Balanced ETFs give investors a one-ticket solution when deciding where to put their money. This class of ETFs, which is offered by all four of Canada’s largest ETF providers, delivers diversified asset allocations, low management fees and simplified account statements in a single product. But are financial advisors recommending balanced ETFs to their clients?

“There are some advisors who use them for their small accounts to keep things simple, but I think that’s almost making [the choice] a bit too simple on the advisory side,” says John De Goey, portfolio manager with Winnipeg-based Wellington-Altus Private Wealth Inc. in Toronto. “But in terms of do-it-yourselfers, I think that maybe 25% to 30% of all DIY investors would be well served, and perhaps even better served, to use a single-ticket solution rather than try to pick stocks or funds, or time markets.”

Ryan Lewenza, senior vice president and portfolio manager, private client group, with Toronto-based Turner Investments, which operates under the Raymond James Ltd. umbrella, says balanced ETFs are a “great idea for DIY investors,” but suggests there’s little logic in a client paying you a fee to recommend a product they can purchase on their own.

“It doesn’t make sense to get a financial advisor, pay me a fee and then buy that fund I sent you. Why are you paying a fee?” Lewenza says.

There also are potential drawbacks to the funds themselves, De Goey says, such as limited options for asset allocation. For example, he says, if you are looking for an allocation of 70% equities/30% fixed-income, but can find only products that have a 60/40 or 80/20 mix, “you might need to build [the portfolio] yourself.”

Another concern is that if a client buys a balanced ETF through an advisor and has specific questions about it — such as how it gets rebalanced — you may be hard pressed to provide answers. “What are you [as an advisor] going to say if [a client] asks why you have only a 4% weighting in emerging markets?” Lewenza asks.

