Build personal relationships to counter robo-advisor competition

Traditional advisors need to emphasize broad-based financial planning, conference told

- By: Jade Hemeon

- January 28, 2015 October 21, 2019

- 10:00

Traditional advisors need to emphasize broad-based financial planning, conference told

With a new year underway, it’s a perfect time to re-evaluate your target market

Dazzled by good returns in the U.S., many clients are failing to rebalance their portfolios

Make sure you know what an ETF owns, conference told

Part three of an equity-income roundtable

In part one of a 10-part series, George Hartman, managing partner with Elite Advisors Canada, explains why it’s important for advisors to plan for their…

Part two of an equity-income round table

Part one of an equity-income roundtable

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, discusses how advisors can beat the robo-advisor competion by delivering services that can’t be commoditized.

Most portfolio managers have their eyes set on equities, but their enthusiasm is tempered by rich valuations for U.S. stocks and the potential that the…

Most portfolio managers suggest that gold prices won't generate much excitement this year, but there is a school of thought that runs contrary to that…

The amount of money Japan's government can spend to stimulate that economy is limited by its monumental public-sector debt. Thus, the government needs to find…

New head of Sprott Assett Management wants to pursue a more conservative strategy in stock-picking for the firm's funds

What central bankers do in 2015 will affect your clients' portfolios

Most economists have predicted rate increases annually since 2009, but those predictions have not come true and rates have remained low. Once again, the consensus…

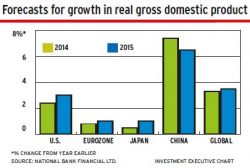

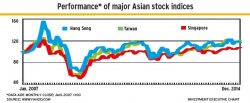

Growth in Asian countries (excluding China) is being driven by a healthy combination of external demand and rising domestic consumption. Potential tightening of global financial…

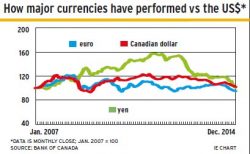

Thanks to a confluence of factors, the U.S. dollar (US$) is expected to continue to rise against most currencies, including the euro, the Japanese yen…

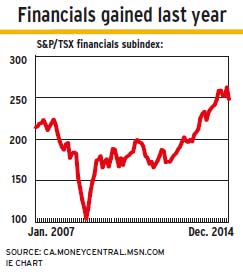

After a solid year, slower domestic growth and uncertainty in the energy sector are likely to mean a more muted performance for banks, insurers and…

Given the weakness in the region's economies - plus the risks they face on several fronts - the overall sentiment on European equities is negative.…

The U.S. is one of the brighter spots among world economies. But with a sharply rising currency and markets nervous over the effects of plummeting…

Financial markets are worried about deflation, particularly in Europe but also elsewhere. In the U.S., the combination of steep drops in oil prices and a…

Regional robo-advisors are growing fast. Many are expanding both geographically and in the services they offer, including special tools designed for traditional advisors

Global financial regulators have made considerable progress in 2014 on reforms sparked by the 2007-09 global financial crisis. In the year ahead, regulators will continue…

Although yield spreads for corporate issues over government bonds have tightened, the premiums still are attractive. But you and your clients must remember that when…

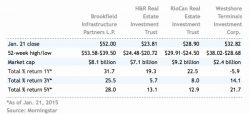

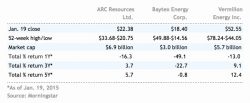

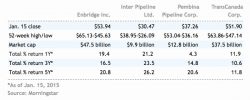

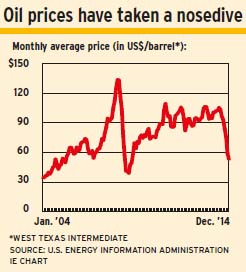

The drop in oil prices has precipitated a decline in energy stocks. However, they could rebound if oil prices begin rising. In contrast, no quick…