ETFs are a cost-effective, efficient way for your Canadian clients to gain exposure to U.S. and other foreign equities markets and achieve diversification within their portfolios. However, when investing outside Canada using ETFs, clients need to take into consideration the effect of foreign withholding taxes (FWT) on their investment earnings.

Most countries levy FWT, withheld at source, when corporations pay dividends to foreign investors. The rate of FWT applied differs depending on the country in which the foreign corporation is domiciled and the country in which the investor is resident.

For example, the U.S. government imposes FWT of 15% when U.S. corporations pay dividends to Canadian investors, a percentage that is based on the tax treaty between the U.S. and Canada. That means when a $100 dividend is paid to a Canadian client by a U.S. company, $15 is withheld at source.

There are two key factors in determining if and how FWT applies to an ETF, and whether those taxes can be recovered by the investor.

The first factor is the structure of the ETF. Canadian investors looking for exposure to foreign investments via ETFs typically will own:

- a Canada-listed ETF that invests in U.S. or international equities directly;

- a U.S.-listed ETF that invests in either U.S. or international equities; or

- a Canada-listed ETF that holds a U.S.-listed ETF in the portfolio as its primary investment.

There are two levels of FWT to which an ETF may be subject.

The first type of FWT is applied by the country in which the underlying foreign investments are domiciled – the Level 1 FWT.

In addition, in the case of a Canada-listed ETF that holds a U.S.-listed ETF that, in turn, invests in international (non-U.S.) equities, or a U.S.-listed ETF that invests in international equities, two levels of FWT may apply. The first is the FWT that’s withheld on dividends paid by the foreign companies to the U.S.-listed ETF that holds shares of those foreign companies (a.k.a. the Level 1 tax).

The other level of FWT is withheld by the U.S.-listed ETF on dividends paid to a Canadian investor or a Canada-listed ETF – the Level 2 FWT.

The second factor in determining if and how FWT applies is the type of account in which the ETF is held.

Non-registered accounts

If a client’s non-registered account holds a Canada-listed ETF that invests in U.S. or international equities directly, or a Canada-listed ETF holds a U.S.-listed ETF that invests solely in U.S. equities, Level 1 taxes apply. The client may claim a foreign tax credit (FTC) on his or her annual tax return to recover Level 1 taxes. The same scenario applies if the client’s account holds a U.S.-listed ETF that invests in U.S. equities.

However, if a client’s non-registered account holds a Canada-listed ETF holding a U.S.-listed ETF that, in turn, invests in international equities, both Level 1 and Level 2 taxes will apply. The client can claim the FTC to offset the Level 2 taxes, but not the Level 1 taxes. The same scenario applies if the client’s account holds a U.S.-listed ETF that invests in international equities.

Because of these factors, a Canada-listed ETF that holds international equities directly “is generally considered the way to go,” as opposed to holding a U.S.-listed ETF that invests in international equities directly, says Wilmot George, vice president of tax, retirement and estate planning with Toronto-based CI Investments Inc. The Canada-listed ETF faces one level of taxes, which is recoverable, while a similar U.S.-listed ETF faces both levels, only one of which can be recouped.

TFSAs, RESPs and RDSPs

ETFs that invest outside Canada are subject to a different set of stipulations when the ETFs are held in TFSAs, RESPs and RDSPs. If one of these registered accounts holds a Canada-listed ETF that holds U.S. or international equities directly, or a Canada-based ETF holds a U.S.-listed ETF that, in turn, invests solely in the U.S., Level 1 taxes apply and the client cannot claim an FTC. The same scenario applies if the client’s account holds a U.S.-listed ETF investing in only U.S. equities.

If a client holds a Canada-listed ETF that holds a U.S.-listed ETF that, in turn, invests in international equities in a TFSA, RESP or RDSP, both Level 1 and Level 2 taxes apply – and the client can’t claim an FTC. The same scenario applies if the client’s account holds a U.S.-listed ETF investing in international equities.

