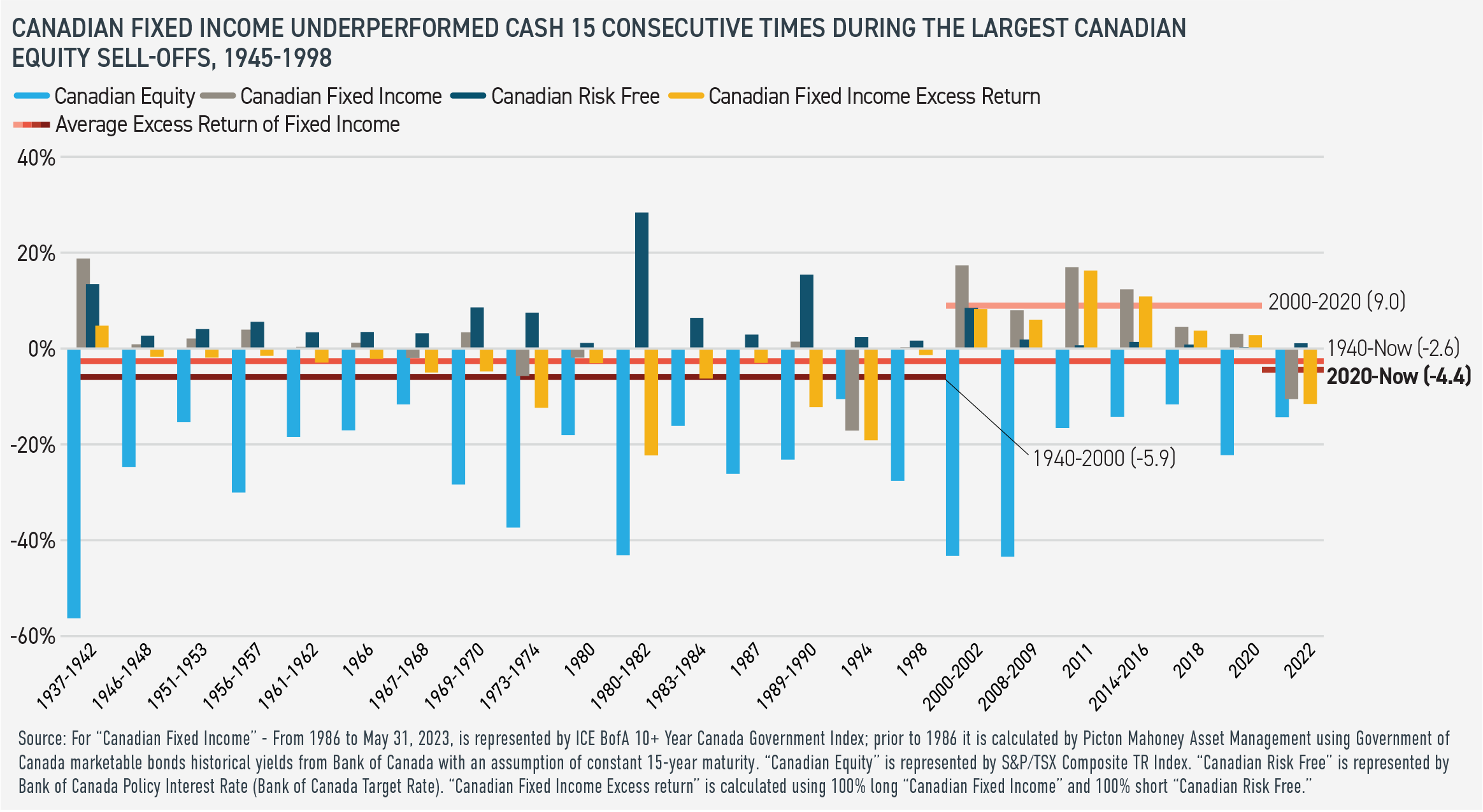

Consider the relationship between equities and government bonds over the past 80 years. In the 2000–2020 period, Canadian government bonds outperformed cash six times out of six during the largest equity sell-offs in the S&P/TSX Composite. However, from 1945 to 2000, government bonds underperformed cash 15 times out of 15 during the largest equity sell-offs. (See image below.)

My main observation is this: historically, government bonds tend to underperform cash during large equity market declines. This suggests that, while the magnitude of the 2022 sell-off may have been unusual — and compounded by the meagre yield cushion afforded investors heading into that year — the underperformance of government bonds last year relative to cash as equities sold off was entirely typical.

Identifying the root cause of higher correlations

What could cause this kind of regime shift in the co-movement of stocks and bonds? Inflation is a potential cause that many market prognosticators have been pointing to lately. According to the inflation calculator on the Bank of Canada’s website, inflation averaged less than 2% per year from 2000 to 2020. By comparison, inflation averaged over 4% per year from 1945 to 2000.

