Brokerage Report Card 2024 main chart

How investment advisors rated their firms’ support offerings and tools

- By: IE Staff

- June 5, 2024 June 4, 2024

- 09:16

How investment advisors rated their firms’ support offerings and tools

Recent changes to the way that active business income earned within a private corporation is taxed may affect some of your high net-worth clients

Although advisors are likely to recommend their firm to another advisor, this changes sometimes based on their perception of their brokerage

Although overall AUM and productivity are up, this isn’t the case at all firms in this year’s Brokerage Report Card

Advisors’ businesses are stronger than ever

Although advisors reported another all-time high average book of business, they're dealing with much uncertainty due to the major changes their firms and the industry…

How investment advisors rated their firms

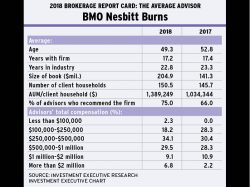

After a rough showing in 2017, BMO Nesbitt Burns and ScotiaMcLeod faced very different assessments from their advisors this year

A firm's standing in the eyes of clients and prospective clients is one of the most important issues for advisors, but some firms have work…

Advisors at four firms cited recent changes that have made the experience of dealing with their back office more difficult

Advisors with bank-owned brokerages were split in their opinions of the roles their branch managers fulfil. Some oppose the producing branch manager model others said…

Advisors with five of the 12 firms in the Report Card rated their brokerages lower by half a point or more in the "online account…

Survey participants raise several concerns

Although the BCSC's ratings increased year-over-year, no other regulators in the survey experienced a similar fortune

IE research journalist Anthony Burton spoke with 108 survey participants from across the investment industry

While some survey participants said regulators should be doing more about cybersecurity, others said the onus is on the industry

Provincial regulators were recognized for facilitating fintech, but some survey participants still had concerns

Regulators are doing a better job of protecting investors without restricting business, but more needs to be done

The OSC, BCSC and ASC were praised for making life easier for smaller dealers, but the same can't be said for the SROs and the…

Although productivity is becoming more critical, there are signs that the best-paid sales forces aren’t necessarily the most productive

The firms with which advisors are most pleased come from every channel in the Report Card series, but share some key traits