Last year’s rebound in resources prices was a big plus for Canadian equities. The resources-heavy S&P/TSX composite index posted a 21.1% increase in total return in 2016, with the materials subindex up by 41.2% and the energy subindex up by 39.6%.

The mutual fund families that posted above-average returns tended to have portfolio managers who anticipated that resources prices would rise from their low levels at the beginning of 2016.

“We began with a positive allocation to materials and added to energy and financials during the year,” says Marc Cevey, CEO of HSBC Global Asset Management (Canada) Ltd. (Firms are based in Toronto unless otherwise noted.)

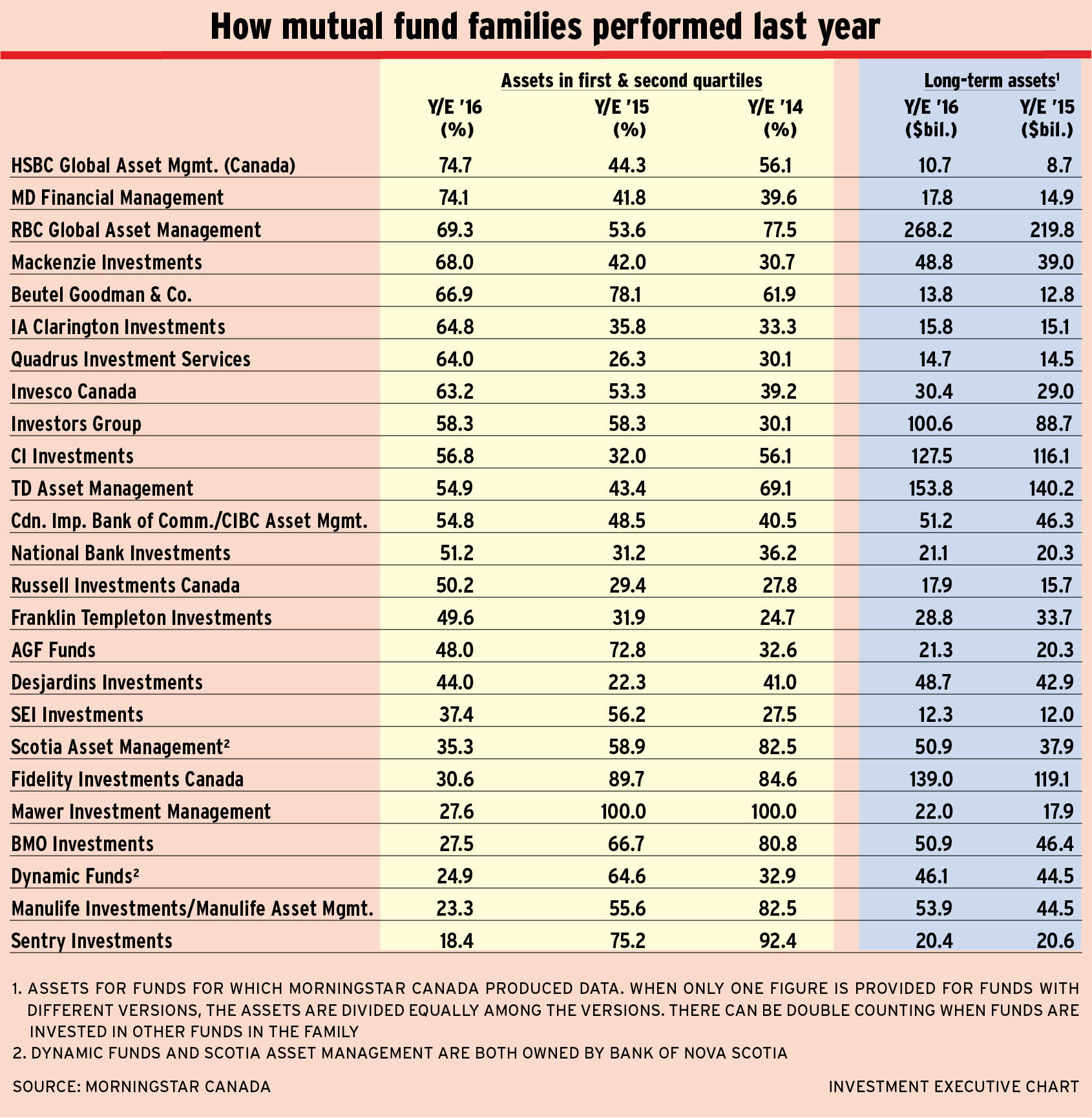

The HSBC mutual fund family had the best relative performance for firms with $10 billion or more in assets under management (AUM). The fund family had 74.7% of long-term AUM ranked in the first or second performance quartile for the year ended Dec. 31, 2016, according to Morningstar Canada data.

