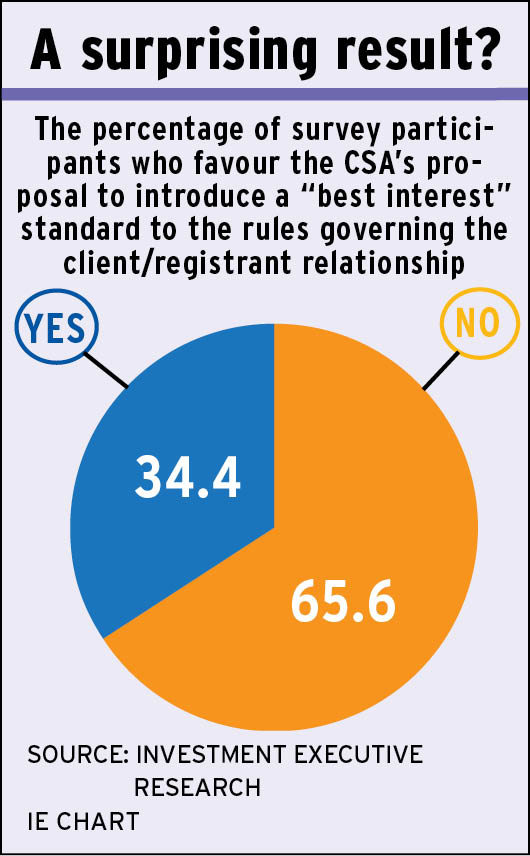

If any of the regulators that comprise the Canadian Securities Administrators (CSA) decide to go ahead and implement a “best interest” standard, the investment industry’s compliance officers (COs) and company executives would probably feel the burden of implementation most acutely. So, it’s surprising that they aren’t deeply opposed to the regulators’ idea.

The COs and company executives surveyed for this year’s Regulators’ Report Card were asked whether they’re in favour of a proposal to introduce a best interest standard to the rules governing the client/registrant relationship. This standard was proposed by the CSA last year.

Given the investment industry’s long-standing opposition to the idea – and the fact that COs would be on the front lines of implementing such a standard – widespread rejection of the proposal wouldn’t be surprising. Yet, that doesn’t appear to be the case.

Overall, 34.4% of survey participants said they support the CSA’s proposed standard. Many of those who favour the regulators’ proposal said it’s the way the industry should be treating clients already – and that regulators should introduce a standard that would apply to all firms.”[Clients’ best interest] is an important piece of investor protection,” says a chief CO (CCO) with an investment-counselling firm in Alberta. “That’s how the good firms are operating anyway – let’s [create] a level playing field.”

In addition, many of those who said they don’t support the CSA proposal indicated that they aren’t opposed to the principle of putting investors’ interests first. Rather, they don’t approve of the CSA’s specific proposal.

In some cases, those survey participants who oppose the CSA proposal indicated that they believe the industry already prioritizes client interests. Other survey participants maintained that a best interest standard effectively exists under the current rules, so having the CSA adopt its own standard would be needless duplication.

Indeed, the Investment Industry Regulatory Organization of Canada (IIROC) previously made the case that its existing rules already amount to an obligation to prioritize clients’ interests – although IIROC acknowledges that there’s work to be done to make this duty more explicit.

Combining both the survey participants who explicitly endorsed the CSA proposal and those who said that the existing regulatory regime already establishes a best interest standard resulted in a slight majority for those who say they’re in favour of such a standard.

Still, others said they approve of the concept of acting in clients’ best interests, but also worry about what the standard’s requirements would mean in practice.

“In principle, I’m in favour of it. In application, I’m not so sure,” says a CCO with an investment dealer in Ontario. “What changes are going to happen to the business? No one has really answered [that yet].”

“It’s one of those things that start off as a great idea, but when you get into implementation, it’s very difficult to do so effectively,” adds a company executive with a mutual fund and exempt-market dealer in Ontario.

A CCO with a securities dealer based in Atlantic Canada worries that mandating a tougher conduct standard for all would nullify one of his firm’s key points of differentiation: “It’s a tough one. A lot of what is in the best interest standard our firm is already doing. Right now, it’s a competitive advantage [for us].”

Despite the high degree of support for the underlying concept of a best interest standard, there were a fair number of survey participants who shared the industry’s oft-stated objections to the idea. Some worry that such a rule would boost costs and reduce the availability of advice to lower-value clients. Others who oppose the idea argued that moving to tougher standards would affect smaller firms disproportionately.

“Generally, it’s a good idea. [But] for small firms, it would be a big burden,” says a CCO with an Ontario-based dual-platform (IIROC and the Mutual Fund Dealers Association of Canada) dealer.

Others who oppose the CSA proposal suggested that either newly adopted reforms, such as the second phase of the client relationship model (CRM2), should be given a chance to work before regulators consider further changes – or that other reforms being considered would be a better way to enhance investor protection.

“The targeted reforms, combined with the proposal to remove embedded commissions, will address the [goals] of the best interest standard,” says a CO with a mutual fund dealer who opposes the CSA proposal.

Still, a sizable minority of survey participants were concerned that the existing rules just aren’t good enough; these individuals believe that a best interest standard is, in fact, required.

“[The CSA proposal] focuses on doing what’s in the best interest of the client over everything else,” says a CCO with an Ontario-based mutual fund dealer. “I’m not sure current rules do that.”

© 2017 Investment Executive. All rights reserved.