While Canada’s economy has slowed, there probably won’t be a recession this year, bank economists say. And if there is a downturn, it’s expected to be mild.

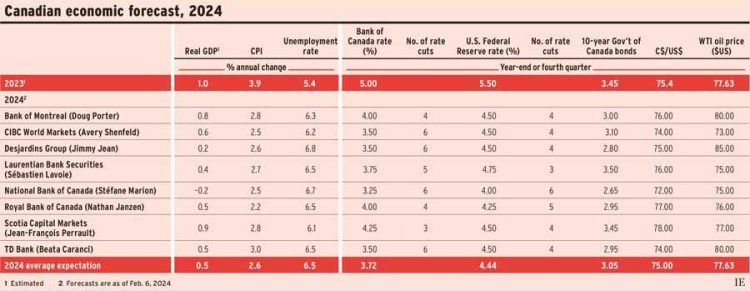

Most of the eight bank economists surveyed by Investment Executive foresee Canada’s real GDP rising by 0.4%–0.9% this year. But Jimmy Jean, chief economist with Desjardins Group, forecasts that GDP will increase by only 0.2%, while Stéfane Marion, chief economist and strategist with National Bank of Canada, expects a drop of 0.2%, including two quarters of negative growth — the technical definition of a recession.

The first half of the year is the vulnerable period, as expected cuts in interest rates will fuel recovery later in the year. Most of the economists anticipate the Bank of Canada’s overnight rate will fall by the end of 2024 to about 3.5%–4%. Marion, however, predicted the overnight rate could drop as low as 3.25%.

Most of the economists don’t expect rates in the U.S. will fall as quickly or as much because the U.S. has been growing at a stronger pace, thanks to healthy consumer spending. Forecasts for U.S. growth this year range from 0.9%–2.3%. However, a downturn can’t be completely ruled out because American consumers are running out of savings.

A major factor behind the anticipated interest rate cuts is lower inflation. The average forecast for the consumer price index is an increase this year of 2.6% in Canada and 2.7% in the U.S.

The central banks must now reverse some of their rate increases to prevent a recession. If they don’t cut enough, the odds of recession increase. If they cut too much and growth is stronger than expected, inflation may take off again, and rates along with it.

In the meantime, geopolitical risks could affect the outlook. These include whether the U.S. will provide the weapons needed by Ukraine to hold off the Russians, whether the Israel/Hamas war becomes a regional war and whether the Republican-controlled U.S. House of Representatives will pass legislation to keep the government operating throughout the year.

There’s also concern that China could attempt to invade Taiwan, although most experts think that’s unlikely to occur this year. And more than 50 countries are due to hold national elections in 2024, including the U.S.

Many of these risks, if they materialize, could impact oil prices and thus inflation. However, the economists surveyed anticipate that oil prices will remain around current levels.

Click image for full-size chart

This article appears in the February issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.