Mixed views on disciplinary proceedings

Some describe the investigative process as a "witch hunt." Others believe enforcement teams consider each situation carefully

- By: Fiona Collie

- March 30, 2017 November 11, 2019

- 23:45

Some describe the investigative process as a "witch hunt." Others believe enforcement teams consider each situation carefully

Some firms are dropping more and more of their smallest clients. Other firms adamantly oppose the practice

Many say the industry should be acting in clients' best interest - and regulators should introduce a standard that would apply to dealers and advisors

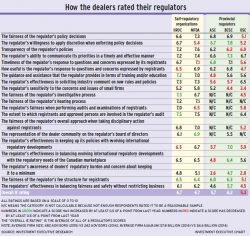

Compliance officers (COs) and company executives in Canada's investment industry shared their views about the regulators that oversee their businesses once again

Being open with auditors will help them go the extra mile and be as flexible as they can on certain mandates

Despite volatile markets, an uncertain economic environment and increasing regulation, Canada's regulators are holding their own

There are conflicting opinions about regulators' auditors and the approach they take during the auditing process

Although regulators usually provide quick responses to registrants, the replies are too cautious in the content they provide

COs and company executives indicated that regulators could take steps to make their policies clearer and more flexible

Fewer resources or smaller compliance departments are making the regulatory burden more onerous for smaller firms

An IIROC/MFDA merger, which 80% of survey participants support, has been the subject of long-running debate

For the eighth year in a row, compliance officers (COs) and company executives throughout the investment industry shared their thoughts about the regulators.

Compliance officers (COs) and senior executives from a cross-section of firms in the investment industry shared their thoughts about the regulators that oversee their businesses…

Survey participants question whether regulators should focus so much on developments outside of Canada

IIROC and the MFDA have advisory committees, regional councils and policy roundtables in place through which to receive feedback

COs and company executives already were reeling from regulatory pressures — and new rules have only added to that burden

Most survey participants would like to pay less in regulatory fees, but realize regulators need resources to operate

Almost two-thirds of survey participants are opposed to a whistleblower program that pays insiders for tips

Almost three-quarters of survey participants say the costs and effort needed to be compliant with CRM2 are significant

The Ontario Securities Commission has taken a major hit for its lack of sensitivity and responsiveness to the investment industry

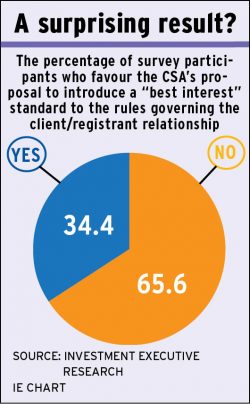

Almost six in 10 survey participants are opposed to the introduction of a "best interest" standard for financial advisors

The vast majority of COs and executives surveyed for this year's Report Card say the CRM 2 reforms will change the sector

Stronger equities markets have given those surveyed fewer reasons to gripe about the regulators that oversee their businesses. Includes main chart.

For the sixth year in a row, Investment Executive (IE) spoke with compliance officers (COs) and executives at various financial services firms to find out…