This article appears in the January 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

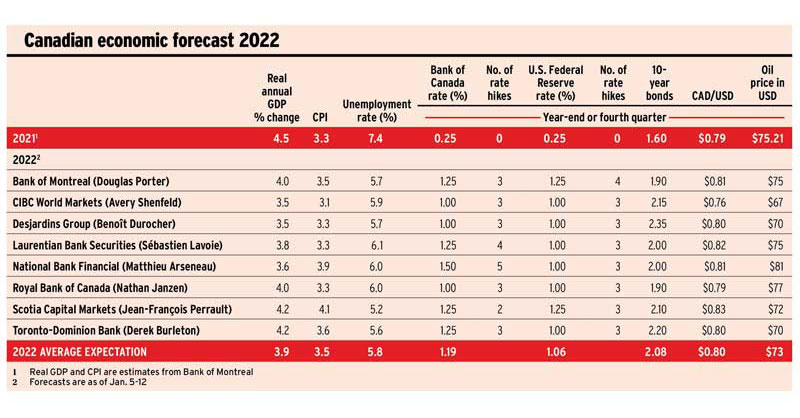

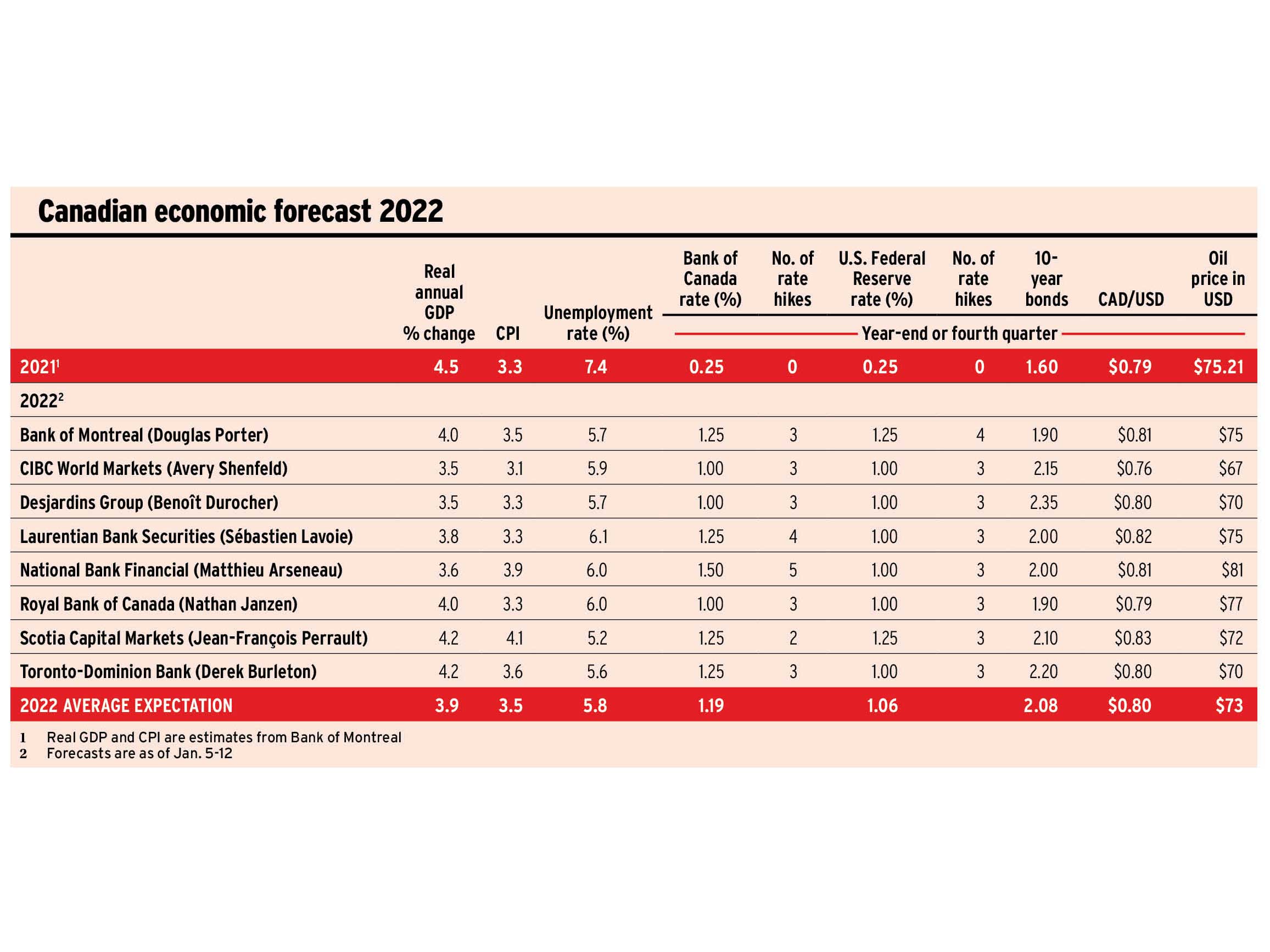

Strong economic growth is expected to continue in Canada this year, with eight financial institutions’ economics departments forecasting an average increase of 3.9% in real GDP and unemployment falling to an average of 5.8%.

Inflation is expected to remain high, with the consumer price index averaging 3.5% compared to 3.3% last year. That’s down from the current level of 4.7% but still too high for the Bank of Canada, which is expected to raise its overnight rate between two and four times in an effort to slow consumer demand.

The U.S. also is suffering from high inflation and the U.S. Federal Reserve Board is expected to raise its overnight rate, too, although not quite as fast. At year-end, the Fed rate is forecast to be between 100 and 125 basis points.

All predictions hinge on omicron’s surge receding in a month or so. But if it doesn’t, or a new deadly or highly transmissible variant emerges, new restrictions and the sheer numbers of those unable to work due to illness will hamper the recovery.

Lingering restrictions also could change both the inflation and interest rate outlook. Inflation could remain higher for longer if there are fewer workers available to produce and transport goods, for example.

That would put central banks in a conundrum. On the one hand, they’d be tempted to raise interest rates higher and more quickly to quell inflation. But if growth is slower than expected, policy-makers would be under pressure to keep rates lower to keep the economy expanding.

Click image for full-size chart