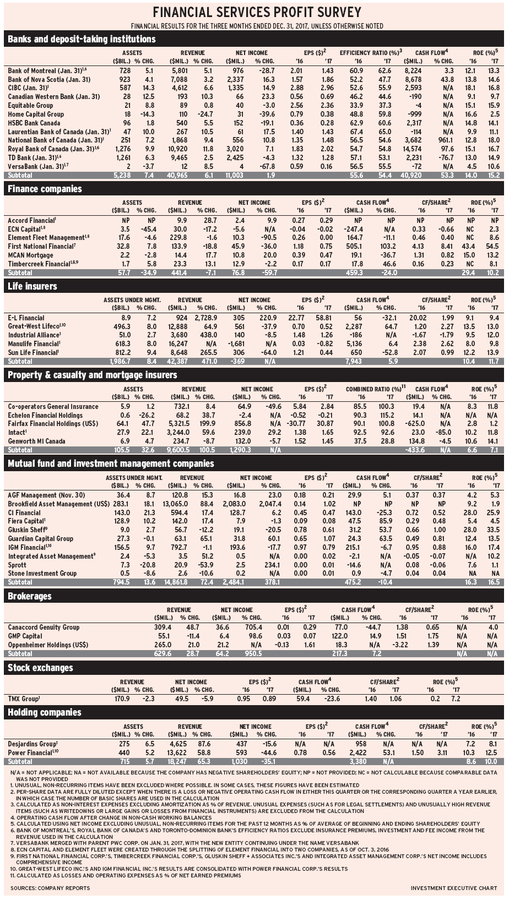

About half of the financial services companies included in Investment Executive’s quarterly profit survey posted earnings gains in the most recent fiscal quarter for which data are available.

The average increase in net income was 6.6% for the 42 publicly traded companies in the fiscal quarter that ended between Nov. 30, 2017, and Jan. 31, 2018, compared with the corresponding quarter a year earlier. That was despite significant charges that the big banks and life insurance companies were forced to take because of U.S. tax reform. Without those charges, the average gain would have been 29%.

(These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., as the results of both are consolidated with those of Power Financial Corp.)

Of these companies, 17 saw their earnings increase and four posted positive net income vs a loss in the corresponding quarter a year prior. That left 18 companies with lower earnings and three in a loss position.

In total, the Big Five banks and the Big Three life insurance companies (lifecos) combined were forced to take $3.2 billion in charges related to U.S. tax reform.

This may sound counterintuitive, as these companies will pay less tax on their U.S. earnings as a result of the reduction in the U.S. corporate tax rate to 21% from 35%. However, the initial impact on the companies’ balance sheets is a reduction in the value of deferred tax assets.

(Deferred tax assets are based on the tax rates that are expected to apply when these assets are reported for tax purposes. This expectation involves anticipated future taxable profits to offset projected tax deductions, such as for previous net losses. When tax rates decline, the value of those future tax assets and liabilities also decline.)

“For the banks, the charges are a short-term impact, as the lower corporate tax rate will allow the banks to earn back these charges over the next few quarters,” says Robert Colangelo, senior vice president, Canadian banking financial institutions, with Toronto-based DBRS Ltd.

The impact on lifecos is more complicated because the U.S. tax reform includes limits on the deductibility of insurance reserves. Lifecos had to recalculate their projected U.S. taxes based on deferred tax assets or liabilities to adjust for the combined effect of the reserve limits and changes in tax rates. For lifecos with large reserves in the U.S., this could be significant, says Stewart McIlwraith, senior vice president, insurance, with DBRS’ global financial institutions group.

This was the case for Manulife Financial Corp., which took a $1.8-billion charge related to the U.S. tax reform. Manulife’s fourth-quarter (Q4 2017) earnings report states that the firm anticipates ongoing benefits from tax reform of around $240 million a year. As a result, Manulife increased its quarterly dividend to 22¢ from 20.5¢ to indicate its optimism about the firm’s prospects.

There were 14 other quarterly dividend increases in the quarter, including those announced by these banks: Bank of Nova Scotia, to 82¢ from 79¢; Canadian Imperial Bank of Commerce (CIBC), to $1.33 from $1.30; Canadian Western Bank, to 25¢ from 24¢; Equitable Group Inc., to 26¢ from 25¢; Royal Bank of Canada (RBC), to 94¢ from 91¢; and Toronto-Dominion Bank (TD), to 67¢ from 60¢. In addition, VersaBank announced its first quarterly dividend of 1¢.

