Following a year of sluggish economic growth and disappointing returns in Europe, portfolio managers are optimistic that 2015 could be a more favourable year. In particular, there are strong investment opportunities in the consumer and health-care sectors. However, investors should be cautious, given the fragile state of the economies in the region.

The European Central Bank (ECB) is projecting real gross domestic product (GDP) growth in the region this year of 1% vs around 0.8% in 2014. Although any gradual improvement is encouraging, portfolio managers say, investors need to be patient as they await a full-fledged recovery.

“The economy is not sinking any further, but it is slow to come back,” says Amber Sinha, portfolio manager with Kingston, Ont.-based Empire Life Investments Inc. and lead manager of Empire Life International Equity Fund. “It’s definitely below par, in terms of how it’s performing right now.”

The weakness has been driven in part by a broader slowdown in global economic growth that has squeezed demand for European exports. Sluggish domestic consumer spending, amid high consumer debt levels and continued fiscal austerity in many European countries, also has weighed on growth in Europe.

“European domestic demand has been very weak,” says Martin Fahey, senior vice president and head of European equities with I.G. International Management Ltd. in Dublin, and portfolio manager of Investors European Equity Fund. “The level of indebtedness is very high, and governments in a number of European countries have increased taxes in an effort to reduce deficits.”

The conflict between Russia and Ukraine also has had an impact, as economic sanctions and tense bilateral relations led to a hefty drop in trading activity between the European Union (EU) and Russia. Export-driven economies such as Germany and France have been hit particularly hard.

Elsewhere in Europe, conditions are more favourable. Scandinavian countries “are all strong economies,” says Greg Gipson, vice president and head of portfolio management, systematic investments, with BMO Global Asset Management Inc. in Toronto, and portfolio manager of BMO Global Equity Class Fund. “They’re growing between 2.5% and 3%.”

Switzerland’s economy also is performing well, and some of the peripheral countries are showing signs of improvement. “Places like Spain appear to be undergoing quite a strong rebound, with the odd hiccup,” says Dominic Wallington, chief investment officer and senior portfolio manager with RBC Global Asset Management (U.K.) Ltd. in London, England, and lead portfolio manager of RBC European Equity Fund.

The U.K. has enjoyed much stronger growth than the eurozone. This is partly the result of the success that the Bank of England has had in stimulating the economy through several rounds of quantitative easing (QE) in the past few years.

In contrast, the ECB has had less flexibility in its use of monetary policy, given the challenge of trying to find a common approach among a group of nations with drastically different economic fundamentals.

“Any sort of QE or any sort of loose monetary policy is typically more effective in a single nation,” Gipson says. “It’s one of the challenges that the ECB is facing.”

The ECB has, so far, held off on launching a full-blown QE program to stimulate the EU economy, given strong opposition from Germany. Instead, the ECB has attempted to ease credit conditions through other, less aggressive policy measures, such as purchasing high-quality, asset-backed securities.

These efforts have helped to bring down the value of the euro, which is beneficial for the region. However, portfolio managers say, it’s too early to determine whether the measures are stimulating debt markets.

The ECB indicated in early 2015 that it will reassess the effectiveness of stimulative measures taken so far, and will consider engaging in QE if necessary.

Fahey suggests it will be necessary: “Inflation in Europe is continuing to weaken, and it will weaken even with lower oil prices. The ECB’s mandate is to have inflation close to 2%, so to meet that mandate, [the ECB] is going to have to do something.”

The possibility of deflation is one of the major risks for the region. The ECB projects average inflation for the eurozone of 0.5% for 2014 and 0.7% for 2015. Although still in positive territory, this trend falls far short of the ECB’s 2% target, says Peter Hadden, portfolio manager with Pyramis Global Advisors in Smithfield, R.I., a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments) and portfolio co-manager of Fidelity Europe Fund.

However, the consensus is that deflation will not materialize. “With the decline that we’ve seen in the euro and an acceleration in economic growth, I would put a very slim chance of seeing outright deflation in Europe,” Sinha says.

Hadden adds that the ECB will help to prevent deflation: “I think [the central bank has] enough tools available on a monetary basis to stave it off.”