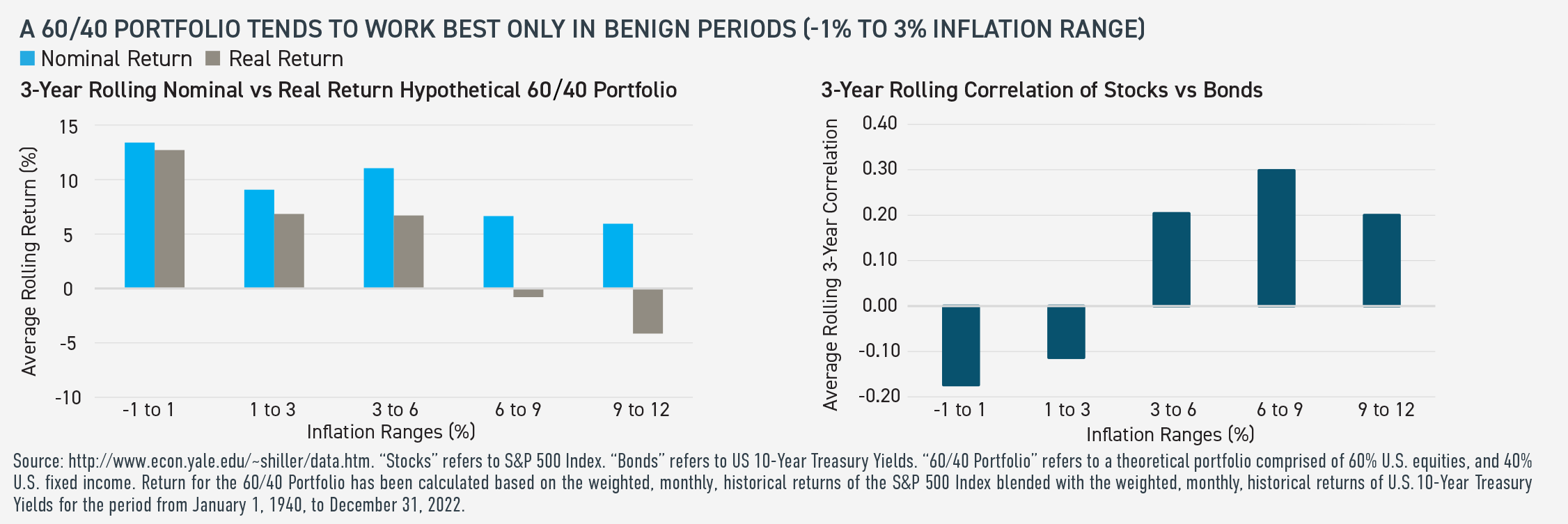

Stocks and bonds tend to be good diversifiers for one another when volatility is driven by growth shocks, but that does not tend to hold true when volatility is driven by inflation shocks. A possible explanation for that: when inflation is low and stable, central banks don’t need to worry about fighting inflation, so they often take a more aggressive stance during a recession by cutting interest rates. In this scenario, bond prices rise due to falling interest rates, while equity prices decline due to slowing economic growth.

Conversely, when inflation is higher and more volatile, central banks generally raise interest rates even if it causes a recession. In this scenario, bond prices decline as do equities, due to rising interest rates and slowing economic growth, respectively. Unfortunately for investors, not only do stocks and bonds tend to behave more like one another when inflation is higher but the returns of stock-and-bond portfolios also tend to be lower. See the graphs below.

A new way to think about portfolios

Just as the assumption that U.S. housing prices would never decline was incorrect, so too is the assumption that government bonds tend to outperform cash during equity sell-offs. This has meaningful implications for portfolio construction. Entrusted with a client’s life savings, it’s critical for advisors to help reduce the likelihood of shortfall against an investor’s financial objective by managing downside risk and lowering volatility. This would help to mitigate both sequence of return risk and the likelihood that an investor would panic and abandon their financial plan at an inopportune moment. If bonds cannot be wholly relied on to protect against equity risk, then investors need multiple layers of fortification within their portfolios.

A smarter way to construct portfolios is to reduce your sensitivity to changes in the level and direction of interest rates and equity markets by incorporating additional asset classes and strategies. When an advisor asks how to better shield investors from the markets, we suggest taking 20% from equities and 10% from bonds to allocate to a framework of 40% equities, 30% bonds and 30% alternative strategies.

Within the alternative sleeve, consider a three-part playbook. First, use enhancers as a replacement for stocks and bonds to provide exposure to those markets in a manner that offers potential for downside protection. Second, diversify your diversifiers beyond bonds by incorporating additional strategies that aim to meaningfully outperform cash without exposing you to fixed income or equity risks. And finally, allocate to asset classes and strategies that seek to protect against unexpected inflation.

Historical performance can be a useful tool for portfolio construction. When you revisit the numbers with fresh eyes — not assumptions — the data can be that much more instructive.

Robert Wilson is head of the Portfolio Construction Consultation Service with Picton Mahoney Asset Management.