For these registered accounts, holding a Canada-listed ETF that invests in international equities directly is always preferable to a holding similar U.S.-listed ETF, says Justin Bender, portfolio manager with PWL Capital Inc. in Toronto: “If you hold a U.S.-listed ETF, you’ll have one layer [of FWT] lost from those international companies paying [dividends] to the U.S. fund, and then you’ll have a second layer [of FWT] lost from the U.S.-listed ETF to Canada.”

RRSPs, RRIFs and other retirement accounts

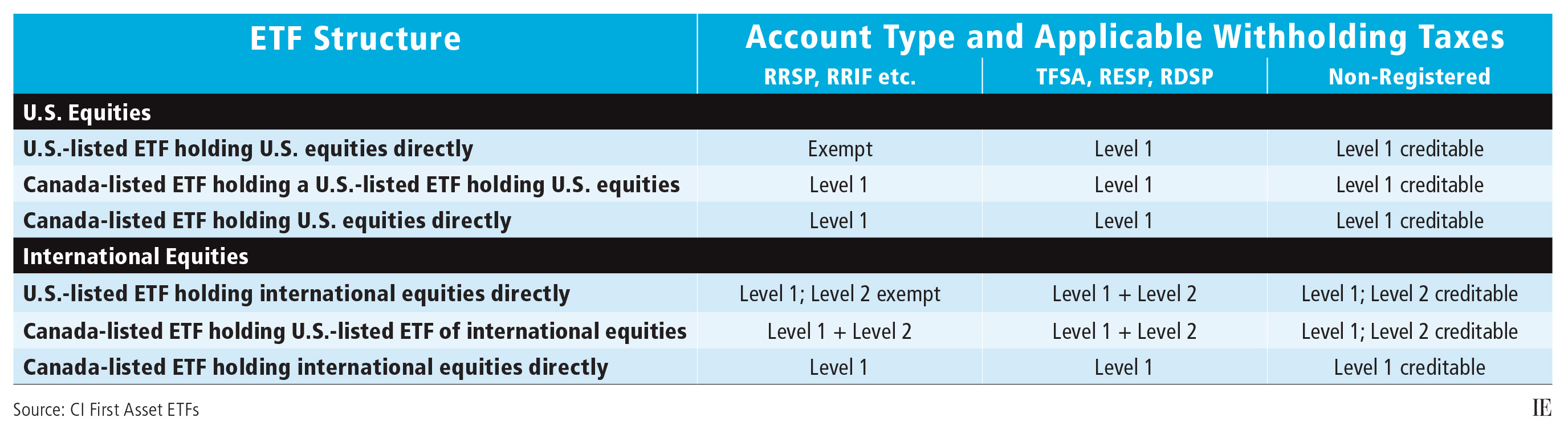

When held in an RRSP or RRIF, Canada-listed ETFs that hold U.S. or international equities directly or indirectly (through U.S.-listed ETFs) are subject to FWT (see chart below). This provision also applies to other retirement accounts, such as individual pension plans and locked-in retirement accounts. Because these are tax-sheltered accounts, clients cannot claim the FTC.

However, a tax-advantaged exemption exists when a client’s RRSP or one of these other retirement accounts holds a U.S.-listed ETF that invests in U.S. equities. Under the Canada/U.S. tax treaty, the U.S. recognizes RRSPs and certain other retirement accounts (but not TFSAs, RESPs or RDSPs) as being tax-exempt, so no FWT applies. If a U.S.-listed ETF that invests in international equities is held in a retirement account, Level 1 taxes apply (and can’t be recovered), but Level 2 taxes don’t apply.

The exemption means holding a U.S.-listed ETF (which invests in U.S. equities) in an RRSP or other retirement account is more tax-efficient for a client than holding a Canada-listed ETF that invests in U.S. equities, Bender says.

In addition, U.S.-listed ETFs may offer lower management expense ratios than their Canada-listed equivalent, Bender says: “There would be a slight product [cost] advantage, generally.”