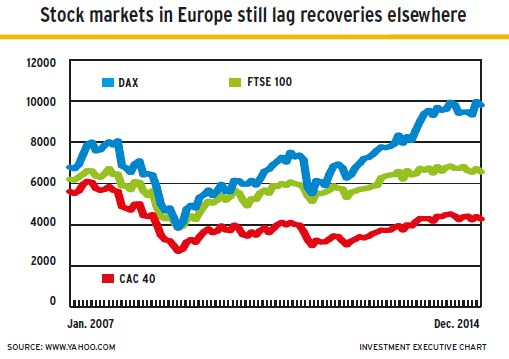

Given the weak state of the region’s economies and the risks facing them, overall sentiment on European equities is negative. The result, says Fahey, is depressed stock price valuations.

Sinha agrees that valuations are attractive: “Companies in Europe are valued as if things will not get better in the near future – but I think they can get better.”

Specifically, a weaker euro should help to increase exports, and lower oil prices are expected to boost consumer spending. “[The price of oil] will be a bit of a tailwind to help on the consumer side,” Hadden says.

Consumer stocks are popular. Wallington especially likes Unilever Group, based in London and Rotterdam, which has significant exposure to rapidly growing emerging markets: “Food and household goods have great growth opportunities in the emerging markets.” He adds that Unilever has a long history of generously increasing dividends.

Wallington also favours two Danish companies: Chr. Hansen A/S, which provides cultures and other natural ingredients to the food industry; and Novozymes A/S, a biotechnology company that specializes in producing enzymes. Wallington expects both companies to benefit from growing consumer demand for functional foods that have a positive effect on health beyond basic nutrition. “The pharmaceutical and enzyme-based technology in these companies,” he says, “is unparalleled.”

Beer companies are attractive as they have fairly steady demand regardless of the underlying economic environment, says William Booth, managing director and senior research analyst with Epoch Investment Partners Inc. in New York, and portfolio manager of Epoch European Equity Fund. He likes Belgium-based Anheuser Busch Inbev SA.

Certain European automakers are poised to benefit from an uptick in consumer spending. Sinha favours Germany’s BMW AG. “When the European auto market turns around – and it already has started to turn – you’ll see a benefit in volumes and in pricing,” he says. “It should do well for shareholders next year.” In addition, he says, BMW has a strong balance sheet and strong growth prospects in emerging markets.

Auto-industry suppliers also should do well, says Hadden, who likes Germany-based Continental AG and France-based Valeo. Since these companies supply parts to a wide variety of automakers, these stocks are an effective form of exposure to the industry: “We saw it as a better way to play on any growth in the sector.”

Telecom companies should benefit from a stronger consumer. Sinha considers Vodafone Group PLC a particularly strong player in the European telecom market. “It’s a great company,” he says. “It has big exposure to Italy, Spain, the U.K. and Germany. And, outside of that, one area of big exposure is India.”

Health care and pharmaceuticals are popular. The defensive nature of this sector is appealing in the current economic environment. “It’s a sector that’s a little more stable,” says Hadden, who favours Switzerland-based Roche Holding AG, as well as Bayer AG and Fresenius SE & Co. KGaA, both based in Germany.

Wallington sees opportunities in companies that are active in the chronic illness space, which continues to grow as conditions such as diabetes become increasingly common. Novo Nordisk A/S in Denmark, for example, specializes in diabetes care. “A lot of the intellectual property to deal with these things,” he says, “is contained within Europe.”

Meanwhile, Europe’s banks have made considerable progress in strengthening their balance sheets. Although the results of the European Banking Authority’s stress tests, published in October, reveal some room for improvement, there were no major surprises.

However, lending activity remains depressed amid high capital requirements and limited consumer demand for loans. “The banking system is in better shape,” Booth says. “It’s healthier, but it’s sort of stuck in first gear – in the sense that there does not seem to be a lot of demand for loans.”

Still, Booth sees some investment opportunities, notably UBS AG in Switzerland. That bank recently scaled back its investment-banking operations and began investing more heavily in the asset-management side of the business, which is less capital-intensive and provides more attractive recurring revenue. Furthermore, he says, “The balance sheet is in great shape.”

Sinha likes Banca Intesa Sanpaolo, the largest lender in Italy. “It’s one of the best capitalized banks in Europe,” he says, adding that this bank should benefit from improvement in Italy’s economy in the year ahead.

© 2015 Investment Executive. All rights reserved.