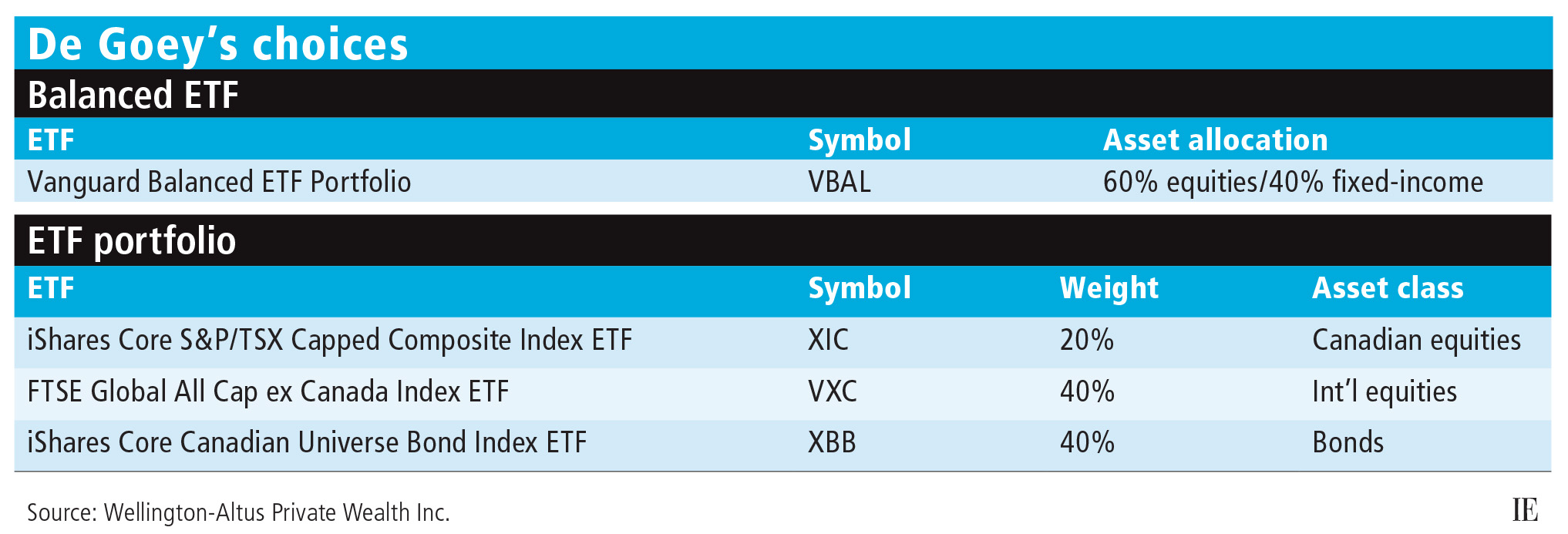

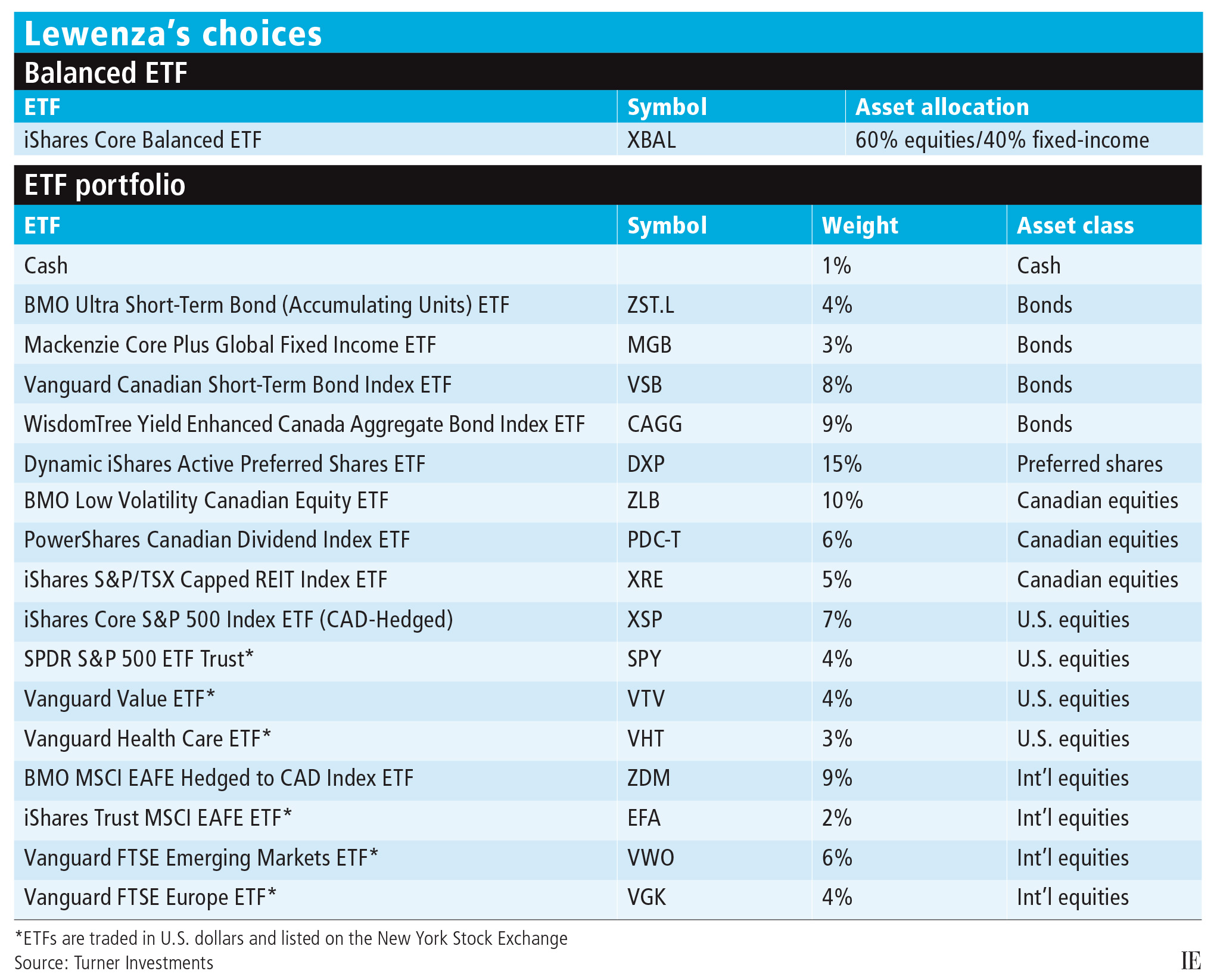

Investment Executive asked both De Goey and Lewenza to compare a balanced ETF with a model ETF portfolio of their own development. Both portfolio managers opted to go with a 60/40 equities/fixed-income mix, but, other than that, their choices were markedly different. (All ETFs are listed on the Toronto Stock Exchange, except where indicated on the chart on page 20.)