U.S.-listed ETFs that invest in U.S. equities may be best suited to clients with larger RRSPs and more than $100,000 in foreign equities, Bender suggests: “That’s usually where you get the most bang for your buck.”

However, balanced against this advantage, you and your client must keep in mind a host of other considerations – primarily, the cost of converting Canadian dollars to U.S. dollars to purchase U.S.-listed ETFs. Unless conversion costs can be mitigated, the advantage of the exemption will be reduced or lost.

In addition, there may be other tax reporting and compliance obligations associated with owning U.S.-listed ETFs, which are considered foreign property. For example, calculating the adjusted cost base for U.S.-listed ETFs is a trickier process because currency exchange rates on the dates transactions were made have to be factored in. As well, a client whose non-registered account holds foreign investments, including U.S.-listed ETFs, with a cost of $100,000 or more must file a Form T1135: Foreign Income Verification Statement annually with the Canada Revenue Agency. Failure to do so may result in heavy penalties.

A Canadian client who, at death, owns more than US$60,000 of “U.S. situs” property, which would include U.S.-listed ETFs, may expose his or her estate to a U.S. federal estate tax-filing obligation, says Chris Gandhu, vice president of high net-worth planning with TD Wealth Financial Planning, a unit of Toronto-Dominion Bank. While only the wealthiest Canadians will have a U.S. estate tax liability, compliance alone can be another burden for an executor. “There are fairly stiff penalties that kick in for non-compliance,” Gandhu says.

Finally, while clients should be aware of the FWT, they shouldn’t let it overwhelm other tax and investment considerations, Bender says: “I’ve been asked by investors whether they should not contribute to their TFSA and, instead, use their non-registered cash to purchase an international equity ETF [because the] FWT is generally recoverable in a taxable account, but lost in a TFSA. [These clients] don’t consider the tax bill they’ll have to pay on the dividend income each year and the taxes they’ll pay on their capital gains [when the investment is sold]. In this case, [it’s] better to contribute to the TFSA, purchase the international equity ETF and not worry about the FWT drag.”

Click the image below to download a full-size version of the chart.

Tax considerations for converting mutual fund portfolios to ETFs

Many clients have considered converting their mutual-fund based portfolios into ETF portfolios, whether because they’re drawn by cost considerations or by a desire to embrace index investing.

However, if a client has held a portfolio of mutual funds for many years, he or she may have built up a significant amount of unrealized capital gains. If all the fund units were to be sold at once in favour of ETFs, the client may be left with a hefty tax bill.

In this context, you must discuss strategies with that client to manage the transition to ETFs from mutual funds.

You should first look to see if the client has any other equities that may not be performing well, says Chris Gandhu, vice president of high net-worth planning with TD Wealth Financial Planning. Selling these equities allows the client “to offset or match capital gains with capital losses, and perhaps result in a tax-neutral position,” he says. Any unused net capital losses can be carried back to reduce taxable capital gains in any of the three preceding tax years or forward to any future tax year.

In addition, the client should consider the timing of the sale of the mutual fund units. For example, if all other considerations are equal, selling an investment with a capital gain earlier in the calendar year is preferable to later, Gandhu says: “If we sell something and trigger a gain late in the year, we know we have to file a tax return by April, and pay our taxes by then. But if we wait [to sell] until after Jan. 1, then the tax return is not due until April of the following year. [That way,] there’s a bit of a [tax] deferral, you buy [yourself] a bunch of months.”

Clients also should consider their current tax bracket, and whether it’s likely to change in the following year. Depending on whether taxable income is expected to be higher or lower next year may influence the decision about the best time to sell.

Of course, taxes should be only one consideration when contemplating a sale, says Wilmot George, vice president of tax, retirement and estate planning with Toronto-based CI Investments Inc. You and your client should ask if any investment in the client’s portfolio has become inappropriate or too risky for the client.

“Are you prepared to pay taxes on the [capital] gain? The answer might very well be yes,” George says.

Gandhu agrees that taxes are but one consideration: “Look at the overall picture.”