The rise in resources stocks’ prices was part of a massive shift in financial market psychology. At the beginning of 2016, there were concerns that global economic growth would remain sluggish. By the end of the year, those fears were gone and markets were anticipating a pickup in corporate earnings as a result of U.S. President Donald Trump’s pro-growth policies. Investors responded by focusing on a value approach – investing in weak sectors (resources and financials, in particular) that will benefit from stronger growth and increasing interest rates.

“Styles were more important than stock selection,” says Dan Chornous, chief investment officer (CIO) at RBC Global Asset Management Inc. (RBCGAM), while noting that RBCGAM’s stock selection “held up very well.” About 69.3% of RBCGAM’s 2016 AUM was in the top two performance quartiles – third place in the 2016 ranking.

The focus on value particularly favoured stocks that had been badly beaten down. Stronger firms, on the other hand, experienced much smaller gains.

“A lot of things worked to benefit our funds,” says Craig Maddock, vice president, investment management, and senior portfolio manager with MD Financial Management Inc. in Ottawa.

However, avoiding certain stocks also was important. “The bigger story was what [the funds] didn’t own,” says Maddock. Shunned stocks included European financials.

MD Financial had 74.1% of its long-term AUM in the first and second performance quartiles, good for second place in the performance ranking.

At the other end of the spectrum were mutual fund companies that invested in good-quality stocks that nonetheless led to the relative performance of the funds’ portfolios suffering as investors focused on beaten-down stocks. Bottom dwellers in the performance ranking include Fidelity Investments ULC, Calgary-based Mawer Investment Management Ltd. and Sentry Investments Inc., all of which had been at or near the top of the list of best-performing mutual fund companies in the previous two years.

Christopher Davis, director of management research at Morningstar Canada, isn’t surprised with the dramatic performance changes, noting that the 2015 and 2016 rankings reflected the tales of two very different markets, so few firms performed well in both years.

Indeed, the only strong performer in each of the past three years was Beutel Goodman & Co. Ltd. The firm favours bottom-up stock-picking, but believes company philosophy, process and discipline allows the firm’s portfolio managers to provide consistently good returns, regardless of market conditions.

Even though Beutel Goodman funds didn’t hold many resources stocks in 2016, 66.9% of the firm’s AUM was in the two top performance quartiles. Mark Thomson, managing director, equities, at Beutel Goodman, says the firm’s portfolio managers look for companies that should earn more than cost of capital and generate free cash flow. The portfolio managers buy only when they expect a 50% return over three years and sell once the stock price has reached business value.

IA Clarington Investments Inc. and Quadrus Investment Services Ltd. were among the firms with investment performance that perked up in 2016.

“Our managers stuck with their beliefs,” says Eric Frape, senior vice president, products and investments, at IA Clarington. “Their conviction that there would not be a global recession and resources prices would bounce back up led to weak relative performance in 2015, but turned out to be correct last year.”

The story at Quadrus is a bit different. Although it benefited from some of 2016’s themes, including strong Canadian equities, changes in portfolio managers and mandates probably were even more important factors in the improved performance, says George Turpie, senior vice president, investment funds, product and market development, wealth management, with Great-West Lifeco Inc. in London, Ont., who oversees the Quadrus family of mutual funds.

Despite 2016’s weak results, neither Mawer’s nor Sentry’s portfolio managers intend to change their approach. Both focus on minimizing downside risk, aim to outperform in bear markets to keep capital losses at a minimum and expect to trail peer performance in strong equities markets.

“If companies are well run, generate cash flow and are good capital allocators, they will stand up to what’s going on and thrive,” says Gaelen Morphet, Sentry’s CIO. Sentry focuses on companies that pay a good, rising dividend, thereby providing income to unitholders.

“We don’t look for the next theme or popular trade,” says David Ragan, director and portfolio co-manager of Mawer International Equity Fund. Stock prices of these “great companies” didn’t plunge in early 2016 and so didn’t bounce back up the way lower-quality stocks did.

He is not worried about the possibility of Trump putting high tariffs on imports: “If you have products that are valued by your customers, you can raise your price by 20% [Trump’s proposed increase].”

***

Correction:

In this article, two mutual fund families with assets under management of more than $10 billion were mistakenly omitted from the story itself and the accompanying table — Edgepoint Wealth Management Inc. and PIMCO Canada. Both had excellent performance, with 100% and 97% respectively of long-term assets in funds in the first or second performance quartile for the year ended Dec. 31, 2016, according to Morningstar Canada data.

© 2017 Investment Executive. All rights reserved.