Assessing the real cost of tax credits

While the Harper government was a strong proponent of tax credits, many experts suggest that these credits cost Canada more than they are worth because…

- By: Rudy Mezzetta

- October 12, 2016 November 9, 2019

- 23:00

While the Harper government was a strong proponent of tax credits, many experts suggest that these credits cost Canada more than they are worth because…

Numerous changes are in the works to make the tax code more coherent while making the pursuit of tax evaders and closing the so-called "tax…

While tax exemptions that apply to some permanent life insurance policies will be tightened up next year, advisors insist insurance will remain a valuable tax-planning…

As the end of the tax year approaches, advisors can help their clients by alerting them to potential savings in their taxes owed. These strategies…

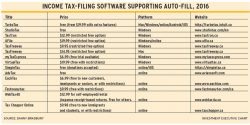

The CRA is marching Canadians toward filing their taxes online for convenience and efficiency. But with that convenience comes vulnerability. How can your clients protect…

The pursuit of tax evaders and avoiders is ramping up around the world. Canada has several new measures and programs to track offshore accounts, including…

Three of the Atlantic provinces, hobbled by debt and population losses, resorted to tax hikes in their latest budgets

Clients can designate three main types of beneficiaries for their TFSAs: a successor holder a named beneficiary or an estate. Each type is subject to…

Hillary Clinton and Donald Trump have completely divergent proposals on how to deal with U.S. estate taxes. Here's what to keep in mind for your…

The Internal Revenue Service now extends its reach to Canadian mutual funds held by American citizens who live in Canada. Know the rules so you…

The 2016 tax-filing deadline may seem far off, but filing an annual income tax return is a task your clients should be mulling over during…

In part three of a six-part video series on regulatory changes, Dan Richards, CEO, Client Insights and Rebecca Cowdery, partner at Borden Ladner Gervais LLP,…

David Nugent, portfolio manager and chief compliance officer, Wealthsimple, explains how the robo-advisor firm digitizes the investment process to offer millennial clients advice and value.…

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds