I joke that my next book will be called But That’s What the Client Wanted because this is a common response by advisors faced with clients complaining about unsuitable investments. Certainly, the analysis of circumstances and advisor’s obligations when a client demands potentially unsuitable products could fill an entire book. Since I’m not writing another book, I will address the issues in this article and direct you to additional resources.

First, some general guidance:

- Marking trades as “unsolicited” does not permit you to disregard your professional suitability obligations.

- Regulators and judges will hold you to the standard to which other professional advisors — lawyers, doctors, accountants — are held: the question will be whether you exercised “professional judgment” in the circumstances given the registrant-client relationship.

- Client sophistication continues to be immensely important. Most clients don’t have the necessary financial knowledge to know what is suitable/appropriate for them given their financial circumstances and risk profile. If you assert that your client had the necessary sophistication, you need a strong paper trail with specific evidence to support this contention. Even so, you will need to prove that you exercised your professional judgment.

- Refusing the trade or sending the client away is an option, and may become your preferred avenue given that a single client complaint can threaten your licence, reputation and livelihood.

All that to say, what the client says they want is secondary to your professional obligation to assess product suitability to avoid allegations of unsuitable investments (which include overconcentration and lack of liquidity).

You have heard me use the doctor analogy: a patient asks for sleeping pills and the doctor provides a prescription without making the necessary inquiries to ascertain the underlying cause of sleeplessness, and misses diagnosing a serious illness. Writing that prescription is negligent and clearly not exercising professional judgment. That is akin to investing based on what the client says they want or need without knowing the client. You are the professional; ask the questions necessary to determine what is suitable.

What if the client has accounts at other firms and wants a specific investment from you that viewed in isolation appears overconcentrated, risky and therefore unsuitable?

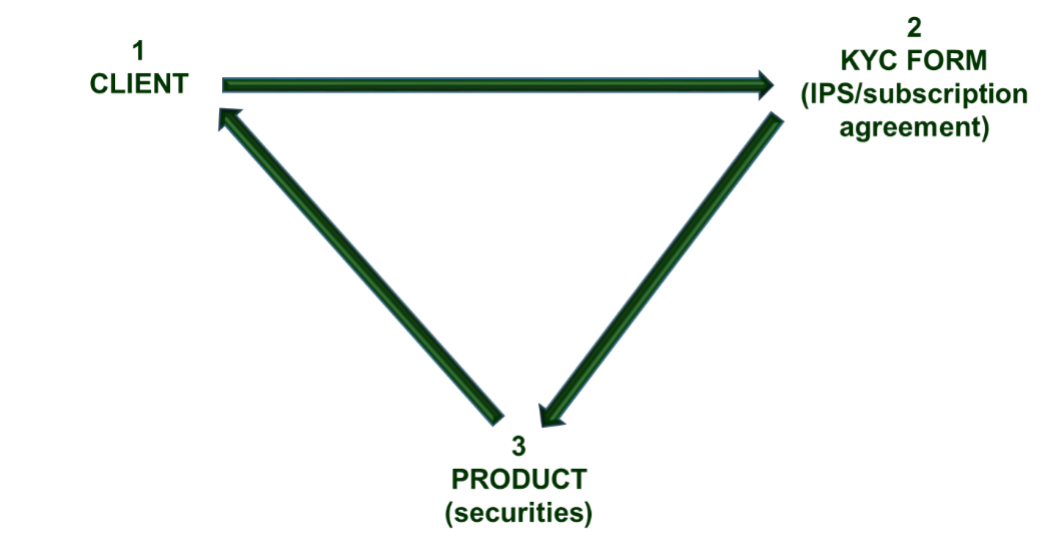

Use my triangle of suitability.

Step 1 is knowing enough about the client’s financial circumstances and risk profile (risk tolerance and risk capacity) to assess whether in your professional judgment it is suitable to invest in the product requested by the client. Step 2 is completing the KYC form (and investment policy statement) with the support of Step 1 evidence. And Step 3 is choosing the product or portfolio. Given the client’s other assets and financial circumstances, and exercising your professional judgment, you will determine if investing in what appears to be an overconcentrated account can be supported with a paper trail to conclude the investment was suitable as well as diversified and sufficiently liquid.

Here is the bigger problem: clients don’t want to share private information with their advisors about assets kept at other dealers and elsewhere. So, if the client withholds such information and doesn’t fall into a category in which suitability is waived (i.e., order execution only account, institutional investor or “permitted client”), what does the advisor do?

While the regulators say you don’t need to send the client away if you don’t have “all of the information,” advisors must collect sufficient information to later withstand a suitability challenge by a client, your own dealer or a regulator.

For more information that clarifies your obligations, check out the CSA’s FAQs on the client-focused reforms.1

Good luck and protect yourself. Remember, by protecting yourself, you also protect your clients — unsuitable investments are not good for them or for you!

1 See FAQs 2, 3, 4, 49, 60, 61–68.