In addition, quarterly dividend increases were announced by GWL, to 38.9¢ from 36.7¢; Intact Financial Corp., to 70¢ from 64¢; Brookfield Asset Management Inc., to 15¢ from 14¢; Fiera Capital Corp., to 19¢ from 18¢; Guardian Capital Group Ltd., to 12.5¢ from 10¢; and Power Financial, to 43.3¢ from 41.25¢. GMP Capital Inc.’s quarterly dividend remains suspended, but the firm announced a one-time “special” dividend of 10¢.

Here’s a look at the industries in more detail:

– Banks. Even with $1.2 billion in charges related to U.S. tax reform, the 12 deposit-taking institutions, as a group, had a 1.9% increase in net income year-over-year. If those charges are excluded, the earnings gain would be 12.2% – and all firms would have had higher net income except for Home Capital Group Inc. and HSBC Bank Canada.

Home Capital’s problems are a result of higher costs in the wake of income-verification issues.

HSBC’s decline is a result of $61 million in loan-repayment recoveries, which led to an increase in the bank’s net income in the corresponding quarter in 2016.

Bank of Montreal (BMO) and TD have large U.S. operations and were the most affected by U.S. tax reform, with charges of $425 million and $405 million, respectively. RBC’s charges were $178 million, CIBC’s were $88 million and Scotiabank’s were $7 million.

Combined loan-loss provisions for the 12 companies in this category totalled $2 billion in the quarter vs $1.9 billion and $1.8 billion in the previous two quarters – not surprising in the wake of rising interest rates.

– Finance companies. Only Accord Financial Corp. and MCAN Mortgage Corp. saw their earnings rise. However, Timbercreek Financial Corp.’s decline was small, at 2.2%.

First National Financial Corp.’s decline was due to unusually high net income in Q4 2016 as a result of a rapid rise in interest rates.

– Life insurers. Charges related to the U.S. tax reform totalled $2.2 billion for the firms in this category, with GWL’s $216 million and Sun Life Financial Inc.’s $251 million on top of Manulife’s charge. If those charges are excluded, there would have been a 14.5% decline in net income.

All the lifecos had large increases in revenue, which isn’t unusual. Life insurers have large assets supporting their often very long-term liabilities. A change in the fair value of these assets is a revenue item, but the changes in value don’t have as great an impact on net income because they’re offset on the expense side by increases or decreases in insurance contract liabilities.

Manulife had a $1-billion charge related to changes to the portfolio asset mix supporting its legacy businesses. Industrial Alliance Insurance and Financial Services Inc. had a $474-million increase in reserves.

– Property & casualty insurers. Intact had higher earnings and Fairfax Financial Holdings Ltd. reported net income of US$856.8 million vs a loss of US$704.2 million a year earlier. Co-operators General Insurance Co. and Genworth MI Canada Inc. both had declines in net income, while Echelon Financial Holdings Inc. was in a loss position.

Fairfax did well on its investments, with net gains of US$180.3 million vs US$1.1 billion in losses the year before, while Intact remained a steady performer. Genworth had lower gains from derivatives and foreign exchange.

On the other hand, a deterioration in underwriting results explained Co-operators’ and Echelon’s weaker results.

– Mutual fund and investment-management companies. Five companies had higher earnings, and Integrated Asset Management Corp. and Stone Investment Group Ltd. reported positive net income vs losses a year earlier.

That only left Fiera, Gluskin Sheff & Associates Inc. and IGM with lower earnings. Fiera had a $6-million charge related to U.S. tax reform; Gluskin Sheff had significantly lower performance fees; IGM had a small decline in net investment income vs gains of more than $22 million in the corresponding quarter a year prior.

– Brokerages. Canaccord Genuity Inc. and GMP had strong earnings gains and Oppenheimer Holdings Inc. had positive net income vs a loss in the corresponding period a year prior. The big news was GMP’s special dividend.

– Exchanges. TMX Group Ltd.‘s net income was marginally lower than a year earlier. TMX Group has been busy, acquiring Trayport Holdings Ltd. and selling Natural Gas Exchange Inc. and Shorcan Energy Brokers Inc.

– Holding companies. Both Desjardins Group and Power Financial had drops in net income. Desjardins’ decline was mainly in its property and casualty operations while Power Financial’s result reflect the drops at GWL and IGM.