This article appears in the February 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

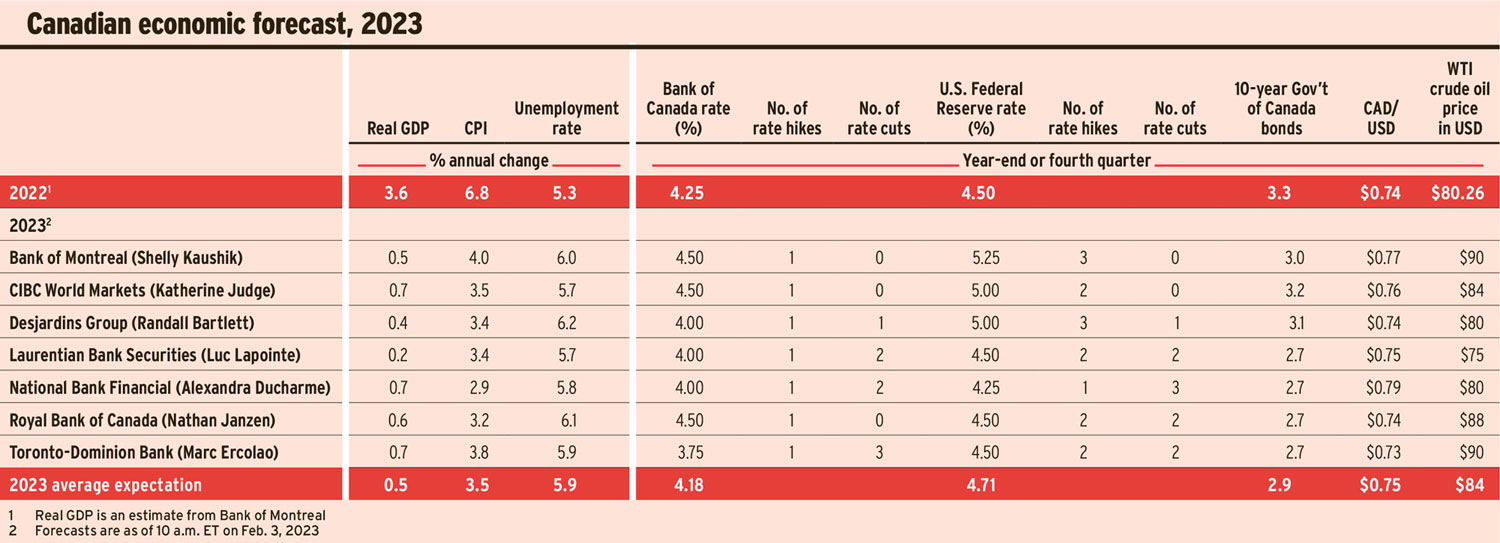

The beginning of this year saw inflation begin to ease, which many hoped would bring rate hikes to an end. But both the U.S. Federal Reserve and the Bank of Canada (BoC) have already raised rates this year, and two of seven economists surveyed by Investment Executive don’t think there will be any cuts before year-end.

The Fed and BoC are balancing on a knife edge. On the one hand, economic growth will be sluggish and recession is possible. Forecasts for real Canadian GDP growth range from 0.2% to 0.7%, with an average of 0.5% — and much the same is expected for the U.S.

On the other hand, inflation is still well above the central banks’ target of 2%, and the economists don’t expect the consumer price index (CPI) to hit that threshold in 2023 — although they anticipate some relief. CPI forecasts this year average 3.5% in both Canada and the U.S., down from 6.8% and 6.5%, respectively.

Oil prices are expected to remain elevated due to the Russia-Ukraine war, with forecasts for the year-end price ranging from US$75 to US$90. The average prediction of US$84 is above the 2022 closing price of US$80.26.

High oil prices are usually positive for the Canadian dollar. But the economists expect the Fed’s policy rate to be above the BoC’s, which could exert downward pressure on the loonie. The CAD is currently expected to end this year around US75¢, above where it closed in 2022: US73.8¢.

Click image for full-size chart