John De Goey: Keep it simple

De Goey’s theoretical client is a 40-year-old male professional with $100,000 to invest: “Young, decent earner, smart — but not financially smart — and straight down the fairway in terms of traditional objectives,” De Goey says.

For the balanced ETF, De Goey went with Vanguard Balanced ETF Portfolio (TSX: VBAL), which offers a 60/40 equities/fixed-income allocation with a management expense ratio (MER) of 25 basis points (bps). The Vanguard ETF invests in a portfolio of index ETFs, including Vanguard U.S. Total Market Index ETF and Vanguard Canadian Aggregate Bond Index ETF.

“A single-ticket solution such as this one gets you the traditional best risk-adjusted return and keeps the focus on the most important determinant of that risk-adjusted return, which is the 60/40 asset allocation,” De Goey says. “It does the most important thing cheaply, efficiently and effectively.”

When De Goey constructed his model ETF portfolio, he went with a similar approach, keeping things simple and cost-effective for his hypothetical client.

De Goey allocated 20% of his model portfolio to iShares Core S&P/TSX Capped Composite Index ETF (TSX: XIC), 40% to FTSE Global All Cap ex Canada Index ETF (TSX: VXC) and 40% to iShares Core Canadian Universe Bond Index ETF (TSX: XBB). The entire portfolio has an average MER of 16 bps, so the ongoing cost is lower than VBAL’s.

De Goey chose XIC, which has an MER of 6 bps, for its broad range of Canadian equities, which include large-caps such as Toronto-Dominion Bank (6.0%) as well as mid- and small-cap companies.

For the international component, VXC — which De Goey describes as “one of my favourite products ever” — offers exposure to companies of all sizes in developed and emerging markets for an MER of 27 bps. “I think [this ETF] is a really great way to get broad exposure to [markets] around the world, to get that cheaply and get it tax-effectively,” he says.

On the fixed-income side, XBB invests in corporate and government bonds of varying durations and has an MER of 10 bps. “There are other products that might allow you to use different strategies, but they’re going to cost you more money. And if the objective is to keep [the choice] simple and get broad exposure to the bond market, this [ETF] is extremely broad and extremely simple and quite cost-effective,” De Goey says.

Click the image below to download a full-size version of the chart.

Ryan Lewenza: A granular approach

Lewenza, whose practice focuses on clients who want a 60/40 mix, regardless of demographic, stayed true to that investment philosophy in his product selection for his model portfolio.

For the single-ticket option, Lewenza chose the iShares Core Balanced ETF (TSX: XBAL), another 60/40 equities/fixed-income product with a management fee of 0.18%. He favours XBAL for its long track record and size (it had assets under management of $157 million as of August 2019), and low cost.

On the fixed-income side, 15% of Lewenza’s model portfolio is in Dynamic iShares Active Preferred Shares ETF (TSX: DXP) to maximize tax efficiency while interest rates remain low. “In an incredibly low interest rate environment, preferreds are giving us a yield of about 4.5% to 5% in dividends,” he says. “So, if you [compare dividends to] an interest equivalent after adjusting for taxes, you’re looking at closer to 6% to 7%, compared with bond yields giving you 2% to 3% or GICs giving you 2%.”

Half of the bonds in Lewenza’s model portfolio have short durations because the flat yield curve means investors aren’t compensated for going long. The largest bond allocation (9% of the portfolio) is in WisdomTree Yield Enhanced Canada Aggregate Bond Index ETF (TSX: CAGG), which holds investment-grade provincial, municipal and corporate bonds and has an MER of 20 bps.

A large share of the equities portion of Lewenza’s model portfolio — 21% of the total — is focused on Canadian equities, with 10% going to BMO Low Volatility Canadian Equity ETF (TSX: ZLB). Being overweighted in Canada, he says, takes advantage of the dividend tax credit: “If it’s Canadian-earned, you get a lot more money in your pocket than [with] a U.S. or a U.K. dividend.” (See story on page 22.)

Overweighting in Canada also reduces currency risk associated with being overweighted internationally, Lewenza adds. Further, he foresees developments such as our federal government’s approval of the Trans Mountain Pipeline as being a potential catalyst for Canada’s economy.

In U.S. equities, Lewenza focused primarily on large-cap stocks as a means of reducing risk in his model portfolio. The portfolio is overweighted internationally — at 21% — due to the attractive price of European equities.

Click the image below to download a full-size version of the chart.